The Summer edition of the Pinnacle features a slightly different format. As done in past publications, we begin by reviewing financial markets. The first half of 2024 was strong across major asset classes, with financial markets experiencing a more volatile and mixed second quarter. We continue to focus on identifying areas of global equity and fixed income markets offering investors an attractive risk and return profile (details can be found in the section titled “Market Update”). Following our quarter in review, we include a questions and answers section with our colleague Nathan Janzen, Senior Director Economic Research and a member of the RBC Economics team. Nathan and his team recently penned a very informative thought leadership piece titled “Canada’s Growth Challenge: Why the economy is stuck in neutral”. The full article can be found on the Ascendant Wealth Partners “Insights” page, here: https://ca.rbcwealthmanagement.com/ascendant.wealth/blog. We strongly believe this is a ‘must read’ for every Canadian, contributing to a thorough understanding of the economic challenges our country is facing, and outlining a path forward to improve Canada’s competitive standing.

The Ascendant Wealth Partners team experienced strong asset growth during the first half of 2024. Further, we welcomed several valuable new team members as we continue to focus on investment excellence and an elevated client service experience. New members of the Ascendant Wealth Partners team this year include Associates, Negar Keyvani and Matthew Marino, supporting Adam Moody; Associate Advisor Max Cameron, supporting Evan Howard; Associate Gabriel Rizzi, supporting Jim Bantis and Evan Howard; and Associate Advisor Griffin Cote, supporting Jonathan Paul. We are now a team of 25 investment professionals, offering clients access to investment management, banking, wealth/estate/tax planning, and insurance and risk management solutions.

Market Update

Global equity markets produced mixed returns in Q2. U.S. Large Cap equities (S&P500 TR Index) returned +4.3%, while Canadian equities (S&P TSX TR Index) and International equities (MSCI EAFE TR Index) were down -0.5% and -0.4%, respectively. In contrast, major fixed Income and credit markets produced positive returns in the quarter. The Canadian bond market (FTSE Canada Universe Bond Index) returned +0.9%, while U.S. High Yield (Bloomberg US Corporate High Yield) and Leveraged Loan (Credit Suisse Leveraged Loan TR Index) markets returned +1.1% and +1.9%, respectively.

The below chart summarizes major index returns for 2022, 2023 and YTD 2024 (as of June 30th).

Source: YCharts, Ascendant Wealth Partners.

The closely followed S&P500 Index in the U.S. continues to outperform all major equity markets (and asset classes) in 2024. The proliferation of artificial intelligence coupled with the surge in profits from information technology companies has been staggering. Investors often ask us about their valuations – provoking the question: are current elevated valuations warranted, or is this period episodic of 1999/2000? The single biggest difference when comparing today to the dotcom bubble, is that the cash-flows and profits generated by companies in 2024 are real. In contrast, many businesses during the dotcom era never turned a profit. Artificial intelligence appears to be the biggest transformative technological innovation seen since the widespread adoption of the internet in the 1990s.

The material outperformance by the S&P500 index has largely been driven by only 8 companies, which contributed to approximately 70% of the return so far this year. Of these 8 companies, the largest contributor, NVIDIA, is responsible for approximately 30% of the index’ year-to-date gains. The below chart illustrates the attribution of year-to-date returns for the S&P500 index.

Source: Bloomberg, Ascendant Wealth Partners, RBC Portfolio Advisory Group.

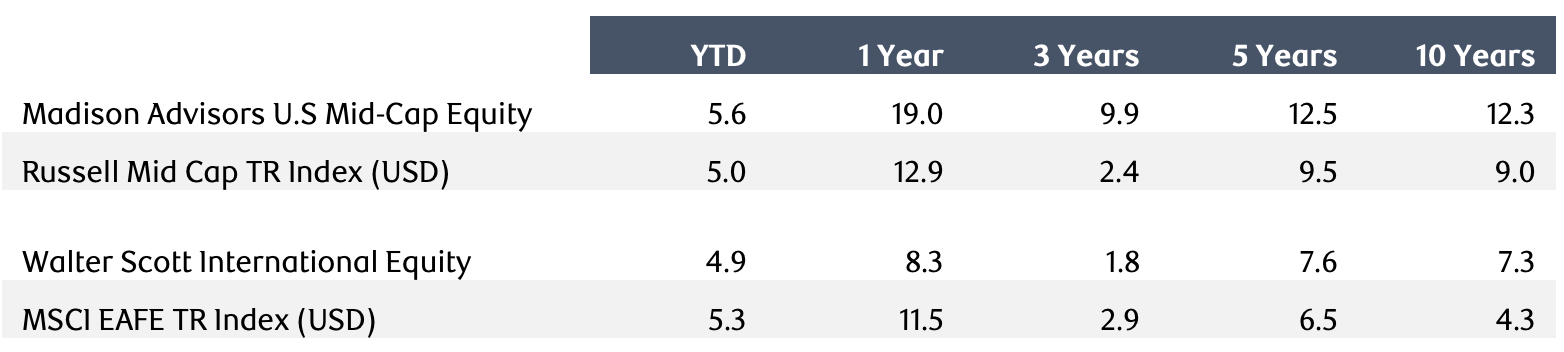

While we still feel that exposure to the S&P500 (market cap weighted) index is prudent, we are excited about opportunities outside of large cap U.S. equities. Specifically, we believe that exposure to carefully selected U.S. Mid Cap companies and International equities offer attractive diversification for equity investors. As discussed in previous publications of The Pinnacle, we feel that the opportunity in U.S. Mid Cap remains attractive and provides investors with exposure to a segment of the U.S. equity market with attractive valuations on both a relative and absolute basis. Within this asset class, we are very pleased with our allocation to Madison Investments, who have materially outperformed their benchmark (the Russell Mid-Cap TR index). This emphasizes the impact that prudent and methodical active management can have on investment returns over time. Similarly, within international equities, Ascendant Wealth Partners selected Walter Scott & Partners for international market exposure through their actively managed International equity strategy.

Below is a summary of the above noted returns:

Source: Madison Investment Advisors, Walter Scott & Partners, YCharts.

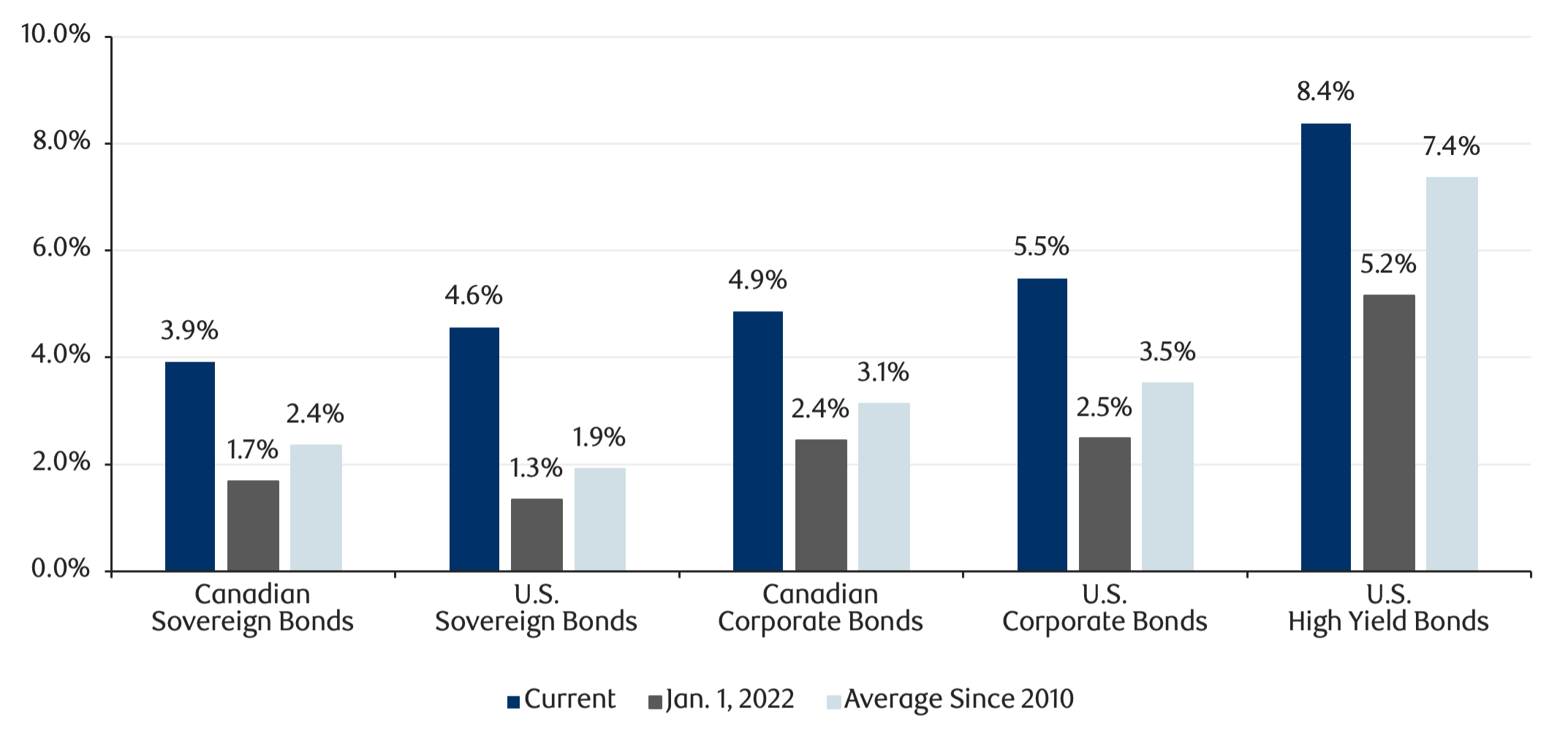

As previously noted, fixed income markets broadly produced positive returns during the quarter. Bond yields remain elevated, offering investors an attractive income opportunity, with flexibility based on individual risk appetite. As credit spreads remain tight, we prefer higher quality rated bond securities. Further, we are seeing particularly good value in shorter-term maturities at the front-end of the curve, which in many cases still provides extremely efficient returns for taxable investors (with a portion of the return coming in the form of capital gains) as the yield curve remains inverted. The below chart illustrates the absolute level of bond yields across fixed income markets over time, highlighting the compelling opportunity of the asset class.

Source: Bloomberg, Ascendant Wealth Partners.

Canada’s Growth Challenge: Why the economy is stuck in neutral

The RBC Economics team released a report in June titled “Canada’s Growth Challenge: Why the economy is stuck in neutral”. The publication discusses Canada’s economic challenges, explaining that Canada has experienced very little growth (viewed on a per-capita basis when adjusted for inflation and immigration) over the last ten years – particularly when compared to other large economies. The recent Federal budget announcement, which has resulted in an increase to the capital gains inclusion rate (for certain investors), does not help in this regard as it will likely perpetuate capital flight to other nations. RBC’s research suggests that Canada’s productivity is 30% less than the U.S., ultimately leading to a decline in Canada’s ranking from the 6th most productive economy in the OECD in 1970 to the 18th most productive in 2022. Much of this can be explained by a lack of investment. Despite a boom in immigration, with seven million new people making Canada their home since the turn of the century, we are having difficulties integrating our largely well-educated working-age population, resulting in little economic benefit.

We had the opportunity to interview Nathan Janzen from the RBC Economics team who offered thoughtful commentary on how we got here, and insight into what can be done to help the Canadian economy flourish.

- Canada’s economy has often been compared to Australia’s – both countries have an abundance of natural resources that the world consumes. You note that back in 2000, the average economic output per Canadian was also roughly equivalent to the average Australian, however, today Australians are almost 10% more productive and their economy has grown at a 50% faster rate on a per person basis relative to Canada over the last 25 years. From your perspective, what has Australia done differently that has led to this relative outperformance?

Part of that outperformance is just geography – Australia has been more directly linked to the rapid expansion of China’s economy since the turn of the century. But Australia is also an interesting comparison to Canada because, like Canada, Australia has struggled historically with an unnecessarily burdensome domestic regulatory backdrop across internal regions. In Canada, those internal trade barriers (across municipal, provincial, and federal governments) are likely a key driver of underinvestment by businesses and slow productivity growth. Australia moved to standardize the regulatory backdrop across states and territories in the 1990s, including the mutual recognition of accreditations across regions in 1993. This change has paid dividends with Australian productivity levels swinging from an 8% underperformance relative to Canada’s in the 1990s to an almost 10% outperformance today.

- The hollowing out of manufacturing since the turn of the century was referenced in your report and you mention that the manufacturing industry is now only half of what it contributed to the economy in 2000. Further, we have seen a resurgence of onshoring of new plants in the U.S. Do you believe the world is rethinking globalization following the pandemic, which caused inventory and supply chain issues? Also, do you think Canada can reinvent itself and attract foreign investment locally?

Yes, the world has been rethinking globalization. Some of those trends may have been accelerated by the pandemic and the supply chain disruptions of 2021 and 2022, but they were already in place. The pace of globalization had already plateaued pre-pandemic and the first Trump administration was a significant departure from earlier trends towards more trade liberalization out of the United States. To-date, though, there has not been a resurgence of onshoring activity outside of some specific industries where there has been deemed to be a national interest in maintaining a domestic production base – for example, in the manufacturing of vaccines during the pandemic and some targeted subsidies for new investments like battery manufacturing in the Canadian example.

The reality is that prior decades of globalization dating back to shipping innovations (eg. containerization in the 1980s) and the explosion of world trade in the 1990s and first decade of the 21st century has resulted in integrated global supply chains that are incredibly expensive to unwind. Canada has some key advantages in that future reorganization, including a highly skilled workforce, stable political environment, and an independent and credible central bank. What is needed is a closer look at harmonizing and streamlining the regulatory backdrop for project approvals and skills recognition across different regions within Canada as a way of ensuring that those advantages turn into actionable investments by businesses.

- Statistics Canada estimates that approximately two-thirds of Canada’s international trade consists of exports to the U.S. With the U.S. election later this year, and a highly anticipated election in Canada next year, what steps could our national leaders improve on to ensure the U.S. remains an important trading partner?

We need to reinforce that trade across the Canada/U.S. border is critical and mutually beneficial. Decades of free trade – particularly in the auto sector where free trade between Canada and the U.S. dates back to the 1960s – has left incredibly closely integrated supply chains across the Canada/U.S. border. Integration is so significant that it blurs the line between imports and exports. For example, a large share of the value of U.S. imports from Canada is actually accounted for by the value of intermediate goods exported from the United States. In the auto sector, the U.S. is actually its own third largest source of imports (larger than Canada at #5). So, U.S. import tariffs on Canada are also essentially indirect tariffs on U.S. exports, and particularly hurt manufacturing activity in critically important swing election states in the U.S. industrial heartland.

- Having already dwelled on a lot of the negatives and hopefully lessons learned to this point, one bright spot of the Canadian economy has been the significant productivity gains achieved in the agricultural space. What specifically do you attribute this success to and is this unique to Canada for this industry?

This is largely a case of the scale of Canadian agricultural production and willingness of farmers to make capital investments and adopt new technologies and techniques. The agricultural sector in Canada is extremely capital intensive and the consolidation of crop farming in particular has allowed gains to productivity from economies of scale. The average farm has become substantially larger and yields have increased. The gains measured over the last century have been exceptionally large – in the 1920s, a third of the Canadian workforce worked on the farm, now that is less than 2%. Put another way, those productivity gains in agriculture freed up almost a third of the workforce to focus on production other than food production. The sector is somewhat unique in Canada – Agriculture and mining are essentially the only industries with significantly higher productivity levels in Canada and the U.S., with the mining comparison benefiting from Canada’s higher weight in very highly capital intensive and productive oil production.

- Your team’s report reflected on the idea that an improvement in productivity could be the single largest factor to a rise in economic growth. In terms of Canada, is there a specific industry where you see upside potential and perhaps constitute a competitive advantage for our country?

Canada has bet on its people – business investment in machinery and equipment and structures have lagged, but Canadian education outcomes and postsecondary graduation rates rank highly among advanced economies. Canada’s venture capital market is much smaller than that of the U.S., but is still the second largest in the G7 as a share of the economy. Highly skilled service production (professional services) is a highly productive growth industry where those investments in education should pay large dividends. The concern in Canada is that the population’s skills are not yet being fully utilized due to mismatches in the kinds of skills being acquired in schools versus what is needed in the job market, and persistent underutilization of the skills of the immigrant population that accounts for essentially all Canadian workforce growth. But the building blocks are there for Canada to compete well versus other countries if those hurdles can be overcome.

Ascendant Wealth Partners Outlook

Reflecting on the above dialogue with Nathan, we asked our Co-Chairs of the Ascendant Wealth Partners Asset Allocation Committee, Jim Bantis and Bruce Leboff, for their thoughts on our positioning to Canada and its evolution over the last decade.

- Looking back to the period following the Great Financial Crisis, can you summarize how your thinking and asset allocation themes have changed as it relates to Canadian content within portfolios?

From 2000 to 2009, the Canadian equity market benefited from notable capital inflows and outperformance by weathering the Great Financial Crisis, largely due to its banking system's conservative lending practices and prudent banking regulations. In addition, a commodities boom by BRIC countries (ie. emerging markets) demand, drove rising prices for natural resources such as oil and metals, which boosted significant components of the Canadian economy. The U.S. market on the other hand, experienced a lost decade largely due to the burst of the dot-com bubble in the early 2000s and a near collapse of their major banks during the financial crisis in 2008, which caused significant downturns in its major indices. In October 2007 and July 2011, the Canadian dollar (CAD) reached peak values at 1.06 USD, reflecting the culmination of these factors above.

In the decade beginning in 2010, our asset allocation approach had undergone significant change, particularly in the context of Canadian content within portfolios. We began to reduce our Canadian equity market exposure in diversified portfolios as we were less confident in continued outperformance and premium valuation against the backdrop of declining commodity prices. In contrast, the U.S. market, particularly the S&P 500, was an area where we saw attractive relative valuations, a rehabilitated banking sector and more diverse composition with substantial representation from technology and healthcare sectors, which saw remarkable growth over the next two decades. Additionally, the U.S. market benefited from the robust performance of large-cap technology companies, often referred to as the FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google), driving returns higher. Furthermore, corporate earnings in the U.S. outpaced those in Canada, contributing to the S&P 500's stronger performance.

Given the relative discount valuation to large-cap U.S. equities, we are now at a point where we are actively monitoring our Canadian equity exposure. However, the catalysts for a change in capital flow back to Canada are not apparent at this time.

- As the Ascendant Wealth Partners’ portfolio construction process largely believes in diversification, what are your thoughts on the Canadian equity exposure and is the Canadian equity exposure well complemented to the style of the U.S. and International equity investments?

We are concerned about excess home country bias, the tendency of investors to favour domestic equities, which can pose several risks for Canadian investors. One significant risk is the lack of diversification, which can lead to increased volatility and lower returns. Canadian markets are heavily concentrated in certain sectors, such as financials and energy, which means that investors may miss out on opportunities in other sectors such as technology and healthcare that are more prevalent internationally. Additionally, overexposure to the Canadian market can result in portfolios that do not capture the full benefits of global economic growth. This bias can also lead to inefficiencies in the portfolio, as it may not be optimally balanced between domestic and U.S./international investments. We suggest that an optimal balance for Canadian equity portfolios might be around 30% domestic and 70% U.S./international to mitigate these risks.

- Fixed Income is an asset class that we think presents good value given the highest interest rate environment we have seen in 15+ years, and our thinking remains that interest rates have either stabilized or will start to decline as inflation is now under better control. Within the fixed income side of the portfolio, can you discuss how our active managers are positioned to access both higher fixed coupon bonds in the U.S. and floating rate loans for public and private debt instruments?

As global inflation finally seems to be coming under control with a soft landing economic outlook, the next twelve months should be a compelling period for bonds after a prolonged back-up in short term rates the past two years. In this environment, active managers may adjust their sector allocation, utilize bottom-up security selection, and add value by reducing portfolio sensitivity to changing interest rates. Investment-grade corporate bonds continue to appear attractive, given their relatively high yields (5-6%) and low to moderate credit risk. Less familiar areas of the credit market are presenting opportunities for skilled managers to find attractively-priced assets with the potential to rise in price and deliver return to bondholders. Even assuming a return to historical long-term default rates and eventual rate cuts, the current jumping-off yield (8-10%) for floating rate senior loans is attractive to deliver positive returns over the next twelve months— while also maintaining the benefits of seniority in the capital structure. In addition, private credit strategies can provide investors with a source of stable, uncorrelated returns, which can be particularly attractive in volatile market conditions. Private credit can also offer higher yield potential (10-12%) compared to traditional fixed income investments, due to the illiquidity premium and higher credit risk associated with private lending.

- Sometimes markets seem to race from one high point to the next. At times like these, investors may face what some refer to as ‘psychological barriers to entry.’ How do you think about investing at "all time" highs?

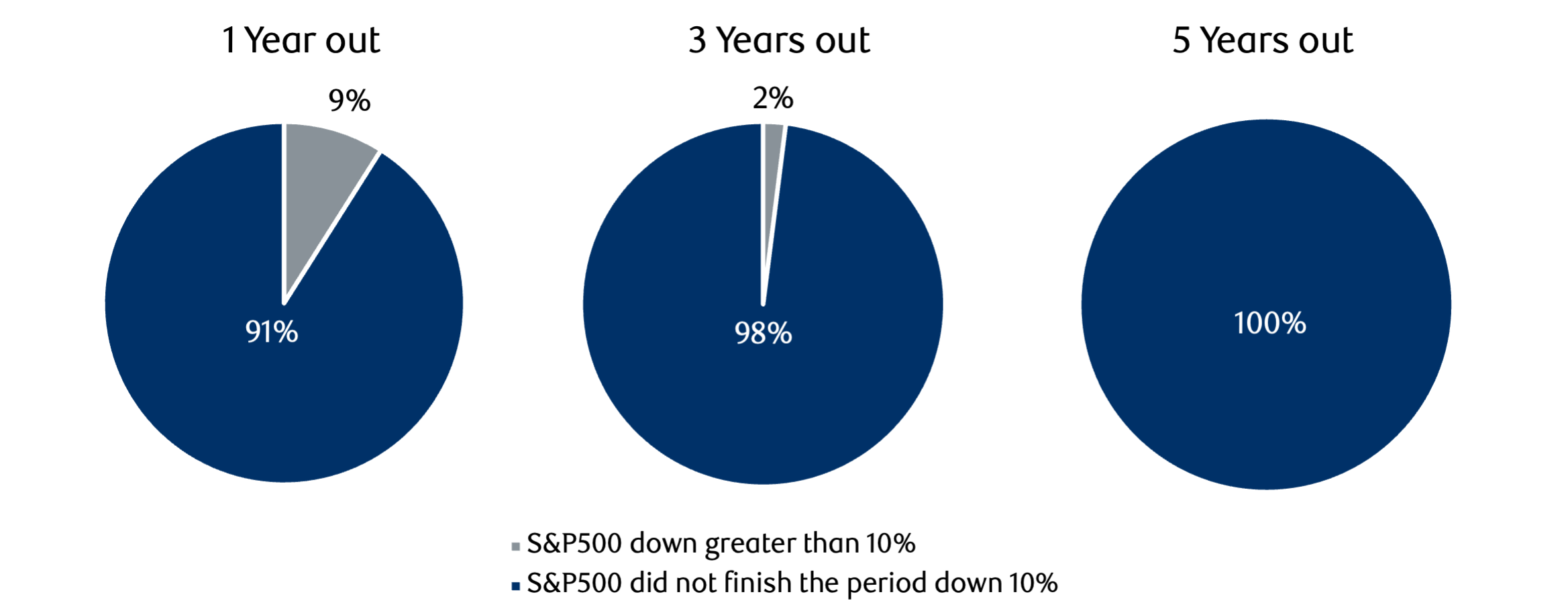

It's natural for investors to hesitate when markets reach new highs, as the fear of a potential decline or the pressure of making an untimely investment is present. However, historical data suggests that markets have a tendency to continue to grow over the long term, despite short-term fluctuations. The broad U.S. equity market, for instance, has consistently set new all-time highs over the decades, averaging over 16 occurrences per year since 1950. This trend underscores the idea that trying to time the market is not only challenging but may also lead to missed opportunities.

Looking out just one year from each all-time high in the S&P 500, market corrections greater than 10% have occurred only 9% of the time. As we extend the time horizon, market corrections become even rarer. In fact, the S&P 500 has never been down by more than 10% at the end of a 10-year period following any of its all-time highs since 1950.

How frequent are market corrections following all-time highs?

Source: Bloomberg, RBC GAM. Data as of January 1, 1950 to March 2024, in U.S. dollars.

A strategy focused on long-term goals and diversification, rather than attempting to predict market peaks and troughs, can help mitigate the risks associated with volatility and the psychological barriers that come with investing at market highs.

We expect to see more volatility during the second half of the year as we approach the U.S. election in November. Even though the number of anticipated rate cuts for 2024 has decreased from six to seven at the start of the year, to one to two presently priced in, the U.S. equity market is on pace to experience approximately 11% earnings growth, which has contributed to strongly positive equity market returns. We will continue to closely monitor key economic indicators and market performance and will be opportunistic as market conditions change. We anticipate that the fixed income component of our portfolios will be a larger contributor to performance in the second half of the year, as yields start to gradually decline with inflation being more contained and growth starting to show some early signs of fatigue.

Thank you for your continued trust and support.