Welcome to our first edition of The Pinnacle. Firstly, we want to thank all of our clients for their continued confidence, trust and support! Our mission with our quarterly newsletter is to provide you with new developments on the Ascendant Wealth Partners team and also share our thoughts on the market and insights related to constructing portfolios. In addition to our regular quarterly newsletter, we will also share other content on our website and on LinkedIn (follow us at Ascendant Wealth Partners of RBC Dominion Securities) on a periodic basis.

As we finalized the first edition of The Pinnacle over the weekend, we have watched in shock and horror at the events unfolding in the Middle East. Israel suffered a brutal attack on its population by Hamas, a terrorist organization. We stand against hatred of any kind and denounce the violence against Israel and the Jewish community. We know many of our clients, colleagues and friends are directly impacted by these horrific events. Our thoughts are with every one of you and your families. We hope and pray for peace and safety in the region.

In our inaugural publication, we present the Ascendant Wealth Partners team members and provide an overview of our investment process and the functions and responsibilities we have divided across the team. We discuss the market drivers of the third quarter and highlight our growing enthusiasm as it relates to traditional fixed income exposure, which we have recently introduced to appropriate client portfolios. Finally, we also review a rare opportunity in terms of favourable tax advantages of investing in bonds – a subset of the market where fixed income securities are presently trading at a discount to par value, which is attractive for taxable investors and can also be an effective cash management strategy in specific situations.

Ascendant Wealth Partners – Introduction

The Ascendant Wealth Partners team joined RBC Dominion Securities in April 2023, serving clients as a boutique within Canada’s largest wealth management firm. At Ascendant Wealth Partners, we pride ourselves on investment excellence, focused on strategic and tactical asset allocation, vetted through intensive due diligence, and realized through a vast open-architecture platform.

Our founding partners were determined to provide clients with exceptional investment management. Founded on the principles of investment excellence and best in-class client service, the vision came to life through a partnership with Canada’s largest bank. In collaboration with RBC, the Ascendant Wealth Partners team helps clients achieve financial success by offering a tailored, high-caliber investment and wealth management experience.

Founding members of the Ascendant Wealth Partners team include Jim Bantis, Bruce Kagan, Bruce Leboff, and Adam Moody, who have amassed 100+ years of collective experience advising and investing on behalf of families, foundations, and institutions. Each founding partner is an experienced Senior Portfolio Manager who has been entrusted with managing $1+ billion in client assets. The Partner group expanded when the founders were joined by two Senior Portfolio Managers and Partners, Evan Howard and Jonathan Paul. The senior members of our team had been working closely together as seasoned leaders at one of Canada’s leading wealth management boutiques for more than ten years. The group leverages a unique combination of advanced skill sets and deep industry knowledge that spans corporate finance, equity research, taxation and accountancy.

The group’s competence is further enhanced by a deep bench of financial service professionals who support the Partners directly. The below organizational chart provides additional information on the Ascendant Wealth Partners team, and we are still growing!

Our team takes a collaborative approach and utilizes formal processes, which are executed by our asset allocation, investment and risk management committees. Key contributors to our investment management process include insights from external macro and market strategists and leaders at RBC Global Asset Management, RBC Portfolio Advisory Group and RBC Economics teams. The Asset Allocation Committee, led by Jim Bantis and Bruce Leboff, is responsible for optimizing asset allocation in the current market environment based on an investor’s goals, objectives, and risk tolerance. The Investment Committee, chaired by Adam Moody, is responsible for conducting in depth due diligence on investment solutions that reflect the asset class weights proposed by the Asset Allocation Committee. The RBC investment platform is very broad and offers choice amongst a universe of 3,000+ active investment strategies, including separately managed accounts and pooled funds managed by RBC and leading third-party managers from all around the world. The Investment Committee’s review also considers passive or index alternatives to gain exposure to certain markets where there are advantages over individual securities (tax, liquidity, scale, cost) and in markets where active management has been difficult to deliver consistent outperformance. The Risk Management Committee, led by Evan Howard, is responsible for reviewing and monitoring exposure and correlations across investment strategies and asset classes. Our formal processes are supported by colleagues across the RBC network and ensure the investment goals of families, foundations and institutions who entrust us with their capital are consistently achieved.

In addition to investment management, the Ascendant Wealth Partners team offers wealth, estate and tax planning services. Our planning services are led by Mark Chan and Jag Gandhi, who bring extensive and sophisticated professional experience to their engagements with clients, and who have worked closely with our team at our previous firm. Mark, a Chartered Professional Accountant (CPA, CA) and Certified Financial Planner (CFP), specializes in tax, estate and retirement planning for high-net-worth and ultra-high-net-worth families. Jag brings over 18 years of legal private practice experience and specializes in trust and estate planning for business owners, high-net-worth individuals and their families.

We also welcome new members to the Ascendant Wealth Partners team internally from RBC Dominion Securities: Akinyemi Thomas, who leads the team’s Trading and Execution function, as well as Sophia Kemularia and Nathaly Minda, who support the team as Associates. Milena Santillan has also recently joined us from another wealth management firm.

The Ascendant Wealth Partners team is excited to carry out our vision in partnership with RBC Wealth Management (RBC Dominion Securities). Canada’s largest wealth management platform offers exceptional resources in areas including technology, administrative services, market research, thought leadership and investment management. Significant and ongoing investments in technology contribute to a smooth digital user experience for both clients and the Ascendant team operationally. In addition, our new relationship provides clients with access to services across the broader RBC service line, such as but not limited to, personal and corporate banking services (including private banking), lending services, wealth, tax and estate planning, and insurance.

Market Briefing

Tighter central bank policy continues to drive market sentiment with additional rate increases

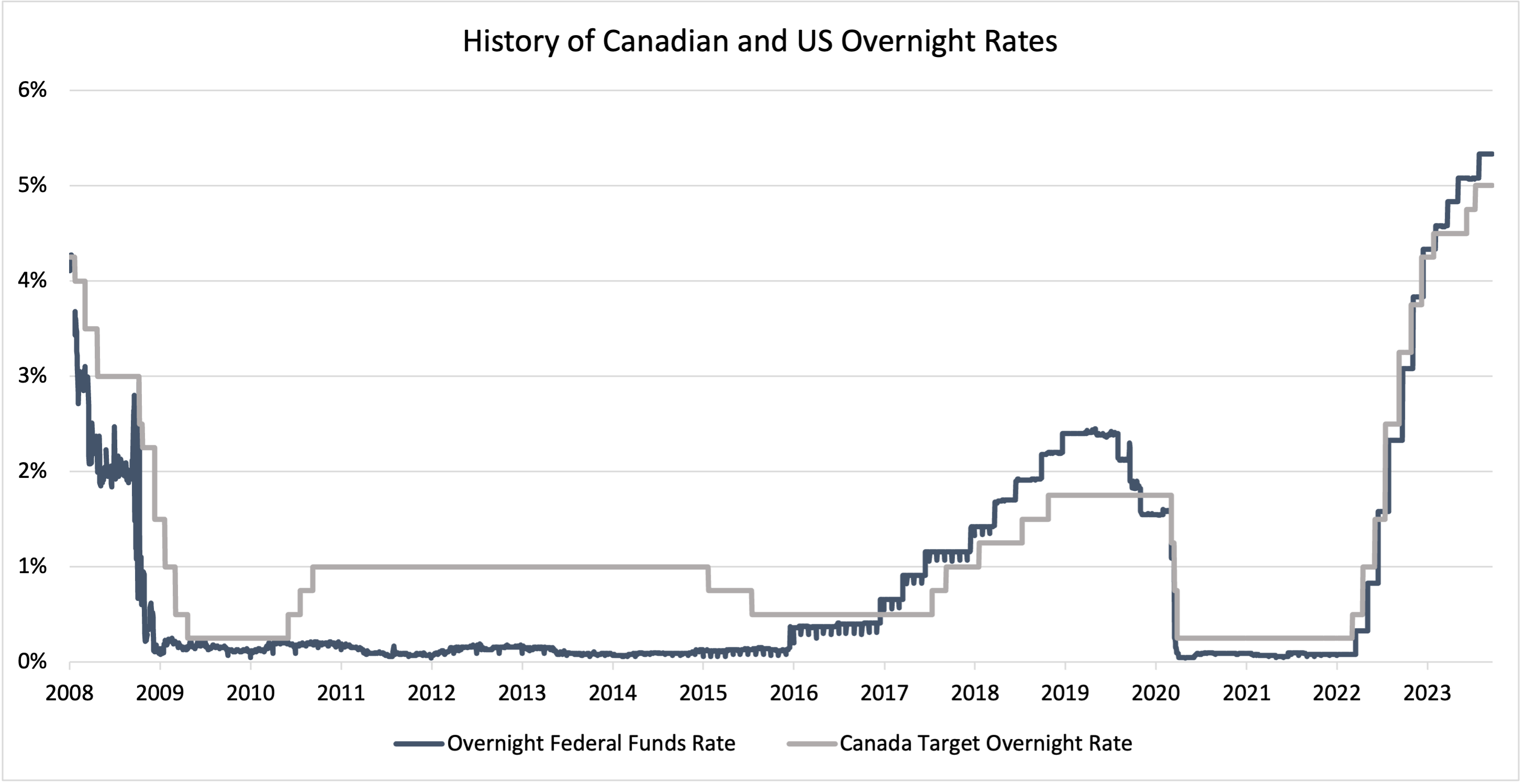

Global central banks continued to tighten monetary policy in the third quarter of the year in an attempt to further dampen the impact of inflation on the economy. Both the Bank of Canada and the U.S. Federal Reserve each increased interest rates another 25bps in July. From the lows set following the COVID pandemic, the Bank of Canada and the U.S. Federal Reserve have hiked interest rates 475bps and 525bps, respectively, over a short 18 months – the sharpest increase over the shortest amount of time in over 40 years.

The following chart shows the path both the Bank of Canada and U.S. Federal Reserve have embarked on dating back to the Great Financial Crisis (GFC) of 2008 and as you can see, the Bank of Canada and U.S. Federal Reserve have moved nearly in lockstep with one another for most of this time period.

Source: YCharts

Inflation remains persistent suggesting rates will remain elevated

The sharp rise in interest rates across the developed world has had a positive impact on cooling inflation. However, inflation rates, particularly the core measures (core measures are considered a less variable assessment of inflation that excludes the impacts of food and energy prices) have remained sticky and above the tolerance of what central banks deem as price stability where they target annual price increases of approximately 2%. With the labour market continuing to show strength, albeit job growth is showing some signs of fatigue, the trend remains positive with modest job growth. The unemployment rate is also coming off of a many decades low in both Canada and the U.S. The broader unemployment rate in the U.S. bottomed at 3.4% in May (a more than 50 year low) and has increased slightly to 3.8% at its most recent monthly reading. All that to say that U.S. Federal Reserve has been successful in their mandate of providing full employment but more work is required to fulfill their second objective of their dual mandate in terms of achieving price stability. Higher energy prices, prices of services, and in Canada, a +30% increase in annual mortgage costs, are proving to be sticky with core inflation rates in Canada and the U.S. still running at more than 4% and recently showing signs of reacceleration after showing significant downward progress in previous readings. Studies suggest that interest rate adjustments by central banks can take anywhere between 12 to 18 months before the economy feels the full impact. Therefore we haven’t even begun to feel some of the more recent increases and central banks face a very delicate balancing act. The last thing central banks want to do is make a policy mistake – wrongly believing that they have slayed the inflation dragon to pause or pivot and start cutting interest rates for inflation only to come back stronger. This is what happened in the late 1970s with inflation and interest rates increasing to double digit figures and something they want to avoid and not repeat. That said, we strongly believe the majority of the tightening in this cycle is now behind us. However, the important takeaway is that rates will likely stay elevated for longer until inflation shows even more signs of slowing towards the central banks’ targeted rate.

Source: YCharts

Source: YCharts

Challenging 2022/2023 and higher risk-free rates = opportunities for long-term investors

Equity markets saw a volatile quarter with early gains wiped out during the closing weeks. The Canadian equity market, U.S. equity market and international equity markets were all down -2.2%, -3.3%, and -4.1%, respectively, during the last three months. Despite negative returns in Q3, all major equity markets sport solid gains heading into the final quarter of 2023, with advances of 3.4%, 13.1% and 7.6%, respectively. The chart below presents the performance of the major indices in 2022 and the recovery in 2023 – bonds have experienced declines now for what may be the third year in a row, and we are now finding compelling value in bonds. Equity markets are looking forward and adjusting for what is expected in terms of interest rate cuts towards mid-2024 – cuts that were anticipated by the market by this time when strategists were assessing their outlooks a short nine months ago. With most markets delivering a whole lot of nothing for the last two years (yet diversified portfolios have generated some value over this time period), opportunities moving forward for long-term investors are strong, with risk-free interest rates much higher and central banks nearing their terminal rate.

Source: YCharts

Portfolio Positioning

With interest rates likely remaining higher and therefore having an impact on the consumer’s behavior which is the single largest segment of the economy in North America, we remain cautiously optimistic with the following thoughts related to positioning:

- Continue to maintain moderately lower equity weights across our different client portfolio models

- Using active equity investment managers who have historically demonstrated added value and provided better downside protection in terms of managing risk

- Introduced a dedicated U.S. mid-cap equity allocation as relative valuations are more attractive vis a vis large-cap U.S. businesses

- Increased exposure to short and medium term bonds – particularly tax effective discount bonds, and have started to reduce our cash and cash equivalent weightings

Bonds are Back!

With the ascent in interest rates and increasing yields that can now be earned in more traditional fixed income securities, we recently introduced some modest interest rate exposure or duration to various client portfolios. It has been more than 15 years since interest rates were at these levels – just prior to the Great Financial Crisis in 2008. Gone are the days back in late 2020 when there was more than $18 Trillion of debt trading at negative yields (a time where stashing cash under your mattress in parts of the world such as Europe and Japan seemed more economically prudent than paying Government’s and high quality corporate issuers to own their debt). With interest rates remaining low for a period of nearly 15 years, investors began evaluating alternative investment opportunities for the “safety” component of the portfolio. Our unconventional approach of hedged interest rate credit strategies and floating rate loan instruments as rates have materially increased have served our clients well in the recent past. We now believe we are at an inflection point where the income and risk mitigating factors that bonds presently provide are extremely attractive.

RBC Wealth Management compared different 10 year time periods over the last 30 years and the contribution that both the equity and fixed income components of a balanced portfolio had on the overall return. Not surprisingly, the 45% allocation to Fixed Income and Cash over the last decade only amounted to 15% of the overall portfolio return – a contribution of one whole percentage point to the balanced portfolio’s annualized return versus 6% annualized for the 55% equity allocation.

However, times have now changed. High quality fixed income securities now generate mid-single digit returns and for the first time in a very long time, bonds are generating a positive real return. We believe that the bond allocation will become a more meaningful contributor to a balanced portfolio’s results as had been previously experienced.

Would you buy a GIC earning more than 7%?!? The opportunity of “discount bonds”

As global interest rates have moved materially higher since March of 2022, the fixed income landscape has drastically changed as we have noted. Rising yields have been accompanied by falling bond prices, which present an opportunity for fixed income investors. With both corporate and government bond yields trading materially higher than where they were three years ago, high quality investment grade bonds trading at a discount to their par value warrant consideration for inclusion in a balanced investment portfolio. The opportunity created by an inverse relationship between bond yields and prices, is particularly attractive for taxable investors, and increasingly so for investors in higher marginal tax brackets.

Bond coupon payments are treated as income, and therefore taxed at an investor’s marginal tax rate. Traditional fixed income investments purchased at (or near) their par value produce most (or all) of their return in the form of interest income. Bonds purchased at a discount to their par value, however, offer enhanced after-tax returns derived from preferential tax treatment of capital gains – the price appreciation from the discounted purchase price to maturity at par value is taxed as a capital gain (and with the current capital gains inclusion rate in Canada at 50%, investors pay half the tax for a $1 earned as a capital gain relative to $1 earned as income). The most attractive discount bond opportunities can be sourced from low coupon bonds that were issued during time periods of historically low interest rates.

There are high-quality bonds that are maturing over the next number of years that are presently generating taxable equivalent yields of between 7% and 8% today. Contact us for more details but these returns are far more attractive than the after-tax returns that GICs, High Interest Savings Accounts, or term deposits generate – and in some cases provide better flexibility in terms of liquidity

Transition well underway

Our transition to Ascendant Wealth Management of RBC Dominion Securities has seen great early success. Our assets under management have grown to nearly $3 Billion in our care and we expect that by the end of the transition (in the coming months) that our assets will be in the $5 Billion range. We could not have done this without the strong support from our clients. We thank you for your tremendous support and ongoing trust and we look forward to speaking with you soon!