The Ascendant Wealth Partners team is pleased to share our third edition of The Pinnacle. In this quarter’s publication, we will review key developments and market performance from Q1 2024, including the AWP Team’s latest market outlook and commentary. Following a review of key economic themes and current areas of opportunity, we will be providing an overview of alternative and private investments as an asset class – including a discussion on the potential role alternatives can play to improve return and reduce volatility.

Market Update

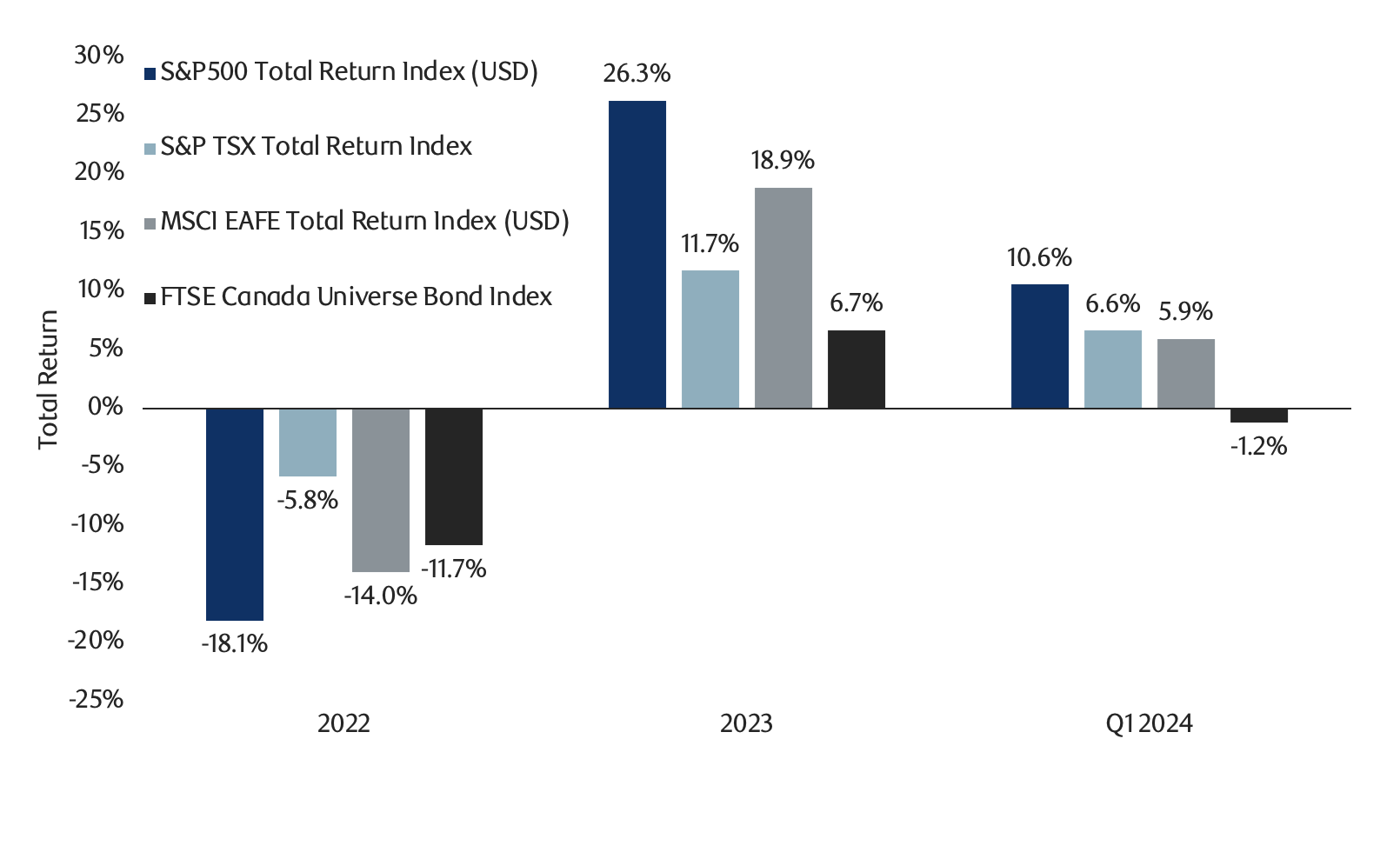

Global equity markets remain resilient, producing strong positive returns during Q1, led by U.S. large cap stocks (the S&P500 index produced a return of +10.6% during the quarter). The below chart summarizes major index returns for 2022, 2023 and Q1 2024.

In contrast, with intermediate term treasury bond yields moving higher to start the year, fixed income and credit market returns were mixed, with higher quality investment-grade bonds producing negative returns (broader Canadian bond market declined 1.2% during Q1) – while high yield bonds and leveraged loans were positive (returning +1.4% and +2.5%, respectively).

Summary of Market Performance

Source: YCharts. Data is presented as of March 31st, 2024.

Despite continued outperformance of U.S. large-cap equities, our Asset Allocation Committee remains excited about the opportunity in the U.S. mid-cap market. In our recent publication titled Winter 2024: The Pinnacle, we noted that the U.S. mid-cap market was highlighting attractive relative valuation levels – which is a theme that persists today. The below chart shows valuation trends (including relative valuations) for large-cap and mid-cap U.S. equities over the past 10 years:

Forward P/E Ratios: Large Cap and Mid Cap U.S. Equities

Source: Ascendant Wealth Partners, RBC Wealth Management; Bloomberg. Data is presented from March 31st, 2014 – March 31st, 2024. “Large Cap US Equities” represents the S&P500 Index, “Mid Cap US Equities” represents the S&P400 Mid Cap Index.

Our conviction in the mid-cap asset class remains strong, as we have begun to see a broadening out of equity market performance beyond large-cap tech-stocks. The S&P400 MidCap index for example, returned +10.0% in Q1 2024, trailing the S&P500 only slightly over the same period. Our Investment Committee favours active management in the U.S. mid-cap equity space. Specifically, our team has identified a high quality U.S. mid-cap equity investment manager in Madison Investments – whose mid-cap strategy has consistently outperformed the broader market and its benchmark. More information on Madison Investments and their U.S. mid-cap equity strategy can be found in our previous publication, titled Winter 2024: The Pinnacle.

On the valuation front, as noted, the large cap U.S. stock market appears expensive. These stretched valuations have largely been driven by the performance of the “Magnificent 7”, a group of seven large technology stocks. If we strip out these seven stocks (leaving 493 other companies), the market’s P/E ratio falls to a more reasonable range of approximately 17x. For this reason, we are not suggesting that the outlook for large cap U.S. stocks is necessarily grim, however, we do believe that attractive opportunities exist in other markets – and further, that diversification within the equity portion of a portfolio is prudent (depending on an individual investor’s situation).

Interest Rate Update

Since the first rate hike of the current cycle in March of 2022 (both the Bank of Canada and the U.S. Federal Reserve increased the overnight rate by +0.25%), all eyes and ears have been on global central bank leadership. Our team has watched and listened closely as economic policymakers have increased target interest rates to levels not seen since before the global financial crisis (2007-2008). The rapid increase of policy rates across most of the developed world has presented both a challenging, and exciting environment for investors.

Today, we have arrived where most observers would consider a pivot point in the current cycle – marking a period where policy makers are likely finished increasing interest rates, and further, are unlikely to keep rates at current levels for much longer. This theme has been observed through central bank leadership communications, including recent comments from Chair of the U.S. Federal Reserve, Jerome Powell, expressing the Fed’s feeling that approximately three interest rate cuts would be reasonable for the 2024 calendar year.

The outlook for the path of U.S. interest rates is widely debated, particularly as recent economic data out of the U.S. has been strong, with the last two U.S. consumer inflation prints coming in hotter than anticipated, and no major sign of any cracks in the labour market. In Canada, although broadly believed by investors that rate cuts are imminent this year, Governor of the Bank of Canada, Tiff Macklem, expressed a somewhat neutral tone in March, stating that we need to give higher interest rates more time to do their work – emphasizing the BoC’s commitment to lowering inflation further towards their 2.0% target. In February, U.S. inflation (measured by the year over year change in CPI) was 3.2%, and in March, the latest print was 3.5%. In Canada, February’s inflation number came in at approximately 2.8%, down marginally from the 2.9% figure in January - marking the lowest published inflation number since June 2023.

The outlook for inflation and upcoming interest rate policy changes remains a key driver of investor sentiment – and in turn, market performance. Currently, the market is pricing in approximately three interest rate cuts in Canada and two-to-three interest rate cuts in the U.S. by the end of 2024. The below chart illustrates current market expectations for the path of interest rates in North America. As the last mile to central bank inflation rate targets have become arduous, rate cut expectations have become more conservative since Q4 of 2023, when investors were pricing in U.S. Federal Reserve policy rates of ~3.75–4.0% by the end of 2024:

Source: Ascendant Wealth Partners, Bloomberg. Data presented as of April 1st, 2024.

In our previous quarterly publication titled Winter 2024: The Pinnacle, we discussed the presence, and important consideration of reinvestment risk. One quarter later, with overnight rate cuts now looking imminent in 2024, our conviction remains that a more attractive opportunity for total returns exists in government and investment-grade corporate bonds (with one-to-five-year maturities), when compared with short-term cash and cash equivalent investments (particularly investments with floating interest rates). The below chart shows the historical outperformance of bonds over cash during periods when the FED is finished raising interest rates, therefore, marking the end of a rate hiking cycle:

Outperformance of Bonds vs. Cash

Source: Morningstar Direct. Based on the average cumulative one to five year returns after the final Fed rate hike. Data from February 1990 – December 2023. Cash = FTSE Canada Canadian Treasury Bill 30-Day. Bonds = FTSE Canada Universe Bond Index. Cost of missed opportunity for cash investors is the difference between the returns for bonds and cash. An investment cannot be made directly into an index. The graph does not reflect transaction costs, investment management fees or taxes. If such costs and fees were reflected, returns would be lower. Past performance is not a guarantee of future results.

As illustrated above, historically, there has been a significant opportunity cost to holding cash equivalents in place of bonds in this environment. We believe this scenario will materialize once again over the next twelve-months, as interest rate cuts come to fruition. With the shape of the yield curve significantly inverted (short term yields are considerably higher than longer term yields), this cycle may behave differently than those in the past. However, we still believe the opportunities in short and intermediate fixed income securities will outpace the returns of cash and cash equivalents.

With interest rates set to decline over the next few quarters, we are taking advantage of opportunities to lock-in attractive yields, and soon, will be considering more exposure to alternative investments, which have the potential to offer superior yields to traditional public fixed income investments.

Inclusion of Private and Alternative Investments in a Well-Constructed Portfolio

Historical analysis suggests anywhere between 75% and 90% of an investor’s return is attributed to asset allocation decisions – that is, the percentage of a portfolio invested in cash, fixed income, equities, and alternative and private market investments.

Our team has extensive experience offering clients exposure to various alternative and private investment strategies. After our successful transition to RBC, a key focus for the Ascendant Wealth Partners team in 2024 is to conduct an in-depth review of the alternative and private investment platform at RBC. Following our team’s due diligence and research, our goal is to incorporate uncorrelated investment strategies in our client portfolios (where appropriate), which will serve as a complement to more traditional equity and fixed income allocations.

In advance of the completion of this project, we want to provide a high-level overview of the benefits that non-conventional strategies provide to a diversified mix of investments.

Many of the world’s leading investors, including pension plans, endowments, and sophisticated family offices have increased their respective portfolio’s allocation towards private and alternative assets. In many cases, this has led to very strong performance, and often, has helped achieve the holy grail of investing: (i) excess returns and (ii) a reduction in overall portfolio risk, when compared with a traditional stock and bond portfolio. However, unlike the types of institutional investors listed above, individual investors typically have a finite lifespan, and do not operate in perpetuity. For these reasons, close consideration of an investor’s time horizon is essential – as many alternative and private investments have liquidity constraints, potentially limiting an investor’s access to their capital.

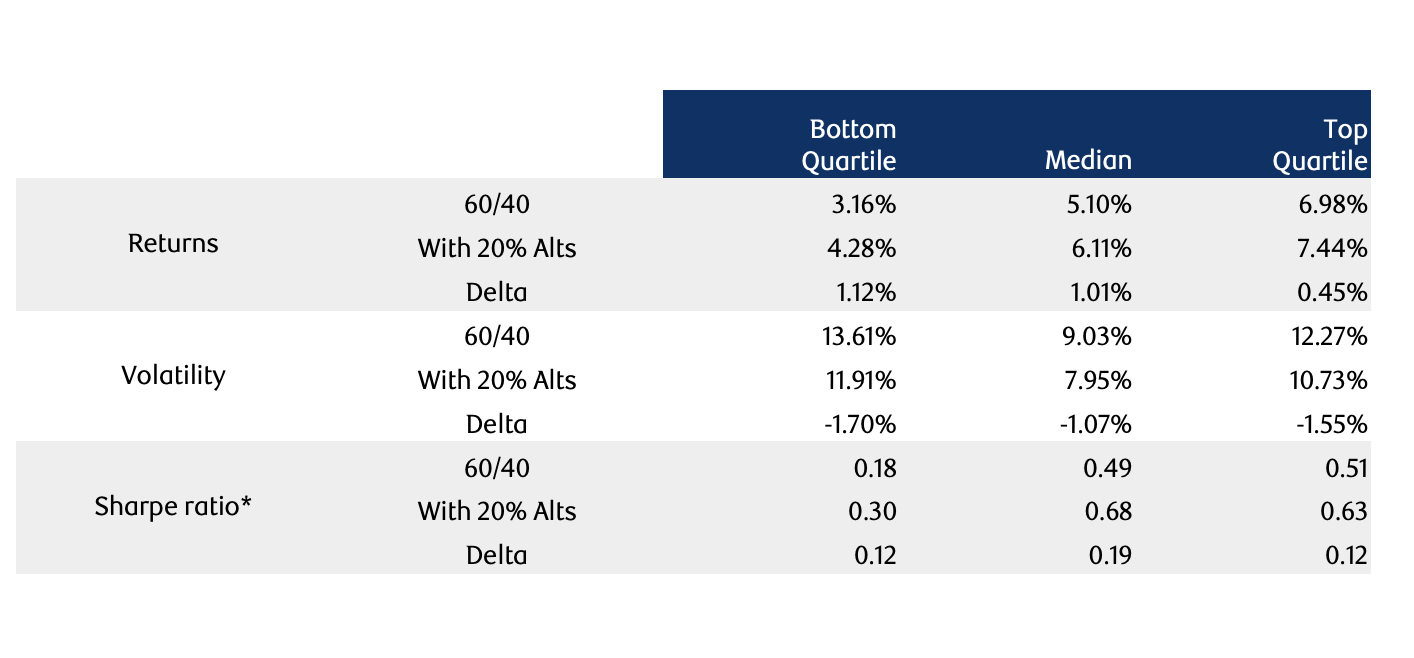

iCapital, an alternative investment platform, completed a study evaluating the risk and return benefits of adding 20% to alternative investments in a portfolio, and compared the results against a traditional balanced 60% equity/40% bond asset allocation. Their analysis showed that the allocation to alternative investments resulted in one full percentage point increase to an investor’s annualized return, over a 16-year period. Further, the inclusion of alternatives improved returns in 98.6% of modeled scenarios. In addition, the study also showed that inclusion of alternatives/private investments helped the overall portfolio outperform a traditional stock and bond portfolio during periods of market weakness – with volatility metrics reduced by more than 10%, on average. The table below summarizes the return enhancements that can be achieved, with a corresponding decline in the level of volatility or risk:

Source: iCapital, based on quarterly index data from Preqin, Cliffwater, MSCI, Bloomberg, NCREIF and HFRI, as of Sep. 30, 2023. Totals may not correspond with the sum of the separate figures due to rounding. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed. See the Methodology section for more information. *The Sharpe ratio is a measure of the risk-adjusted return (or return per unit of excess risk assumed) of a security or portfolio. It is calculated by looking at the standard deviation of returns relative to the performance of a “risk-free” asset.

The next chart shown below outlines the performance of a diversified alternative investment allocation, when compared to a traditional balanced 60% equity/40% bond portfolio during periods of market shocks and declines. Private and alternative investments do not typically exhibit the same “minute to minute” volatility, and therefore tend to exhibit less emotional and behavioural biases, given their restricted liquidity characteristics. As illustrated below, the downside protection private and alternative investments provide is very apparent.

Maximum drawdown of Diversified Alts and Traditional Balanced 60/40 Portfolios

Source: iCapital, based on quarterly index data from Preqin, Cliffwater, MSCI, Bloomberg, NCREIF and HFRI, as of Sept. 30, 2023. For illustrative purposes only. Past performance is not indicative of future results. Future results are not guaranteed. See the Methodology section for more information.

Private investments were helpful additions to the portfolio over a prolonged period of time when interest rates were held near record lows. As a capital allocator, access to unconventional and complementary asset classes has allowed us to construct portfolios that increase returns, while limiting our clients’ exposure to incremental risk. We strongly believe alternative and private investments have an important role in a diversified portfolio, and the allocation to these strategies is worthy of consideration.

Not all Private Credit is Equal

There have been several articles written over the last year about apparent stresses in certain private credit and real estate investment strategies. We thought it would be important to review some of the key considerations that the Ascendant Wealth Partners team, as well as the RBC Alternative Investments group, believe are critical features when contemplating an allocation to private investments.

Firstly, most private investments have irregular liquidity terms. Typically, the underlying investments have limited liquidity, whether that be private loans, private equity, or real estate properties. As a result, investors should not expect the redemption profile of a private investment strategy to mirror that of a traditional stock or bond portfolio (which typically offer daily or monthly liquidity). Notice periods of six months with quarterly redemptions are very common terms in the private credit space. Further, most investment strategies will only allow a certain percentage of the total Fund assets to be redeemed within a specific redemption window, potentially limiting an investor’s ability to sell their investment.

These provisions are generally included to provide a level of protection to all investors. For example, if a material number of investors were to exit a private investment at the same time, and there were no redemption limitations in place, the investment manager may become a forced seller, forcing them to liquidate assets at a price that could be outside of their control (ie. selling investments at distressed prices). As a result of the irregular liquidity parameters in many alternative asset investments, understanding an investor’s liquidity requirements is key to determining the appropriate allocation within a portfolio.

In addition to liquidity risk, we have a heightened awareness to the following risks in private and alternative investments:

- Concentration Risk – the old adage “Don’t put all of your eggs in one basket” is fundamental, and thus having a higher level of diversity with a greater number of positions reduces the overall risk

- Credit Risk – accessing a deeper market such as the U.S. as an example, leads to more selectivity and scrutiny with respect to the purchase decisions. The private credit strategies that we look to access expand well beyond Canada and have a primary focus in the U.S. market.

- Valuation Risk – understanding the process by which an investment manager values private investments that do not trade on an exchange is critical. Do they use a third party or independent valuation agent? “Mark to market” methodology and frequency of valuations are equally important.

- Disclosure or Lack of Information Risk – does the investment manager provide a listing of the securities held and are they forthcoming with current pricing, maturity profile and current yield? While we have seen regulatory oversight doesn’t always provide 100% protection, regulation provides another level of scrutiny with more complete information.

The RBC Alternative Investments team also holds these risks in high regard and uses them as essential guideposts when adding a new private or alternative investment strategy to the RBC platform. As Canada’s leading bank and largest asset manager, the RBC Alternative Investments team has fortunately avoided many of the troubled investment managers that have been widely publicized, largely because of their intense due diligence process.

The Ascendant Wealth Partners group leverages the expertise of the RBC Alternative Investments team for initial manager selection, then, following our own due diligence, makes a collective and final decision on what private and alternative investments are appropriate for our clients.

Upcoming Events and Announcements

Tax season is upon us. The RBC tax documents have all been uploaded to the RBC client portal, Wealth Management Online. They can be found in the “Documents” and “Account Documents” sections under the “Tax Documents” folder – you will then need to toggle between accounts using the dropdown menu to download or print each of the available tax documents that have been published. For any assistance, please reach out to any member of the Ascendant Wealth Partners team.

Four of the Partners of the Ascendant Wealth Partners team will be in Scotland in May and will be meeting with Walter Scott & Partners Limited in Edinburgh. Walter Scott manages approximately $82.5 billion, with a long-standing track record of strong performance. The Ascendant Wealth Partners team has been actively allocating capital to Walter Scott’s International Equity strategy. We will be publishing highlights of the due diligence our team conducts in a future edition of The Pinnacle, including an overview of Walter Scott’s investment process.

In late May we will be holding our next webinar to discuss our market outlook and delve deeper into some of the themes we have highlighted in this edition of The Pinnacle.

We thank you for your continued confidence, trust and support.

Source: iCapital – Trading Places: Mapping the Impact of Alts in a Traditional Portfolio (February 2024)