Andy's Angle

International:

EZU: iShares MSCI Eurozone ETF: +23% since 12-31-2016

Europe is en fuego!

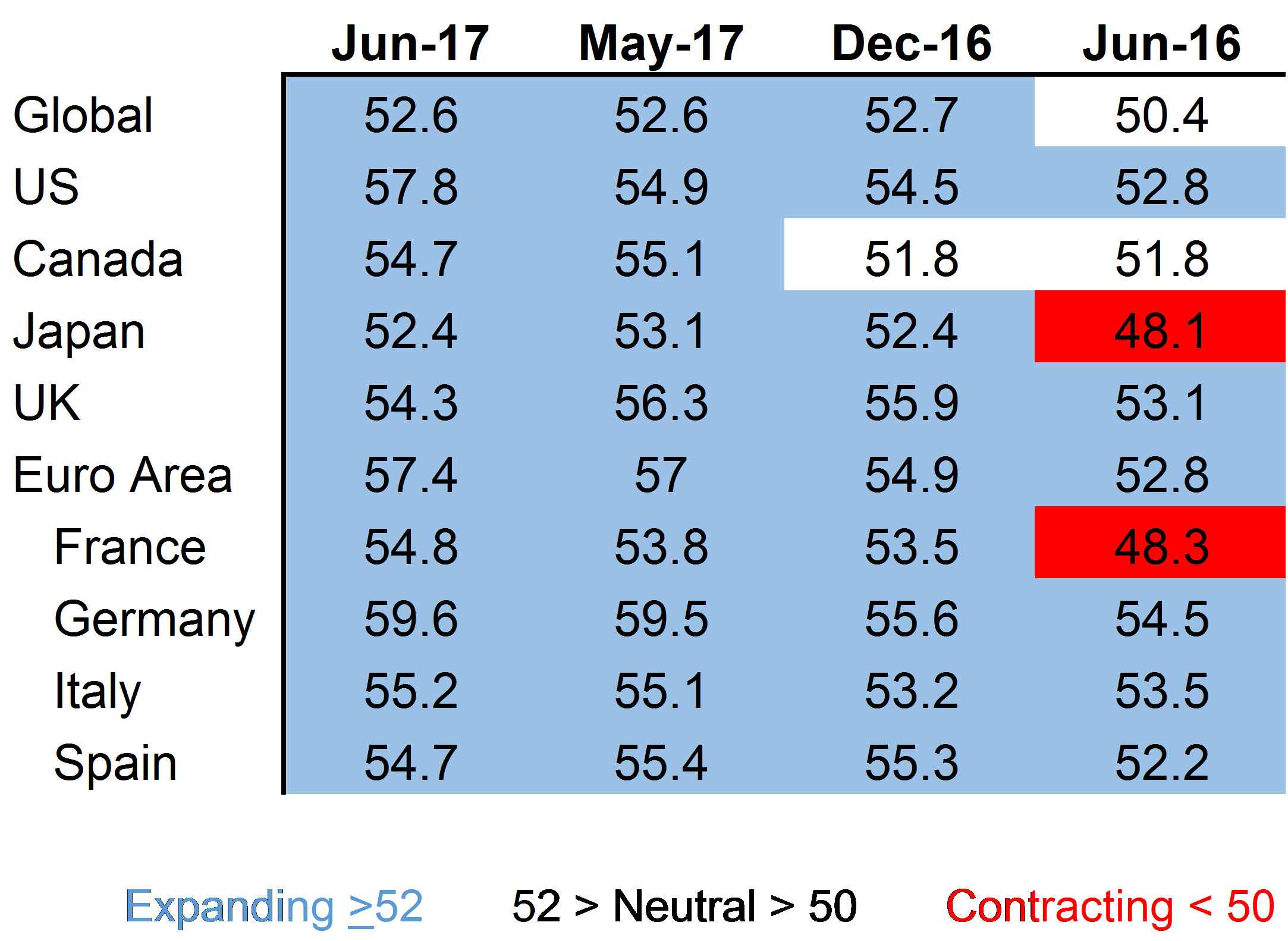

European markets have been on a tear for the past year and are amongst the top performing equity markets. Economic surprises from the Eurozone have been strong with purchasing managers index surveys (Chart 1), loan growth and relatively cheaper valuations boosting stock markets and driving a cyclical recovery. Populist electoral risks have receded with France’s National Front, Alternative for Germany and the Italian Five Star Movement either defeated or losing significant ground in the polls. We would argue there is still legs to the European recovery and recommend hedged exposure to continental Europe with preferences Spain, Italy and France vs. export-oriented Germany given the strength of the Euro.

Chart 1: European Purchasing Managers Survey Index remains expansionary and key indicator of economic growth

Source: RBC Capital Markets, Markit

‘Merica: Not too Shabby

SPY: SPDR S&P 500 ETF +11.5% since 12-31-2016

US Earnings Season

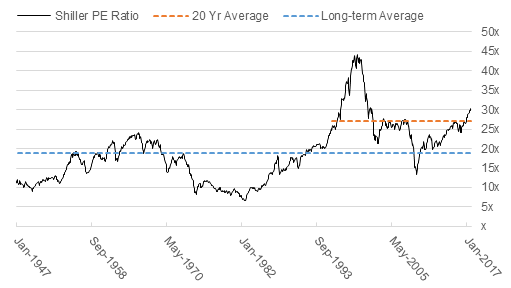

Second quarter corporate earnings season is winding down with 93% of the S&P 500 reporting results, beating market expectations by 5.7%. US companies have reported an impressive 5.1% sales growth and 11.3% earnings per share growth driven by exceptional results from technology and financial sectors. This quarter is turning out to be one of the strongest corporate earnings season since 2011 and has helped justify valuations not seen since the late stages of the Tech bubble in 2002 (Chart 2).

Chart 2: Market is expensive and above its 20 year average

Source: RBC Wealth Management, http://www.multpl.com/shiller-pe/

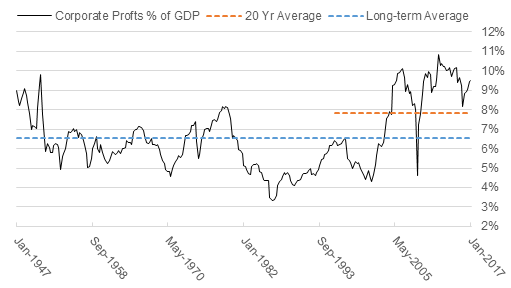

Increased liquidity from global quantitative easing and the ‘Trump Trade’ may be the primary drivers of the market, however we would also argue that stronger sales growth and corporate profitability is helping to justify a more expensive market. Over the past 20 years, corporate profitability has increased 20% from the long-term average (Chart 3). This change can be attributed to a number of factors including increased globalization and brand power, the emergence of new technological heavyweights and steadily increasing corporate power or moats.

Chart 3: A new era of stronger corporate profitability

Source: RBC Wealth Management, Federal Reserve Economic Data: St. Louis Fed

US economic fundamentals remain strong with moderating job growth, low unemployment and a recovering housing market. Risk-on indicators suggest the market has more room to run with credit spreads at record lows and semiconductors, transportation and financial stocks leading the market. Only a stubbornly flat yield curve, underperforming small cap stocks and the historical calendar weakness of August and September remain areas of concerns. Thus, we remain positive on the US market longer-term, however recommend investors tactical deploy cash to high quality, secular growth companies trading at reasonable valuations.

Canada: Woof

XIC: iShares S&P/TSX Index +0.3% since 12-31-2016

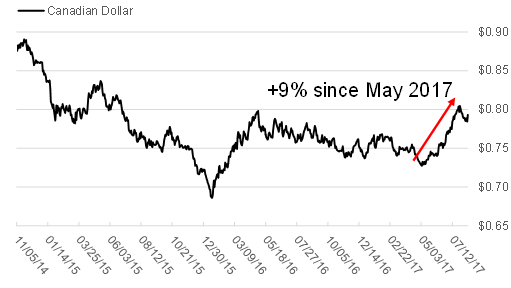

Flight of the Loonie

The Bank of Canada took markets by surprise with an interest rate hike that sent the Loonie soaring from $0.72 to $0.80 in a three month period. Furthermore, stronger than expected economic growth in May driven by the energy sector increased the probability of further rate hikes by the Bank of Canada. We expect one more rate in the next six months which should sustain the Loonie’s strength and help rein in Canadian consumer debt and an over-valued housing market. The historical correlation between the 10 Yr US Treasury and 10 Yr Cdn Bond is 97% over the past 25 years. The US Federal Reserve plans to increase interest rates three more times in 2018, therefore I would put the odds of higher interest in Canada next year at about…..…97%.

Chart 4: Canadian dollar should hold at these levels

Source: RBC Wealth Management, Thomson Reuters

We recommend investors switch from variable to fixed-rate mortgages and add protection from rising interest rates in their portfolios through rate-reset preferred shares. These preferred shares carry more seniority than stocks and offer attractive dividends which are reset every five years depending on the 5 year government of Canada bond yield. Rate-reset preferred shares increase in value when interest rates rise as opposed to bonds which decline in value. We remain neutral on the Canadian stock market and prefer exposure to US and international markets.

Chart 5: Higher Interest Rates = Higher Preferred Shares

Source: RBC Wealth Management, Thomson Reuters

Risk Ahead

Finally, with the US Federal Reserve announcing its plan to wind down its $4.5t balance sheet in September, the European Central Bank slowing down its quantitative easing program in December and potentially a new head of the Federal Reserve in February, there are plenty of near-term catalysts to suck liquidity out of the system and a cause pull-back in the markets. We recommend investors deploy capital tactical and cautiously to high-quality companies with promising growth prospects and reasonable valuations.

Andy’s Portfolio Views

Andy’s Hot Stocks

Domino’s Pizza: Who wants a slice?

NYSE: DPZ Price: $196 +18.4% since 12-31-2016

Domino’s reported second quarter results that beat street estimates but the stock dropped -10% on the opening bell because international organic sales growth came in below analyst estimates at +2.6%. This was a buying opportunity for Domino’s Pizza.

Domino’s has put up positive international organic same store sales growth every year for the past 21 consecutive years. The pizza pie maker grew 9.5% organically in the US, continues to add more stores and has arguable the best online delivery service in the restaurant industry. Store square footage is small due to the delivery model, EBITDA is growing in the mid-to-low teens and margins are close to 20%. It’s no Libretto, but it’s pretty convenient. J

Source: RBC Wealth Management, Thomson Reuters

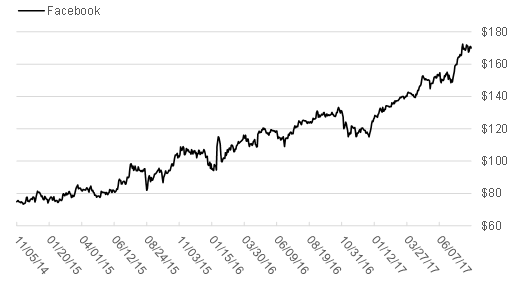

Facebook: Like this stock

NYSE: FB Price: $169 +47.7% since 12-31-2016

If you don’t already own Facebook, stop reading this useless commentary, slap yourself in the face and put in a limit order.

2.006 billion people log-on to Facebook every month. This does not include Whatsapp (1.2Bln users) or Instagram (700Mln users). There are only 7.5Bln people in the world and Facebook is not in China.

Revenue grew 45%, EBITDA Margins were 55% and free cash flow grew 47%.

To put his numbers into perspective, sales growth for the rest of the companies in the US S&P 500 grew 5% in the most recent quarter.

Facebook trades at 31x price to earnings ratio but grew second quarter earnings at 87%.......this stock is still cheap.

Source: RBC Wealth Management, Thomson Reuters

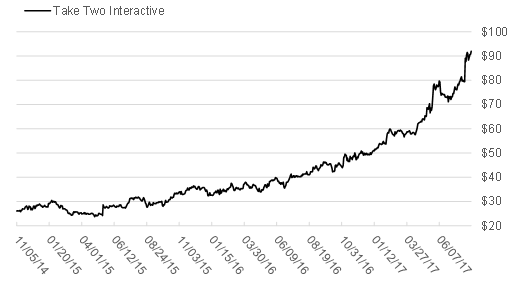

Take-Two Interactive Software:

NYSE: TTWO Price: $91 86.69% since 12-31-2016

Take-Two Interactive Software is the video game company that created Grand Theft Auto along with a few other lesser known video game franchises. The company released Grand Theft Auto 5 in 2013 which broke Guinness World records as the fastest and highest revenue generating form of entertainment of all time. The game brought in over $1Bln of sales in 24 hours. To put that number into perspective, it took Star Wars: The Force Awakens 3 days to generate $529Mln of ticket sales.

These video game companies are high margin, low capital intensity businesses that produce solid cash flows and have a fan base that is almost addicted to their products. New video game consoles such as Play Station 4 are connected to the internet allowing customers to purchase full games and additional levels online, bypassing video game retail stores such as GameStop which took a cut of the sales price. Every additional online purchase is margin accretive for Take-Two and the company continues to digitally monetize its catalogue of games with online sales up 47% in the most recent quarter.

Given the almost scary return on the company throughout 2017, we recommend investors who already hold the company to trim some of their position as the stock approaches $100, and wait for the stock to consolidate and grow into its valuation multiple.

Source: RBC Wealth Management, Thomson Reuters

If you have questions about something in the commentary don’t be shy, feel free to contact me.

Securities or investment strategies mentioned in this newsletter may not be suitable for all investors or portfolios. The information contained in this newsletter is not intended as a recommendation directed to a particular investor or class of investors and is not intended as a recommendation in view of the particular circumstances of a specific investor, class of investors or a specific portfolio. You should not take any action with respect to any securities or investment strategy mentioned in this newsletter without first consulting your own investment advisor in order to ascertain whether the securities or investment strategy mentioned are suitable in your particular circumstances. This information is not a substitute for obtaining professional advice from your Investment Advisor. The commentary, opinions and conclusions, if any, included in this newsletter represent the personal and subjective view of the investment advisor Andy MacDonald who is not employed as an analyst and do not purport to represent the views of RBC Dominion Securities Inc.

The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof.

RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ®Registered trademarks of Royal Bank of Canada. Used under licence. © RBC Dominion Securities Inc. 2016. All rights reserved.