Happy Friday,

This edition of Andy’s Angle will touch on Japanese and Canadian equity markets followed by our outlook in the 9th year of this bull market.

Included is an invitation to two of our informational events focusing on the role of an executor and dividend/income investing. The events take place on November 15th and 29th at 6:30pm. Details are attached. Please RSVP to andy.macdonald@rbc.com Attendance is complimentary, but seating is limited.

And let’s not forget, this Angle’s Hot Stocks will include two names – Johnson & Johnson and Capital Power Corporation.

Have a great weekend,

Andy’s Angle:

Shinzo Stumbles in the Sand

Japanese and Canadian markets lead the pack - Darude - Sandstorm

It has been a great three months for global markets with all regions posting positive mid-single digit gains. Japanese markets have led the pack posting some of the strongest economic results in two years and the seventh consecutive positive GDP growth number. Prime Minister Shinzo Abe’s landslide election victory in late October was icing on the cake and helped solidify Abe’s dream of reforming Japan’s World War 2 pacifist constitution.

Don’t let Prime Minister Shinzo Abe’s recent backward stumble into a sand trap with Donald Trump deter you from Japanese markets. The global economy is on an upward trend and it may not be too late to take a swing at the cyclical Japanese equity market.

Click on the image for the video.

After underperforming for the bulk of the year, Canada rebounded with the TSX sprinting out of negative territory returning 5.6% in the past three months. A more cautious Bank of Canada combined with stronger economic data and energy prices helped push bank and resource stocks higher and the TSX an all-time high.

Regulatory changes to residential mortgage lending rules brought about by B-20 should create a short-term boon to housing sales, house prices, bank stocks and insurers. Homebuyers will likely rush to buy houses before much tighter mortgage stress tests suck air out of the market on January 1, 2018.

Chart 1: Japan and Canada lead the pack

Source: Thomson Reuters, RBC Dominion Securities

The Consumer is feeling pretttty good

Confidence is High - AC/DC - Money Talks

Markets have shrugged off geopolitical risks (Trump & North Korea) and stomached global monetary policy transition and reversal of quantitative easing. Even the US Federal Reserve’s changing of the guard and appointment of Jerome Powell has not translated into a catalyst for meaningfully increased market volatility.

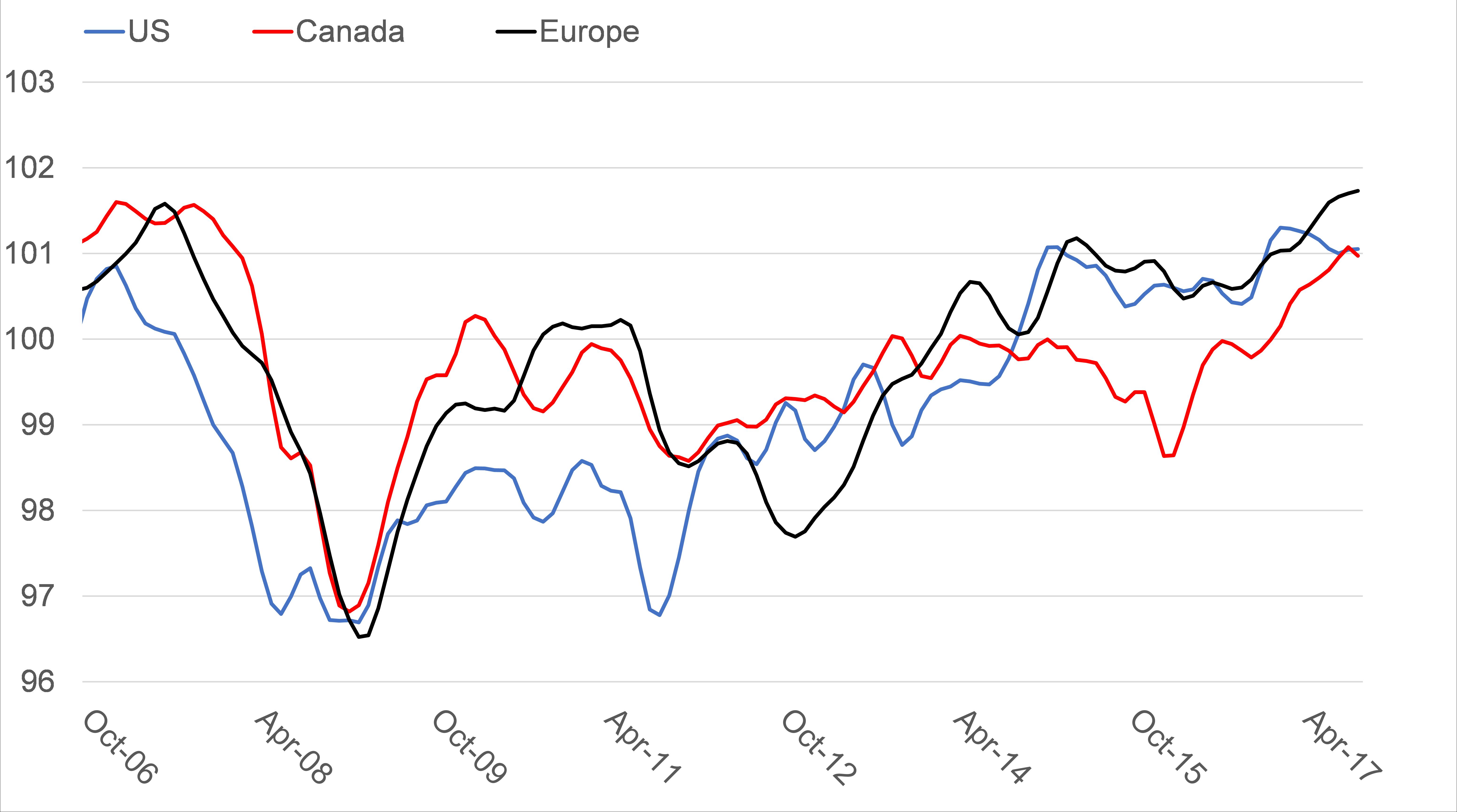

Global economic activity continues to improve evidenced by strong manufacturing data and steadily improving consumer confidence. Mr. Consumer feels like he is the bee’s knees with consumer confidence approaching pre-2008 levels (Chart 2). Consumer spending in the US, Canada and Europe represents 68%, 58% and 55% of the GDP, respectively and is arguably one of the most important drivers of the economy. It’s been a long and hard road from the bottoms of 2008, but consumers now feel like they are on solid footing and with steady wage growth of 3.5% in the US. As Mark Twain said, “All you need in this life is confidence and ignorance and success is sure.”

Chart 2: US, Canada and Europe Consumer Confidence is solid

Source: OECD, RBC Dominion Securities

The Trend is your Friend….till it isn’t

B.B. King - Let the good time roll

As we close in upon the 9th anniversary of the second longest bull market in history, it is reasonable for anyone ask themselves, how much longer can this last. Bear markets fall into a few categories one of which is event-driven shocks such as an oil crisis or war. The other type of bear market is caused by financial bubbles (2008, Dot-com bubble) or an overheating economy. Hindsight is 20/20 but cyclical or bubble-driven bear markets tend to occur over time and may have some traits that may make it possible to predict. The last two market crashes broke-down over an ~18 month period before bottoming (Chart 3).

This may be a crude form of analysis, but the current market shows no signs of breaking down. Valuations are expensive but with low interest rates and corporate earnings beating street estimates, the market may not be as expensive as the street believes. Most indicators point to a healthy environment. We believe the bull market remains intact and could continue for a couple more years. There will always be market noise and valid reasons to worry but for the time being let the good times roll.

Chart 3: The Trend is your Friend

Source: Thomson Reuters, RBC Dominion Securities

The Christmas Rally

Andy Williams - It’s the most wonderful time of the year

Our healthy outlook for markets comes at an opportune time due to the historical seasonality of the Christmas rally or January effect. The Christmas rally is a well-documented anomaly, which debunks the efficient market hypothesis. Over the past 70 years, the six-month period of November to April has returned an average of 6.1% while the period from May to October has only returned 0.8%. The three-month period of November, December and January is the strongest time of the year due to expectations for consumer spending. The best ways to play this market anomaly is through some past Hot Stocks including Dollarama, Amazon and Take-Two Interactive. Unfortunately, if you are a member of the MacDonald clan you may be accustomed to stocking gifts from the first of these stocks.

Andy’s Portfolio Views

Andy’s portfolio views remain largely unchanged from the previous edition with an overweight to Technology, Financials, US and Continental Europe. Two noticeable changes are an upgrade from underweight to equal weight for the healthcare and energy sectors.

Andy’s Hot Stocks: Johnson & Johnson and Capital Power Corporation

Johnson & Johnson - Spice Girls - 3 become 1

Two’s company, three’s NOT a crowd

NYSE: JNJ Last Price: $139 Dividend yield 2.4%

JNJ is a historic American company established in 1885 by the Johnson brothers in New Brunswick, New Jersey. The company owns some of the most iconic brands in American history including Band-Aid, Tylenol, Listerine and Johnson’s baby powder. JNJ is one of the most diversified health care companies in the world with 20% of sales from consumer products, 37% from medical devices and 43% from pharmaceutical products. This diversification is important because strong and stable cash flows from the consumer product and medical device business units help smooth out the volatility of successes and failures of new drugs in the pharmaceutical division. Additionally, these strong cash flows help fund one of the largest pharmaceutical R&D budgets in the world which should create a strong drug pipeline over the next four years. This is a proven business model that will continue to reward shareholders for years to come.

Chart 4: JNJ: Two’s company, three’s NOT a crowd

Source: Thomson One, RBC Dominion Securities

Capital Power Corporation – Public Enemy - Don’t Fight the Power

A Capital Idea

TSX: CPX Last Price: $24 Dividend yield 6.7%

Capital Power Corporation is a power generation company based out Alberta and dates back to the Edmonton Electric and Power Company formed in 1891. The company has a strong balance sheet and has promised to grow its dividend by 7% until at least 2020. Recent acquisitions have shifted its reliance on coal power generation to renewable energy sources. The stock trades at a discount to peers because of uncertainty regarding political landscape in Alberta and the effects of lower oil prices on the Alberta economy. The Alberta utility landscape is an auction system, which allows company to bid on prices to supply to the province. This means CPX is poised to benefit the most from recovering demand or high priced supply from competitors.

Chart 5: Capital Power Corporation – Don’t Fight the Power

Source: Thomson One, RBC Dominion Securities