“Sell and reinvest before June?” A common question I been getting since the proposed Capital Gains inclusion rate increase from 50% to 66.67% announced by the Federal Government.

I like to do some number-crunching and do some forward-looking wealth planning before making financial decisions. Please find attached this article which goes more in-depth on the topic with some examples. I encourage you review this carefully.

Petrov Economic Perspective

The proposed Capital Gains inclusion rate change to 66.67% could affect every-day Canadians and the economy as a whole.

The Government claims this would only affect 0.13% of Canadians, but here is why it has much broader implications:

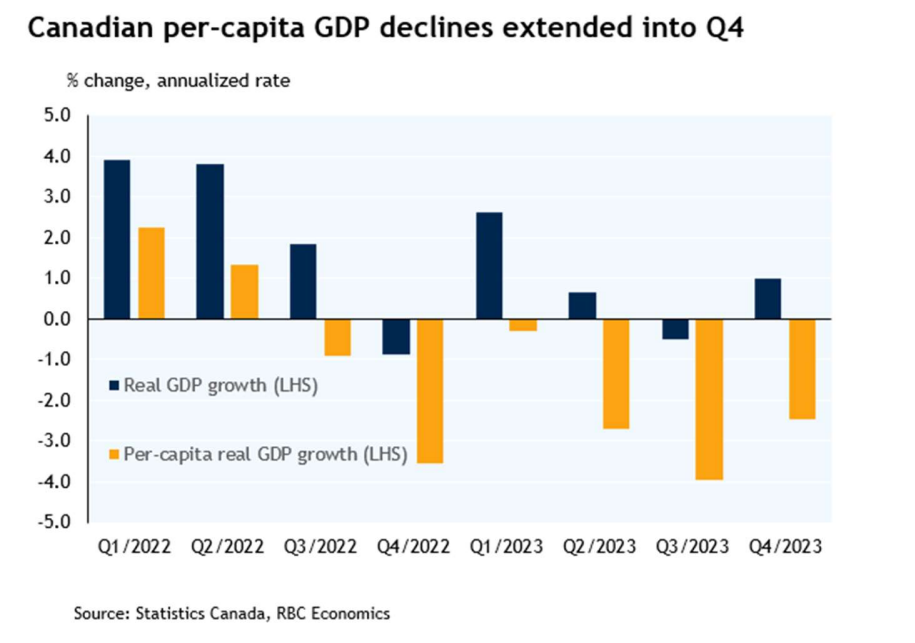

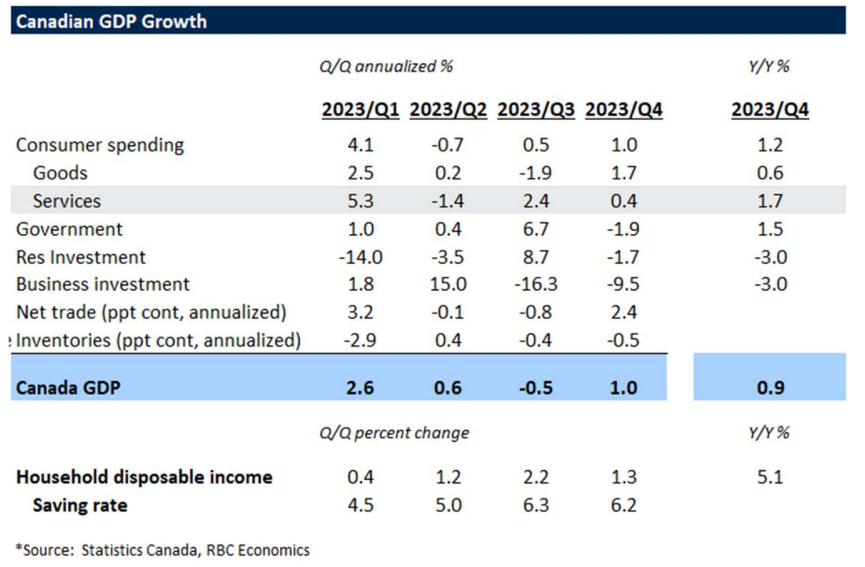

Canada is already suffering from declining productivity as measured by GDP per capita as well as GDP as a whole.

Taxes on investments disincentive new businesses and investments from being made in Canada. Capital could allocate itself where investment is incentivized. The economic impacts of such policy remain to be seen.

Also, 250K in capital gains does not only happen with the ultra-wealthy. Here are just a couple of quick examples of an every-day single Canadian who:

- Sells their Duplex or cottage they bought 30 years ago. They paid increasing and recurring property taxes every year. They invested in renovating it. Now if they sell it or pass it down to their children they will be retroactively subject to the higher capital gain inclusion rate.

- Diligently saved $500 per month for 30 years at a 7% ROR. Now they have close to $600K of which close to 400K could be unrealized gains. What if now they are retired and they want to finally buy the little cottage they've been dreaming about. They want to avoid the high mortgage interest rates and they want to buy it in-cash. They will have to sell a big part of their investments and be subject to this new capital gains inclusion rate.

- Incorporated professionals such as doctors, lawyers, accountants and others who will be subject to the 66.67% inclusion rate on every dollar of capital gains realized in the corporation.

- Etc etc...

If this budget passes in the House of Commons, I will be committed to protecting my clients’ hard-earned dollars through diligent wealth planning.

Petrov Portfolio Perspective

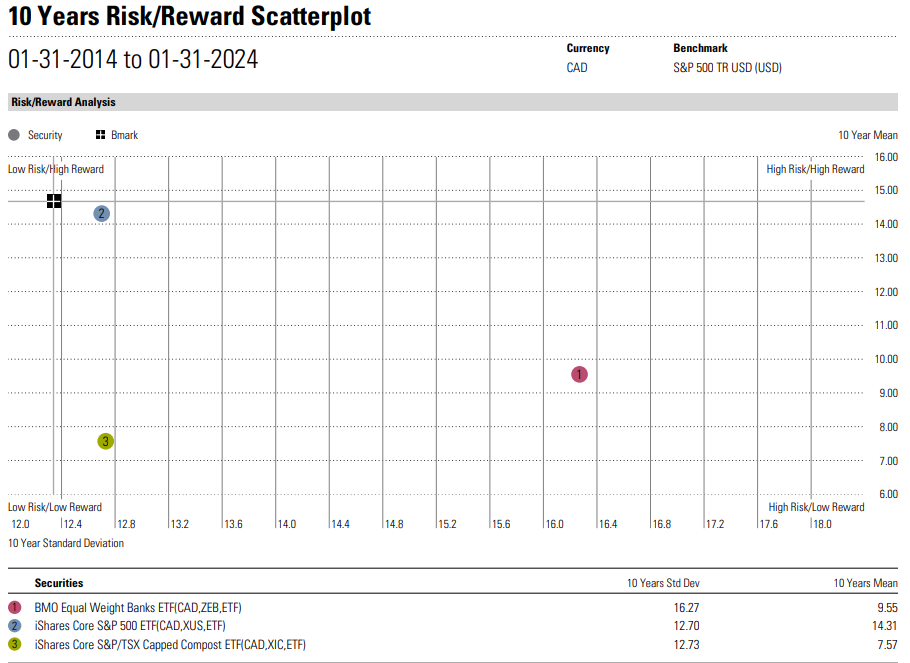

For years I have allocated more of my client’s assets to US equities compared to Canadian Equities. My stance on this long pre-dates this Federal Budget but I will take the opportunity to remind you why I do this. The US currently represents 70% of the MSCI world index while Canada only represents 3%. The US Economy is much larger and more diversified across sectors. Productivity numbers are also more favorable. These are some of the reasons US equities have outperformed Canadian Equities over long periods of time with less volatility.

See below a risk-reward scatterplot where I compare the S&P 500 (US), S&P/TSX (Canada), and the BMO Equal weight banks ETF (Canadian banks-only). You can see that the S&P 500 has experienced higher returns with less volatility.

- Source: Morningstar

Please feel free to reach out to me if you have questions.

Best regards,

-Alexander Petrov