The US government has passed President Trump’s One Big Beautiful Bill Act. The Bill represents Trump’s key piece of legislation and includes a collection of tax cut extensions and increases to military spending, among many other things.

I am not so sure this Bill is Beautiful. Readers might write their own word in the blank space provided, or even write in a guess at the debt it will pile on to the American taxpayer, estimated by the non-partisan Congressional Budget Office at between $2.4 and $2.8-trillion (you might need a Bigger Blank Space).

The US government bond market showed some signs of concern when the initial Bill was first unveiled, as markets became anxious about the potential long-term impact to the deficit. But bond yields have since retreated, reflecting less concern, or a view that meaningful changes to the Bill could be on the way. We shall see.

The US president seems to be of the view that he can go aggressively into further debt because of all the revenue that his tariff and other policies are going to bring in. The facts on the ground are that so far, as we approach the end of the original 90-day grace period (more on that in a moment), the only deals in place are with the United Kingdom and Vietnam.

TARIFF TALK

Two tariff deadlines are approaching. The reciprocal tariffs that were lowered to 10% across a host of countries were set to expire (i.e. go up to as high as 50%) July 9th. The latest news, as of time of publication, is that a number of Asian countries including Japan and South Korea have been extended to August 1st, although Canada is hoping to wrap up a new trade deal with the US by July 21st.

In theory, tariffs are set to increase after that. However, there is the possibility of agreements being reached, or some extensions being offered to buy more time for negotiation. It appears that China and the US have settled on some framework for an agreement, although details have not been revealed.

It is hard to predict, but the strength of the global equity market suggests that markets are not too concerned.

PATIENCE

Part of this dynamic is that many national governments around the world have not panicked, believing time is on their side with the extensions given. They are viewing the situation through a lens not unlike that of the long-term investor. To that investor, the end of Trump’s term – assuming he leaves – will arrive in the blink of an eye, a little over three years from now. This long-term lens is a key reason the markets have been performing reasonably well despite all of the uncertainty.

On the one hand, the relatively good performance has served as a reminder that despite headlines that seem unnerving, markets can be resilient – and it’s important to avoid being swayed by short-term developments. On the other hand, equity markets are now trading at or near all-time highs, suggesting expectations have also risen, leaving some room for disappointment and potential weakness if the economic and earnings trajectories do not unfold as positively as markets seem to be expecting.

We never let complacency set in, and for these reasons we continue to remain vigilant despite having a renewed sense of optimism.

DOLLAR DROP

So far this year, the US dollar has fallen more than the US stock market has risen. This means that for Canadians, the gains from the US market have been completely wiped out by the drop in the US dollar.

Here is the good news: This is not a problem our clients are experiencing, because all of our client portfolios, carefully customized as they are, are still well in positive territory this year.

How so? Because we acted in accordance with our long-time strategy, which called for us to be very busy in the wake of President Trump’s tariff announcement on “Liberation Day.” On April 3rd, the S&P 500 dove 4.8%, one of the sharpest single-day declines in history. It fell a total of nearly 6% in four days.

As we said in the May edition of this blog, we are of the view that tariffs are not sustainable, and therefore we bought a number of great companies (trading below their intrinsic value) at great prices, with the knowledge that before long, the market would realize their value.

Nvidia is a great example: it has risen 50% since we added to our position in April, and is the most valuable company in history.

As always, we continue to be proactive and are capitalizing on the opportunities the market presents to us.

A CEILING ON HOMES

For some time now, we have been optimistic that the Canadian housing market will improve. The Bank of Canada lowered interest rates from 5% to 2.75% over the past year. One would expect such borrowing relief to support a housing rally – but then the US launched the tariff war.

The effect is that the market is gripped with uncertainty. June sales were down 16.5% in Calgary on a year over year basis, and down 12% in Toronto.

The housing market is particularly important to us because our client portfolios own the big Canadian banks, all of which have considerable exposure to the housing market through their mortgage lending. We note that bank stocks have been performing reasonably well, and take this as a sign of cautious optimism among investors.

OIL OBSERVATIONS

A theme of this blog is that the markets tend not to get overly concerned about short term events. The escalation in the Middle East is a case in point.

The Israeli military carried out airstrikes against Iran's nuclear facilities on June 12th. Oil prices responded immediately with one of their largest moves in some time. Iran retaliated by launching a series of missile strikes at Israel and warned of further retaliation should other countries get involved. Regardless, the United States entered the fray with a series of targeted strikes on Iranian nuclear facilities.

The key investment concern remains the potential risk to the oil market, as nearly 20% of the world's oil passes through the Strait of Hormuz, a narrow channel on the Persian Gulf which Iran has in the past threatened to disrupt. There is skepticism that Iran would take this action, given the harm it would inflict both on Iran and its largest oil customer: China.

Higher oil prices could drive up inflation, similar to what we saw after Russia invaded Ukraine. We are monitoring the situation closely.

THE SECOND HALF

The most important factor in the second half of the year may be the way in which economic data and corporate guidance unfolds. Markets will be watching for signs of any potential impact of higher tariffs, either through inflationary pressure or slower growth. There have been some small signs here and there, but overall, there have been limited indications of a meaningful impact to the US economy so far. If data continues to be resilient, the confidence in the corporate earnings outlook will rise, providing further opportunities for equities to move higher.

SUMMER

Summer is here again! As I note every year at this time, summer is a season of reflection for many of our clients. Spending time with parents, children and grandchildren brings on thoughts of intergenerational wealth planning and legacy.

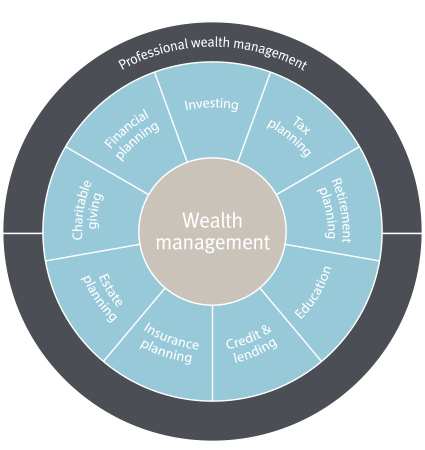

The fact is this: many advisors do not provide the comprehensive services we are so proud to deliver. Estate planning and intergenerational wealth planning are absolutely crucial to our clients’ lives – so it is our honour, and simply the right thing to do, to not only offer these services, but at the highest level of quality, thanks to RBC’s unrivalled depth and breadth of resources.

If you, or someone you know, are thinking about the big picture issues, or wondering if they should be doing better, please be in touch with us, or refer your family, friends and colleagues for a completely confidential, no-obligation consultation on how their needs might be better handled.

Thank you – and Happy Summer!

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO