We hope you are doing well. Like in the past, we would like to share Mr. Petrov’s market commentary for this fall and a few important elements to put your financial affairs in order.

Table of Contents

- Petrov Commentary

- Market Snapshot & Economic Snapshot

- Financial Clean-Up

Petrov Commentary

Markets spent the past month balancing optimism around moderating inflation with caution over central bank policy. Recent economic data suggest price pressures are easing, but policymakers remain non-committal on rate cuts, waiting to see progress continue for a while before shifting course.

Corporate earnings have generally exceeded expectations, adding support to equities, while bond markets continue to adjust to the evolving interest rate outlook.

For investors, this environment reinforces the importance of maintaining the attitude I always encourage: Cautious optimism.

My investment philosophy is rooted in 3 core tenets: Conviction, Discipline, Patience.

I only invest in companies and industries in which I have high conviction.

At the time of writing this, the top 7 companies account for nearly one third of the S&P 500 index. This is an unprecedented level of concentration risk that needs to be carefully considered. As such, I stay disciplined by spreading out the risk through diversification and limiting exposure to any sector or company and I remain patient through all market cycles.

This is why our clients’ portfolios are positioned to weather periods of volatility (remember March/April?) and capture long-term growth.

Inevitably, the next bout of volatility will come and will feel “different” again, and then it will go. As long as we stay disciplined in the good times, we will overcome the bad times.

I have my eyes on the road and my hands on the steering wheel.

-Alexander Petrov

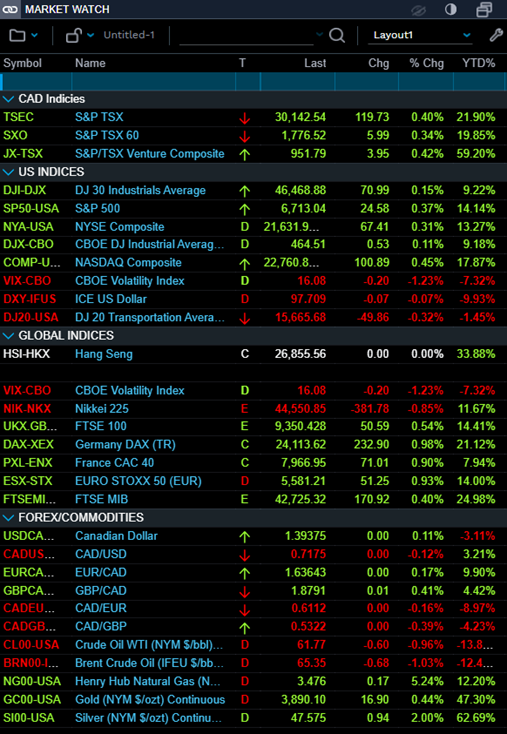

Market Snapshot

Dated : October 1st 2025

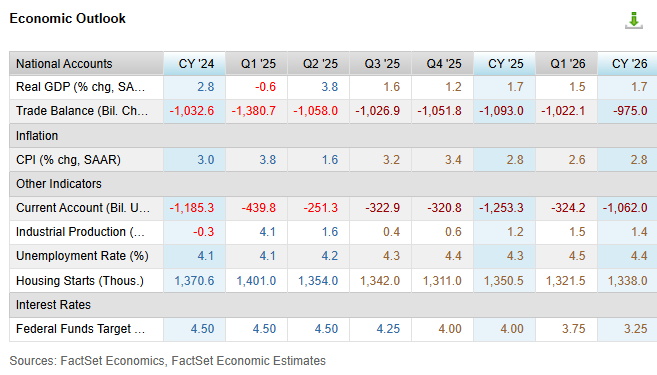

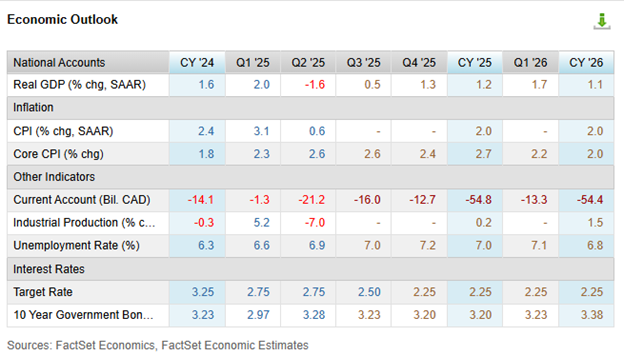

Economic Snapshot

US

Canada

Financial Clean-Up

Fall is a great time to step back, review, and prepare your finances before the year wraps up. Just like organizing your home for the new season, your financial life benefits from a thoughtful review.

This seasonal check-in helps you:

- Update financial goals or adjust for life changes

Book a meeting with us to see if these new goals or changes impact your financial plan or warrant an adjustment to your investment strategy

- Review cash flow and spending as holiday expenses approach. If you want an easy-to-use budget worksheet, feel free to reach out to us and we will gladly send it to you.

- Maximize contributions and other annual limits

Corporate Investment Accounts

You may be sitting on cash that you don’t need for the operations of your company. If this is the case, it would be a good time to take it off your to-do list & deploy the cash into your investment portfolio.

RRSP

If you know how much you will earn in 2025, we encourage you to check this task off your list early before the RRSP season deadline. The deadline for contributing to your RRSP for the 2025 tax year is March 1, 2026. Find out what your available room is and contact us to help you make the contribution.

TFSA

All Canadians who are over 18 years of age can contribute $7,000 to their TFSA for 2025. We encourage you to verify if you also have any unused TFSA contribution room from the past and top it up. You can find out what your unused TFSA contribution room is through CRA my account.

RESP

Contributions must be made between January 1 and December 31 to be eligible for that year. To receive maximum grants, you can contribute up to $2500 per beneficiary annually until the age of 17.

FHSA

In addition to the lifetime contribution limit of $40,000 CAD, you can make a $8,000 annual contribution per year.

- Ensure estate plans and insurance are current and aligned.

Please reach out to us if you wish for your current Will and/or insurance policies to be reviewed.

The Petrov Wealth Management Group accepts clients primarily by referral. If you think we can help a loved one or a colleague, please reach out and let us know.

Cheers,

Alexander & the Petrov Wealth Management Group