HAPPY NEW YEAR!

The start of a fresh year is the perfect time to reflect and to strategize about the upcoming 12 months. 2024 was a strong year for our portfolios, which outperformed all of our benchmarks, especially on a risk-adjusted basis – and despite the geopolitical tensions and noise that is always present. Our long-time investing strategy continues to serve us very well.

Looking ahead, the markets now anticipate smaller cuts to US interest rates than previously expected. While the US Federal Reserve cut interest rates at its mid-December meeting, Chair Jerome Powell said it will likely be appropriate “to slow the pace of further adjustments.” Expectations are that rates will be cut by only 0.5% in 2025 – half of what was previously anticipated. As a result, the inflation forecast for the year has been raised.

The Bank of Canada is also signalling a more restrained approach to interest rate cuts. Markets currently expect 0.50% to 0.75% worth of rate reductions this year. That said, we would not be surprised if the BoC decides to be somewhat more aggressive than that, to avoid missing its 2% inflation target.

The Canadian economy, especially compared to the US, has been relatively lacklustre, with expectations this may continue in the near term, which has contributed to lower Canadian bond yields and interest rates than in the US.

VACATION

Have you considered a winter vacation to the US, perhaps to a sunbelt state? Then you are especially aware that our currency has weakened relative to the US dollar – due in large part (as we have noted in past editions of Marche Monthly) to the fact that Canada has lowered interest rates faster than the United States, and that global funds tend to flow towards higher-yielding currencies, thereby strengthening their value relative to lower-yielding ones.

RESIGNATION

Meanwhile, Prime Minister Justin Trudeau announced his resignation. This was not a big surprise after months of poor polling, recent exits of key officials from Cabinet, and mounting calls for his departure. Even so, his exit creates political uncertainty at a time when the country is dealing with the threat of tariffs from the incoming US administration. Trudeau will remain in office until his successor is selected, with Parliament suspended until late March. Although our federal government has the power to impose counter-tariffs on the United States without legislative approval, the leadership void could complicate negotiations. This uncertainty is also weighing on the Canadian dollar in addition to the interest rate gap already noted.

ALL OF THAT SAID…

Simply put, the US economy is firing on all cylinders. Wages and jobs are going up every month. Policies in the United States are, relative to Canada, more conducive to productivity and growth. Yet we always keep in mind that these expectations – positive for the US and less so for Canada – are already reflected in current market valuations. It is the potential for change in the outlook, for better or worse, that will likely drive market movements. That is what we will be watching for in the months to come.

Recent developments in Canada may not inspire a lot of confidence in investors. But it is worth noting that the Canadian equity market may not depend as much on political or economic developments at home as it once did. After all, Canadian equities were up nearly 20% last year. In addition, US growth has benefited many of the Canadian businesses that have, over the years, become increasingly tied to activity south of the border. While we expect some continued pessimism about Canada and its near-term economic prospects, interest rates may continue to move lower, which may drive some anticipation of better economic and earnings growth later this year.

We will also reiterate that the primary driver of our portfolios’ success is the quality of the companies we own – and that those companies’ long-term performance will be unaffected by short-term events. This is why we tend to manage concentrated portfolios composed of quality businesses we want to own for many years. We believe this approach will maximize long-term performance and improve after-tax returns, all while keeping costs to a minimum.

MORE IMPORTANT THAN EVER

Speaking of after-tax returns: now that the Prime Minister has indicated his intention to resign, we should say again that a key component of his legacy will be the massive debt he is leaving behind, ensuring that we, and future generations, will pay high, and possibly increasingly high, taxes. And so, as we have said on many occasions, we always keep in mind that your investment returns are crucially important – and what you earn after taxes is even more important.

That is why tax planning is more important than ever. We have conversations with clients throughout the year – especially in December and January – on the topic of registered plans, which, because of the power of tax-sheltered compound growth, are one of the most important components of your customized financial plan. A strategy of careful planning, consistent management and making your maximum allowable contributions on a consistent basis is essential to maximize the value of these vehicles.

As we approach the RRSP deadline and tax season, we want to remind you of the details surrounding the use of tax-sheltered savings plans as an effective way to grow your investments.

RRSP Deadline and Contribution Limits

The 2024 RRSP contribution deadline is March 3, 2025 and the RRSP contribution limits are $31,560 for 2024 and $32,490 for 2025.

If you have the funds available, consider making your 2025 RRSP contribution early in 2025 rather than waiting until the deadline in 2026. The simple act of contributing early maximizes the tax-deferred growth of your investment portfolio.

TFSA

You are allowed to contribute $7,000 to your TFSA in 2025. If you did not contribute to a TFSA in prior years, with the contribution room from 2009-2025, you will be able to contribute up to $102,000 to grow tax free.

FHSA

The First Home Savings Account is a newer registered plan that gives eligible Canadians the ability to save up to $40,000 on a tax-free basis, for the purchase of their first home. It combines the features of a RRSP and TFSA where contributions are tax deductible (like RRSP) and withdrawals, including earned income are tax-free (like TFSA), provided funds are used to purchase a qualifying home. The annual contribution limit is $8,000 with a maximum lifetime contribution limit of $40,000 (click here for more information).

Determining your available contribution room

Check your latest Notice of Assessment, RRSP Deduction Limit Statement (Form T1028), or log on to your Canada Revenue Agency account here.

Please give us a call if you would like to explore these strategies, and we will help you develop a plan that makes the most sense for your situation.

You can also make a contribution by transferring funds to your RBC Dominion Securities account directly from any RBC Royal Bank account through DS Online. For DS Online help or more information on transferring funds, contact Tanvir at 416-974-4811.

Tax filing deadlines

For individuals, it is April 30. For the self-employed, the last day file to file without penalty is June 16.

CAPITAL GAINS UPDATE

With Mr. Trudeau on the way out and Parliament prorogued, it is unknown whether the capital gains changes proposed in the 2024 budget will be passed by our current government, by the next one, or whether they will be completely set aside. The proposed changes, as a reminder, were to increase the capital gains tax inclusion rate from one-half to two-thirds on all corporate capital gains and for over $250,000 in gains personally.

Given the uncertainty, we believe it is prudent to take a wait-and-see approach, and not make any related decisions now.

TANVIR

We bid Joy a very fond farewell in December and are pleased to say again that the transition has been seamless, and that Tanvir is fully up and running, getting to know clients, building rapport and bringing great value to your overall experience with Marche Wealth Management. If you have not already been in contact with Tanvir, by all means reach out to him at 416-974-4811 or tanvir.howlader@rbc.com.

CALIFORNIA WILDFIRES

We have all been stunned by the devastation and tragedy in California. The end is not yet in sight. We pray for the victims and know that a great city and people will prevail.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

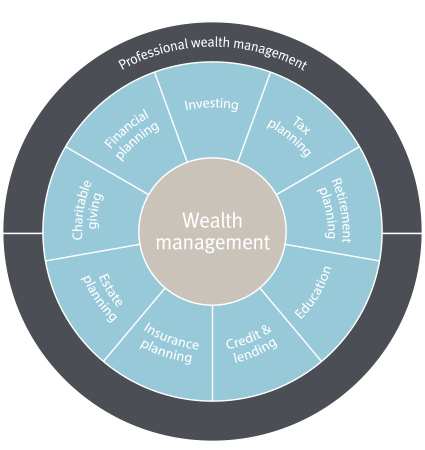

WHAT WE DO