Andy's Angle

Market Commentary

Happy New Year,

This edition of Andy’s Angle will touch on RRSP vs. TFSA contribution decisions, our market outlook for 2018, two more our Hot Stocks and review some past picks.

Have a great weekend,

TFSA vs. RRSP

The RRSP deadline for 2017 is March 1st, 2018 and Canadians also received an additional $5,500 of TFSA contribution room for 2018. So, how do you decide which account to prioritize…..RRSPs or TFSAs? It’s easy….fill them up to the brim! In all seriousness, there is no simple formula to figure which account to use. The optimal contribution mix depends on your income, retirement plan and liquidity requirements for the money. Below is a link to an RRSP vs. TFSA calculator and I’ve also attached two helpful fact sheets, but it’s prudent to consult a professional planner.

http://ativa.com/tfsa-vs-rrsp-calculator/

What a Year!

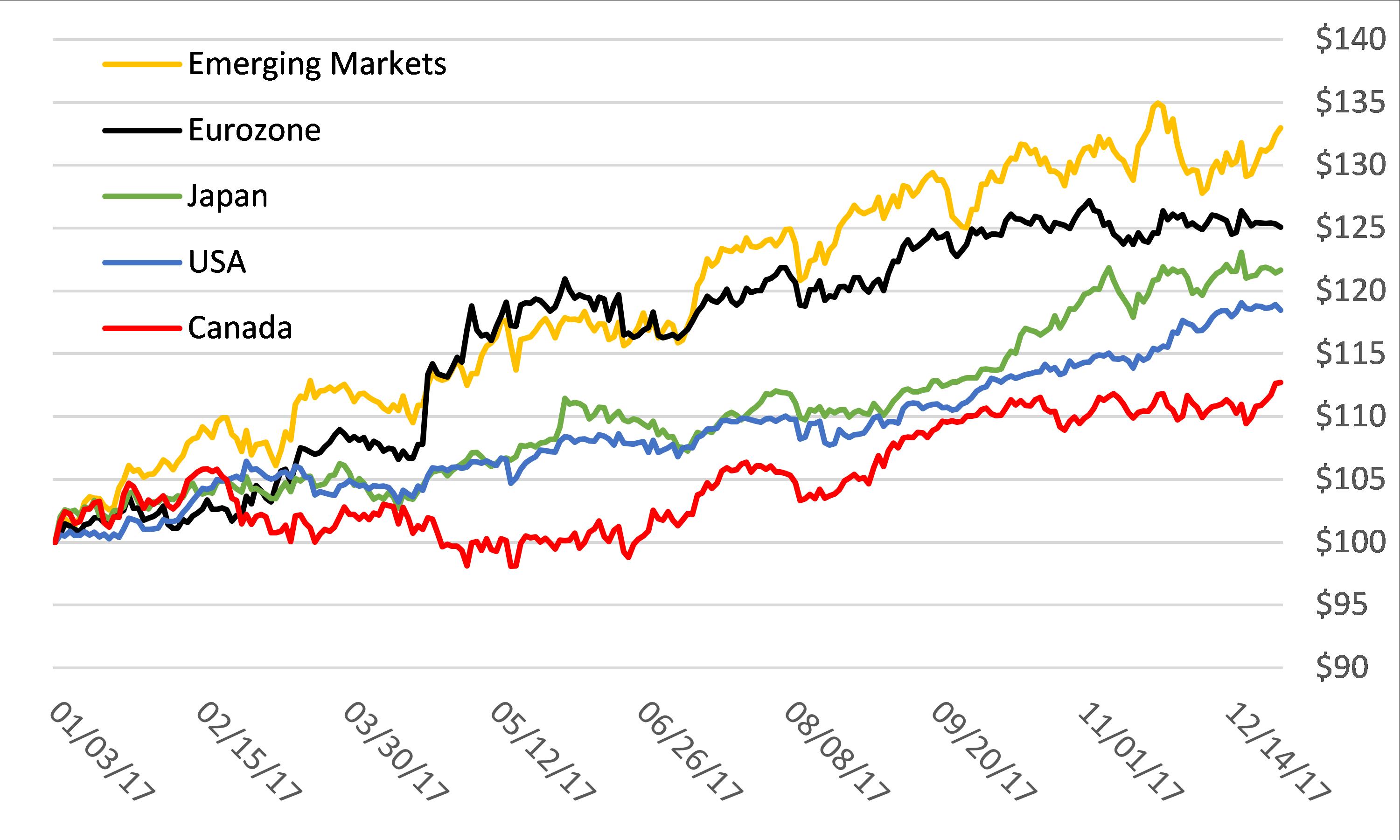

2017 will go down in the books as a beauty year for the markets with the S&P 500 up 13.5% and the TSX up 9.1% (returns in CAD). Holy Hannah!, for the first time in 90 years the S&P 500 DID NOT post a single monthly loss. However, international equities stole the show and fought back with a vengeance after years of underperformance. Emerging markets, Europe and Japan were en fuego and the top performing markets of 2017, respectively (Chart 1). Global synchronized GDP growth was the name of the game and cyclical markets geared to growth performed the strongest. But what’s good for the market is not always good for the world. The past year will be remembered as the year Donald Trump was inaugurated, North Korea went nuclear and we lost the great Tom Petty.

Chart 1: International Equities are en Fuego!

Source: OECD, RBC Dominion Securities

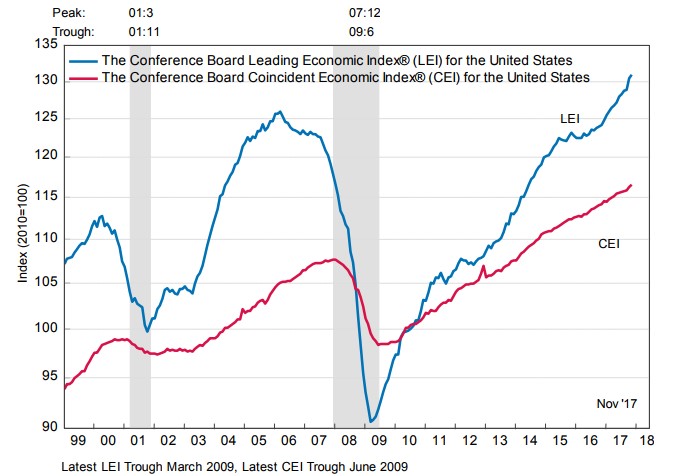

This Angle is late but around this time of year market pundits give their outlook for 2018 and here is our two cents. 2018 should be another strong year for equity markets. The story remains the same and our thesis is intact. Markets have climbed over the proverbial ‘wall of worry’ and concerns regarding a reversal of global monetary policy, populist uprisings in the Europe and US geopolitical tensions are in the rear view mirror. The global economy is ripping with consumer confidence, manufacturing indicators, unemployment and other leading economic indicators all moving in the right direction (Chart 2). We may be in the last couple innings of the business cycle, but the great recession left deep scars on global consumers and businesses that have finally healed. These scars have extended the length of this market cycle. The party is closer to the end rather than the beginning, but let’s keep dancing until the music stops.

Chart 2: Leading indicators are keeping the party going - Just Dance - Jamiroquai

Source: The Conference Board, RBC Dominion Securities

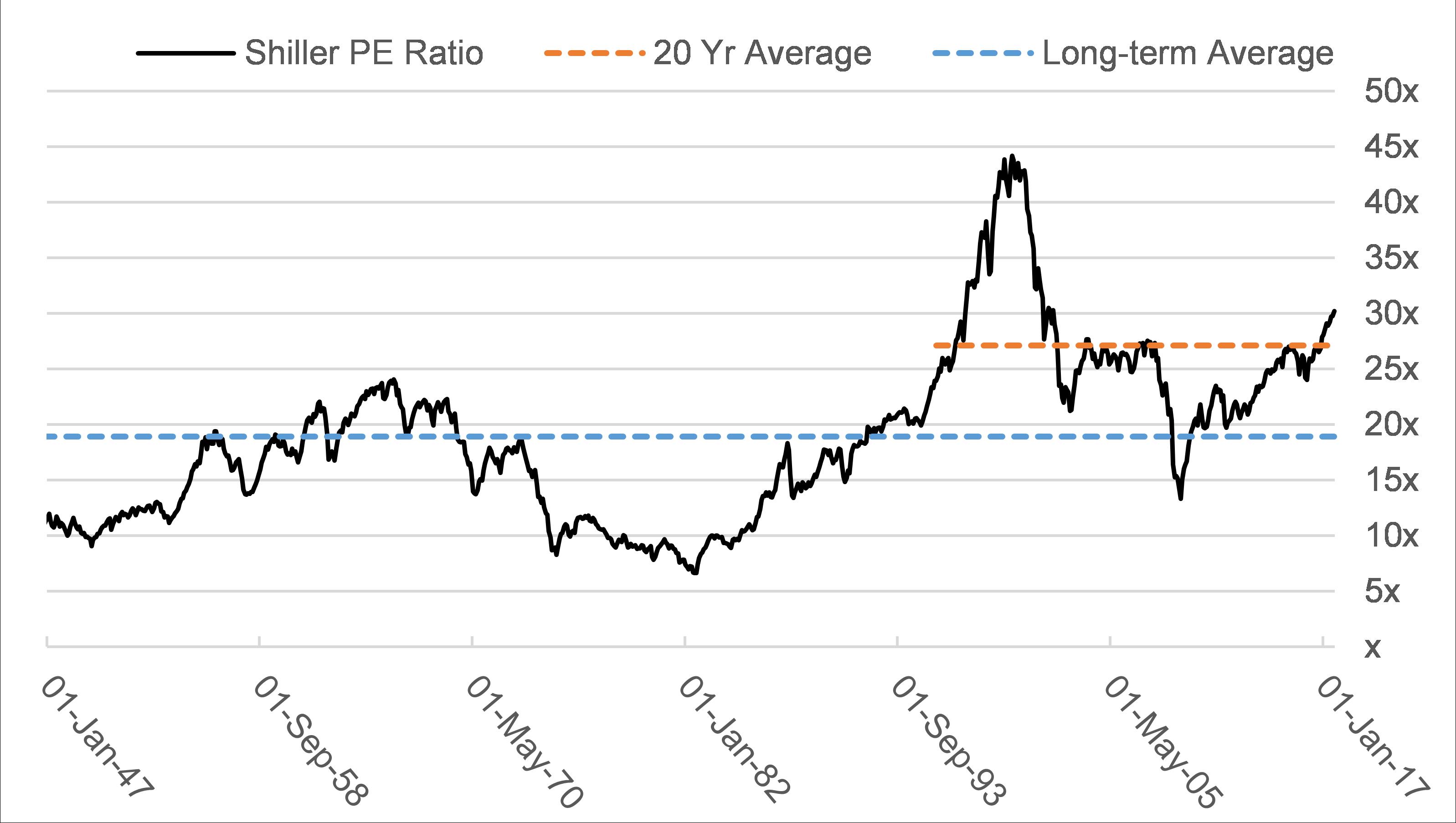

By any measure markets are expensive with valuations surpassing long and short-term averages (Chart 3). However, valuation itself is not enough to kill the bull market and a sense of euphoria and exuberance is necessary to push the market over the edge. This euphoria and an overheating economy may cause central bankers to jump the gun and kill the bull market through aggressive interest rate hikes. I do not believe we are at that point yet, and if the market makes sense to the Oracle of Omaha then its good enough for me.

Chart 3: Valuations are expensive but nothing is more expensive than a missed opportunity

Source: multpl.com, RBC Dominion Securities

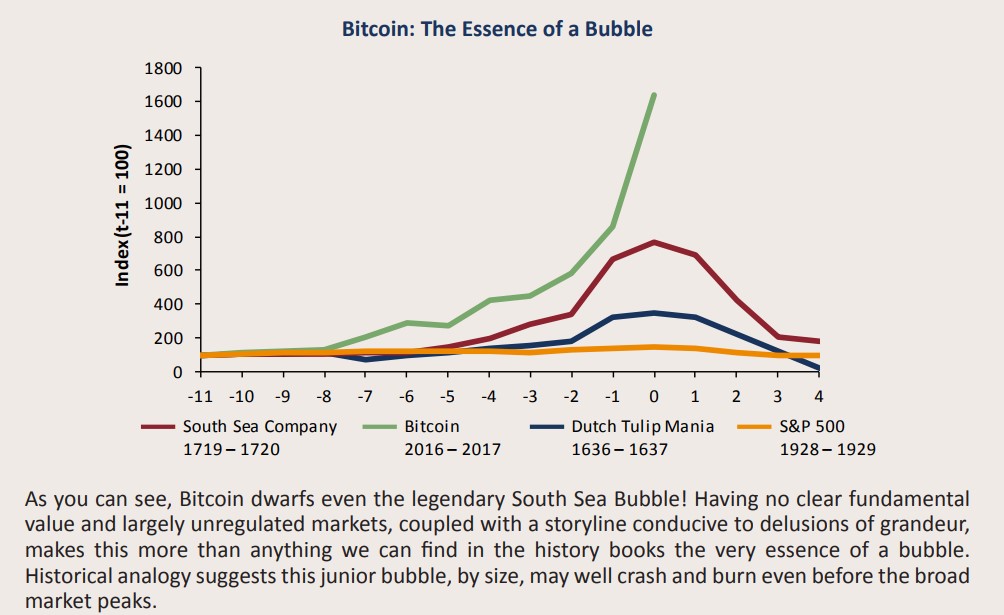

Fundamentals of the economy and market are strong with solid sales and earnings growth combined with tax reform in the US. These factors should provide a nice tailwind for the markets. We may be witnessing early signs of euphoria and market complacency with the popularity of speculative crypto-currency and cannabis investing (Chart 4), but it has yet to spread to rest of the market. We see further upside to equity markets and recommend investors deploy capital to quality companies with secular growth tailwinds.

Chart 4: Double Bubble - Crypto surpassing some of the biggest bubbles of all time

Source: GMO, RBC Dominion Securities

Chart 5: Portfolio Positioning

Our portfolio positioning remains the largely unchanged. We continue to favour US and international equities vs. Canadian stocks. Rising global interest rates should continue to pressure bonds and bond-proxies such as consumer staples, utilities and telecommunication companies. Despite the bounce back in retail stocks, we remain underweight the consumer discretionary sector. Market indicators are healthy with semiconductors, railways, credit spreads behaving well and suggesting a risk-on environment.

Andy’s Hot Stocks: Alibaba and Sands China

Alibaba (NYSE: BABA) Price: $184

Hop on the magic carpet ride – Magic Carpet Ride - Steppenwolf

Alibaba is the Amazon of China. Jack Ma created a behemoth that controls 80% of the Chinese consumer e-commerce market. Alibaba is the driving force behind China’s most popular retail holiday and the world’s largest retail event, Single’s day. Single’s day is now 4x larger than Black Friday and Cyber Monday and sells everything from discount lobsters to iPhones. BABA differs from its American counterpart in that it is the software platform that enables the buying and selling of items and does not inventory or warehouse product. Thus, it has software-like EBITDA margins of 47% in 2017 and 44% in the most recent quarter with limited capital expenditures. The company’s sales are growing at 56% with only 53% of the Chinese population using the Internet vs. 90% in Canada, 93% in South Korea and 95% in the United Kingdom. The Chinese consumer economy continues to grow and is only 39% of economy vs. 58% in Canada. Alibaba should continue to benefit from the secular trends of increased internet penetration and a growing Chinese consumer. Hop on the magic carpet ride!

Chart 6: Alibaba- Open Sesame!

Source: Thomson One, RBC Dominion Securities

Sands China (HK: 1928, OTC: SCHYY) Price: H$46, U$58

Let’s roll the dice together - The Gambler - Kenny Rogers

Sands China is a subsidiary of the American casino company Las Vegas Sands and operates five casinos in Macao including Venetian Macao, Sands Macao, Plaza Macao, Sands Cotai Central (The Londoner) and the Parisian Macao. With the exception of state-run lotteries, gambling remains illegal in mainland China, so Chinese citizens must travel abroad to roll the dice. Macao is the closest and most logical destination with a land bridge to be completed 2018 which will connect Macao with Hong Kong and China. Ferry terminals and flights also link the island of Macao with Hong Kong and the rest of the world drawing in visitors from abroad but primarily China and Hong Kong. Macao surpassed Las Vegas as the largest gambling hub in the world in 2007 and currently generates greater than 2x the revenues of Las Vegas with a minimum bet size more 10x that of Vegas. Macao casino operators have only recently started to recover from China’s 2012 anti-corruption campaign and fears of a materially slower Chinese economy. Sands China has the largest exposure to a growing segment of lower-tiered gamblers and gives 4% dividend yield. Ante up, let’s double down.

Chart 6: Sands China – Winner Winner, Chicken Dinner

Source: Thomson One, RBC Dominion Securities