The Threat of Tariffs on the Market and Canadian Economy

It has only been a week since Trump was inaugurated as the 47th President of the U.S. and news headlines have been buzzing with every soundbite and executive order that has been signed. Among one hot button issue that has been tabled is the implementation of tariffs.

Canada has been caught in the crosshairs of the tariff debate and Trump has threatened a 25% across the board tariff on all goods entering the U.S. While this is a very fluid situation and the path forward remains uncertain, we wanted to provide our insights and thinking on what this could mean for Canada and review the potential impact across our portfolios. For those interested in a more detailed economic assessment of the impact of tariffs and how they may work their way through the Canadian economy, a link to a recently published and extensive report by the RBC Economics team can be found at the end of our newsletter.

Key Questions and Considerations for Canada on Trade and Tariffs:

- Are the 25% tariff threats simply a negotiating tactic or is there a real concern that they could be implemented? What is the impact to the Canadian and U.S. economies, and financial markets?

- How does the Bank of Canada navigate in such a time of uncertainty?

- Without any strong political leadership in Canada, are we at a major disadvantage if negotiations and tradeoffs can be debated?

- What can we learn from Trump’s first presidency and how will Canada retaliate if required?

- With USMCA being reviewed in mid-2026, how integral is having a trilateral agreement? How can Canada ensure that its best interests are protected given the importance of our strong trade relationship with the U.S.?

Key Takeaways:

- The importance of bilateral trade between Canada and the U.S. is essential for each nation. In 2023, nearly $3.6 Billion worth of goods and services crossed our border each day. While Trump has been vocal about his protectionist policies, often citing the term ‘tariff’ as “the most beautiful word in the dictionary”, imposing tariffs on Canadian produced goods will hurt the U.S. consumer and lead to higher prices. Energy is one critical industry in particular – the U.S. imports more than 4 million barrels of oil each day from Canada, which accounted for over 60% of all U.S. crude oil imports in 2024.

- More than 70% of Canada’s GDP is represented by services that wouldn’t have the same impact as the goods-producing industries segment of our economy. It is also important to note that tariffs themselves are a tax on trade flows, they are not a tax on manufacturing or production. Therefore, the sectors most impacted are not necessarily those that have the highest composition of Canadian GDP, but instead the greater share of trade per GDP. The automotive sector is one where there is a multiple of 10:1 of trade to production, in terms of exports/imports of motor vehicle sales between Canada and the U.S.

- Companies are likely in the process of adjusting their supply chains for a classic “what if” worst case scenario. Many American businesses may accelerate purchasing decisions from outside the U.S. with the objective of front-running any future tariffs and thus, stockpiling inventory. This could result in the Canadian economy seeing a false signal of short-term economic growth – borrowing from what would otherwise represent future growth.

- We have a playbook for Trump’s first term as President where he placed tariffs on softwood lumber, steel, and aluminum, which were quickly followed with retaliatory tariffs from the Canadian government. While Canada may be perceived as weak given our government’s current state of prorogation, Canadian leaders have been adamant that they will not back down and would respond accordingly with a dollar-for-dollar retaliation.

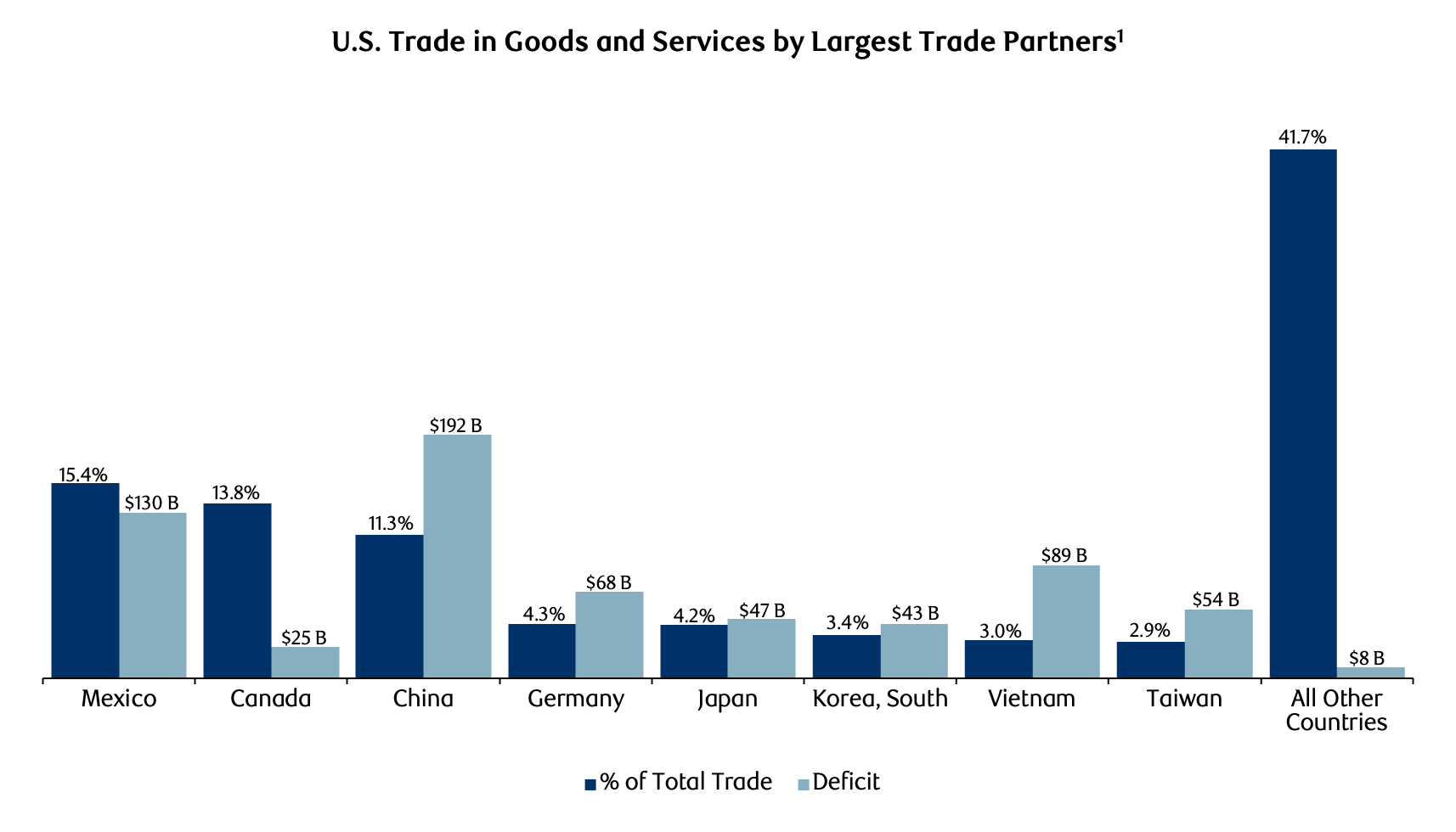

- As the table below illustrates, the trade deficit that the U.S. has with Canada pales in comparison to Mexico and China. Trump is not only focused on ensuring the U.S. borders are secure, but he wants to ensure that trade equality is restored, and that the U.S. is not running major deficits – though Canada should not be his first target. In addition to the trade deficit, we have also shown the total value of trade and the importance of trade that both Canada and the U.S. share.

Notes:

Percentage (%) of total trade values are reported on a current basis as of November 30, 2024.

Deficit values ($B = Billions) presented are in absolute terms and reported on a cumulative year-to-date basis as of November 30, 2024.

Source: United States Census Bureau, November 30, 2024.

1. Trade deficits are seasonally adjusted and reported on a Balance of Payments (BOP) basis.

Asset Allocation and Portfolio Positioning Thoughts:

- We wrote about our increased allocation to U.S. equities (and corresponding reduction to international equities) in our last special edition of the Pinnacle, shortly after it became clear that the Republican party would control all three branches of the U.S. government. We continue to believe that the U.S. economy will be the fastest growing developed economy in the world, and U.S. equities should benefit from an extension of U.S. corporate tax rates (and possibly even lower corporate tax rates) and deregulation.

- When we evaluate our Canadian equity positioning, we have a couple of important distinctions to highlight. Firstly, it is important to separate the economic realities from the performance expectations of the stock market. While many of Canada’s largest companies are global businesses with revenue outside of Canada, given the service orientation of Canada’s economy (as noted previously, services comprise more than 70% of Canada’s GDP), there are companies that wouldn’t be impacted directly to any tariff announcements, and any indirect exposure would be assumed to be minimal. Then there are other companies that are more sensitive, where we have already seen their share price be subjected to volatility with each reference to any tariff imposition. We have long believed that the Canadian equity market is a universe where a strong manager that can assess fundamental value and is able to adjust positioning and react to changes in the economic landscape, has a greater ability to outperform a passive benchmark. With the uncertainty of tariffs overhanging Canadian and international equity markets, we strongly believe that an active management and discerning security selection process is critical in this environment as winners and losers will emerge.

- The Bank of Canada is in a very difficult position – and as expected, policy interest rates have been cut by another 25bps this week. Inflation continues to trend around 2%, at the mid-point of their targeted 1% to 3% range, and economic growth remains very modest. Canadian fixed income yields haven’t trended to the same degree as U.S. bond yields over the last three months – in fact, the short to intermediate part of the Canadian bond curve has seen yields fall while U.S. bond yields have moved higher quite aggressively. We think there is still value in shorter-dated Canadian bonds with some modest price appreciation should the Bank of Canada continue to cut interest rates more than what the market expects. An announcement on tariffs and the negative implications that might have on the Canadian economy could be the catalyst for greater price appreciation in bonds. We will be watching closely as we have already begun to rotate out of part of this position for alternative and private investments as the current interest rate environment is considerably lower than this time last year. We expect to continue to adjust to higher income-oriented opportunities as the year progresses.

- We continue to have a significant position of our client portfolios in U.S. Dollar investments. With the Canadian Dollar trading below 70 cents, this has been a tailwind and helped performance over the last few years and we think maintaining a higher U.S. Dollar exposure is still appropriate.

We expect 2025 will be a year where we will see policy uncertainty from the Trump administration. We will continue to watch whether Trump can deliver what he promised during his campaign trail, along with the extent of the timing and magnitude of any policy changes. That said, we anticipate increased volatility across equity markets, bond yields and currency markets and when markets dislocate from their fundamentals, this generally presents the best investing opportunities. We will assess our Canadian equity exposure as new details on the Canadian tariff front become clearer.

As mentioned, Frances Donald and Nathan Janzen from the RBC Economics team shared their insights titled “A playbook for how to measure a tariff shock in Canada”. Their complete summary can be found in the link below: