In this week’s edition:

- A look at the Canadian Real Estate Market

- Bank of America: August Fund Manager Survey

- Investing in the Energy Sector

- Articles of interest

A look at the Canadian Real Estate Market

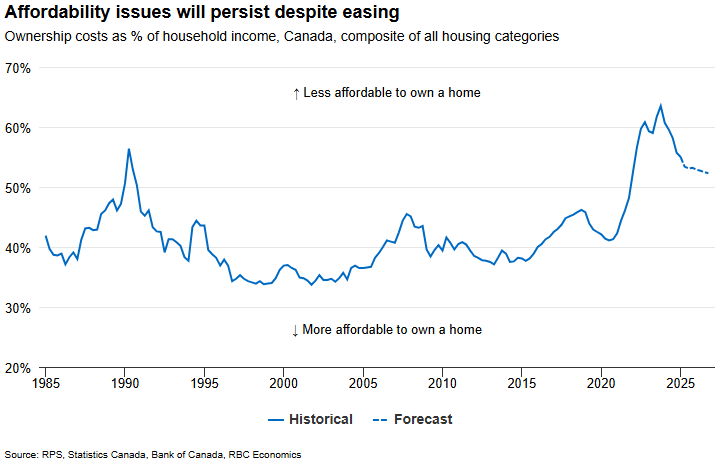

Canada’s housing market has faced an uneven recovery in 2025. A recent report from RBC Economics notes that early momentum was disrupted by trade tensions, pushing home resales to cyclical lows, especially in Ontario and B.C. While lower interest rates are beginning to entice buyers back, RBC projects a modest 0.7% national price gain this year before a slight 0.7% decline in 2026, with the steepest drops expected in Ontario and B.C. due to high inventory and affordability pressures.

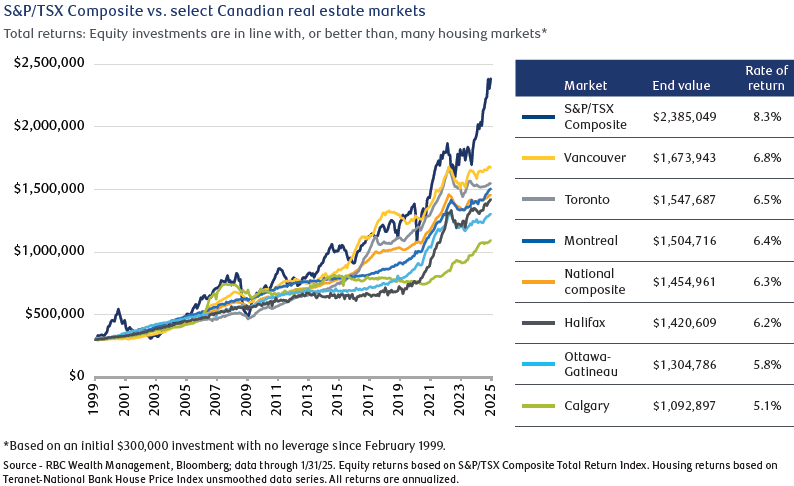

From an investment perspective, RBC Global Asset Management and RBC’s Portfolio Advisory Group reinforce that while real estate offers stability, equities have historically provided stronger long-term growth when comparing broad indexes for both asset classes.

Overall real estate and equities are complementary rather than competing assets, and optimal portfolios often hold both, tailored to an investor’s time horizon, objectives, and risk tolerance.

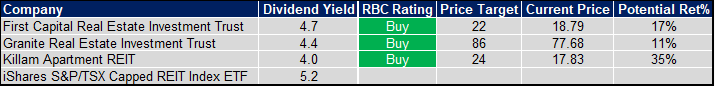

When looking at the publicly investable Canadian Real Estate market, RBC Capital Markets reports that valuations remain reasonable, with the TSX REIT Index up roughly 6% YTD compared to the S&P/TSX’s return of approximately 12.75% YTD. While macro uncertainty persists, the sector’s liquidity and fundamentals position it well to navigate the current environment.

Below are a few investable recommendations in the Canadian REIT sector.

For more information on any of the reports mentioned, to discuss the investments mentioned above, please feel free to reach out to me.

Bank of America: August Fund Manager Survey

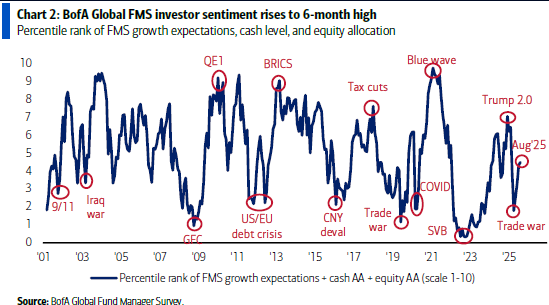

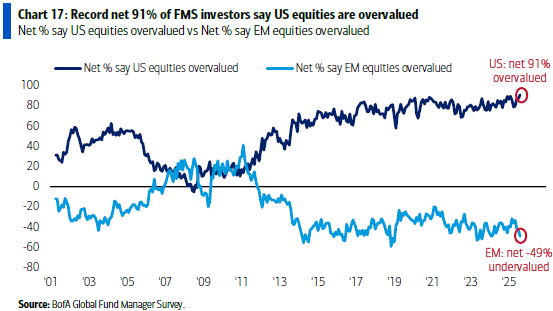

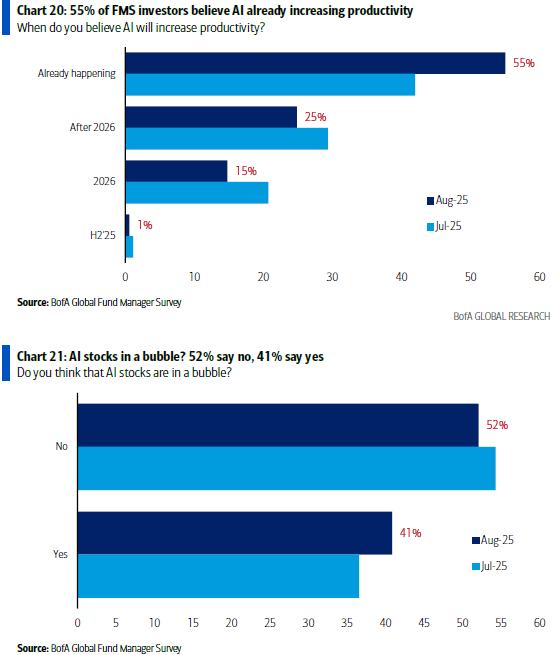

The August BofA Global Fund Manager Survey shows sentiment at its strongest since February, with hard-landing fears at their lowest since January. A majority (68%) of Fund Managers expect a “soft landing,” and cash levels have fallen to a historically low 3.9% of AUM, triggering BofA’s contrarian “sell” signal.

Charts of interest:

Feel free to reach out to me for the full report.

Investing in the Energy Sector

When looking at how the global population can fuel growth, it is clear that an “all of the above” approach will be required. This means the use of solar, wind, electric, nuclear, and traditional fossil fuels, etc.

The RBC Economics predicts that by the mid-2030s, global energy demand will be the equivalent of adding “another United States” of consumption, driven largely by emerging markets. Renewables are on track to provide 20% of global energy by then, growing 5x faster than conventional sources, yet oil and natural gas will remain essential. Peak oil demand is not expected before 2035, and natural gas is positioned as a key transition fuel, especially where coal remains dominant.

Canoe Financial is a leading Energy investor, and they believe we are in the early stages of a profitability super-cycle for energy. The thesis is simple — as global energy demand continues to rise, hyperscale data centre growth alone could add 3% annual power demand for decades, and companies are returning more capital to shareholders while trading at attractive valuations.

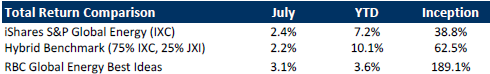

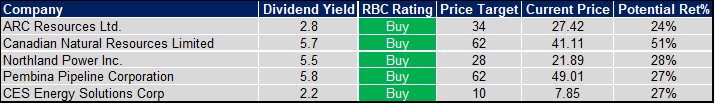

Turning to investment positioning, an updated RBC Capital Markets Global Energy Best Ideas list was just published, which has a terrific track record and highlights several Canadian companies as solid investments.

For more information on any of the reports mentioned, to discuss the investments mentioned above, please feel free to reach out to me.

Articles of interest

OpenAI is planning to invest in a brain implant start-up. Merge Labs would be in direct competition with Elon Musk’s Neuralink, which seeks to wire brains directly to computers. OpenAI’s proposed investment, reported by the Financial Times, also pits its CEO Sam Altman against Musk, an OpenAI co-founder who is now a fierce rival. Merge, valued at US$850-million, is among a slew of young companies looking to take advantage of recent advances in artificial intelligence to build more useful brain-computer interfaces.

Americans are picking nicotine over beer and whiskey. Only 34% of Americans claim beer as their alcohol of choice, compared to 47% back in the1990s, according to a Gallup poll. But as beer companies such as Molson Coors see their valuation sink, tobacco companies like Philip Morris have seen an up tick as nicotine pouches are becoming Americans’ new guilty pleasure. Three prominent Kentucky whiskey businesses also filed for bankruptcy in recent months due to changing consumer preferences and America’s trade fights with several countries including Canada and the EU.

Ontario is falling short on its housing target. Housing starts in 2024 stood at just over 94,000 units in 2024, compared to the 125,000 needed for the province to meet its 1.5-million-home target by 2031. This year’s not shaping up well either, according to the province's financial accountability officer. The disappointing figures come despite the government adding new categories to boost the numbers. A lack lustre economy and construction sector layoffs are adding to the challenging environment, said Dave Wilkes, president and CEO of the Building Industry and Land Development Association.

U.S. stocks buybacks are set to top US$1.1-trillion. The biggest repurchasers include tech giants Apple and Google parent Alphabet, and banks JPMorgan Chase, Goldman Sachs and Wells Fargo. Strong earnings growth and tax cuts have left companies’ aflush with cash. Some analysts say the repurchases will only serve to prop up the market at a time of stretched valuations and divert funds away from capital investments. Others question whether companies are using buybacks to boost share prices and paper over the hit from Donald Trump’s tariffs on their balance sheets.