U.S. and global stocks posted another week of severe losses during the week ended Sept. 23. The 4.6 percent weekly decline in the S&P 500 marked its fifth week of losses out of the last six weeks, and a 14.2 percent decline from its mid-August peak. The S&P 500 and Nasdaq Composite Index of technology stocks avoided posting new closing lows for the year, but only by a hair’s breadth, and other major indexes such as the Dow Jones Industrial Average ended the week at the low of the year.

What happened?

The Federal Reserve raised interest rates by another 75 basis points (bps) at its Sept. 21 policy meeting. This move was widely anticipated, and, in fact, market-based interest rates leading up to the call implied that some traders were even looking for a 100 bps hike. But what really upset equity markets was commentary from Fed Chair Jerome Powell. He said, “I wish there were a painless way to [bring inflation back down to two percent]; there isn’t.”

In combination with Fed officials’ views of much stickier inflation and a commitment to tighten policy beyond the perceived neutral rate of three percent, Powell’s statement was viewed by traders as an acknowledgement by the Fed that curing inflation might require poisoning the economy too. In sum, we believe the rate hikes enacted since the start of the cycle in March, together with their likely trajectory, means the odds are probably better than 50:50 that the U.S. economy is either in a recession now, or will be within the next year.

Aren’t stocks cheap now?

They’re certainly cheaper than they were at the start of the year. At the all-time high on Jan. 3, the S&P 500 traded at a price-to-earnings (P/E) multiple of 21.5x the consensus earnings forecast of $223.46 for the year ahead. This was a high P/E multiple relative to the long-term average of 16x–17x, but it wasn’t unreasonable, in our view, given that the rates of return of other asset classes were so low.

For example, the interest rates on 2-year and 10-year government bonds were 0.79 percent and 1.63 percent, respectively, and real inflation-adjusted interest rates implied by 10-year Treasury Inflation-Protected Securities (TIPS) were still negative at minus 0.97 percent. The same securities yielded 4.21 percent, 3.69 percent, and 1.32 percent at the Sept. 23 close.

And there’s the rub. P/E multiples tend to move depending on the attractiveness of other investments. Bonds look a lot more interesting at today’s higher coupon rates, so stock P/E valuations have had to come down until they can attract buyers.

If we multiply the long-term average P/E ratio of around 16.5x by the current consensus estimate for S&P 500 earnings of $242, we get an implied year-end target of around 4,000 for the index. But we think the speed of Fed hikes together with the increased probability of a U.S. recession means current estimates are still too high.

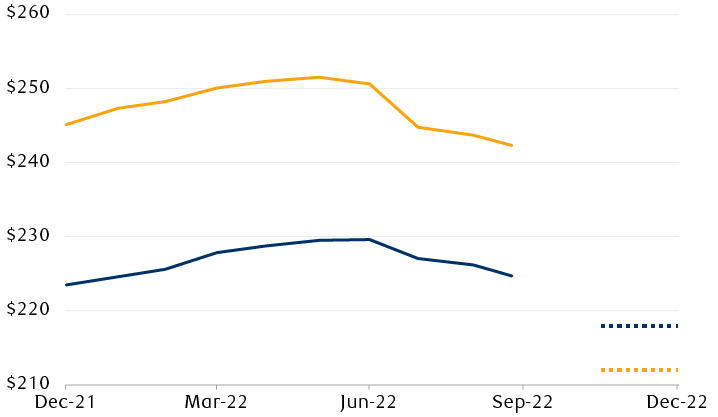

Earnings estimates rose steadily through the first half of the year as analysts looked toward the easing of both global COVID-19 restrictions and supply chain issues. But by the end of June, the suddenly hawkish Fed prompted more caution amongst analysts (see chart). RBC Capital Markets, LLC Head of U.S. Equity Strategy Lori Calvasina thinks the consensus hasn’t gone far enough. Her models argue for an additional cut of 13 percent to 2023’s estimates, which would imply the broad markets may have further downside potential.

Earnings estimates have barely budged … so far

S&P 500 Index earnings estimates

Line chart showing the monthly progression of earnings estimates for the S&P 500 this year. Consensus estimates for 2022 and 2023 increased steadily through the end of June to $230 and $252, respectively. They declined slightly into the end of Q3 2022 to $225 and $242, respectively, but are still much higher than RBC Capital Markets' estimates of $218 and $212, respectively.

Source - RBC Wealth Management, RBC Capital Markets estimates, FactSet consensus estimates

The analyst community typically makes its most meaningful estimate changes around the time of the quarterly earnings reporting season. Given the increased economic uncertainty and wider range of potential outcomes, we expect these numbers to decline further after the Q3 2022 earnings season, which starts the first week of October.

Are there any positive signs?

Stock traders have had plenty of time to digest the restrictive rate hike regime from the Fed, so we believe a case could be made that most of the bad news is already reflected in stock prices.

And the extreme moves during the week pitched the widely watched Cboe Volatility Index, or VIX, up to levels that have historically been good times to buy stocks (see table). The VIX closed at 30 on Sept. 23; over the last 30 years, the subsequent six-month performance of stocks when the VIX closes at 30 or above is significantly better than average, and the “win” rate is higher too.

A VIX close above 30 is associated with above-average subsequent stock returns

| Number of instances | Average six-month return | % better than average | |

|---|---|---|---|

| VIX > 30 | 668 | 12.4% | 76% |

| VIX < 30 | 6,871 | 2.1% | 60% |

| All VIX | 7,539 | 3.0% | 61% |

Note: Using daily closing data, last 30 years

Source - RBC Capital Markets forecasts, Bloomberg

Bottom line

The Fed’s actions have broadened the potential range of outcomes for stocks, and this added uncertainty has pressured markets. Higher interest rates feed into lower valuation multiples, and although the consumer appears to be in a relatively solid position in terms of savings and employment, we believe a slowing economy means earnings estimates may have further to fall.

But investors with a longer time horizon may want to use this pullback to create a shopping list of high-quality stocks that should benefit from an eventual stabilization and ultimately a reversal of this year’s market weakness.