Emotions and Investments:

...Sound Familiar?

...Sound Familiar?

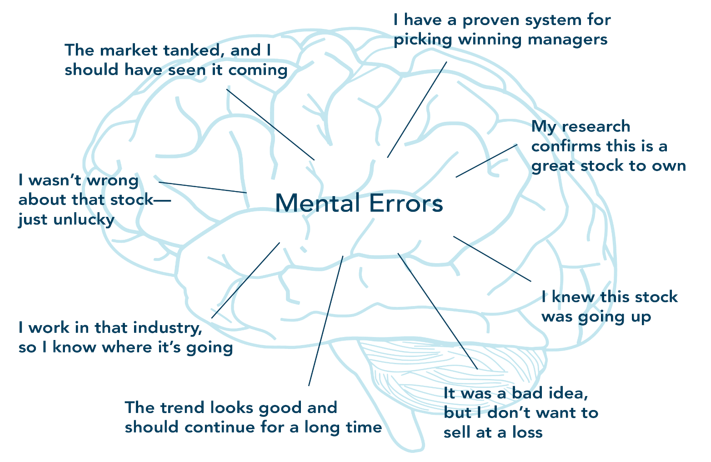

When it comes to optimizing the investment experience, there is no greater barrier to overcome than our own impulses. Prudent wealth management begins with an understanding that, left unchecked, we are hard-wired to make sub-optimal decisions regarding our investments. This has been proven by countless academic studies. In fact, an overwhelming interest in understanding how emotional decisions impact investment outcomes has given rise to a relatively new field of study known as Behavioural Finance. We continue to utilize the growing body of research to help our clients mitigate the pitfalls that reacting emotionally can have on their investment experience.

The DALBAR Study:

The DALBAR group is a leading independent expert in the evaluation of "best practices" in the financial services industry. Each year the DALBAR group publishes a report titled "Quantitative Analysis of Investor Behavior", which examines the impact that reacting emotionally tends to have on long-term investment performance.

In 1994 DALBAR began tracking the effects of investor decisions to buy, sell and switch into and out of mutual funds over short and long timeframes in a report titled “Quantitative Analysis of Investor Behavior” (QAIB). The results of DALBAR’s annual study consistently show that the average investor earns less – in many cases, much less – than mutual fund performance reports would suggest. A key conclusion of the QAIB is that investor behaviour is a major contributor to investor underperformance. The objective of the QAIB is to help individual investors, and financial advisors, improve portfolio performance by managing behaviors that cause investors to act imprudently. (Source: DALBAR Quantitative Analysis of Investor Behavior)