SHOULD TARIFFS SCARE US?

In the October edition of Marche Monthly, I asked you to forget about the impending US election. Here in the November edition, I am asking you to forget about the result.

Yes, President-elect Donald Trump has already introduced considerable uncertainty, most notably by threatening imports from Canada and Mexico with a 25% tariff unless those governments enhance border security (a 10% tariff has also been threatened on Chinese imports). Here is why, while we do not regard Trump’s threat as empty, we are not panicked.

Countries generally use tariffs to protect domestic industries by raising the cost of imports and encouraging consumption of locally-produced goods. Tariffs also provide a source of government revenue.

However, in practice, the benefits to the country imposing the tariff are often offset by several forces. For example, domestic businesses that rely on foreign inputs to produce their goods may face higher costs. As well, retaliatory tariffs (which, in this example, Canada, Mexico and China could levy) can harm exporting industries.

Ultimately, consumers usually bear the brunt of the costs through higher prices. One relevant example is oil, which accounts for nearly a third of Canada’s exports to the United States; energy makes up a significant portion of the Canadian equity market. If implemented, tariffs could hurt the Canadian economy and its stock market. However, Canadian oil represents around 20% of US oil consumption, and without clear alternatives, oil prices in the US would likely rise, aggravating inflation-weary consumers.

These factors risk creating a political cost to the incoming administration, one it may seek to avoid.

The trade-offs of imposing tariffs, along with lessons from President Trump’s first term – when similar threats resulted in negotiated compromises – suggest this development may be part of an early negotiation strategy. Looking back to 2019, Trump threatened to escalate tariffs on Mexican imports unless the country took measures to curb illegal immigration. Mexico responded by deploying additional border troops, thereby avoiding the tariffs. A similar scenario may play out this time.

In line with this view, North American equity markets, which have been flirting with new highs, have largely shrugged off the tariff threats. The Canadian stock market has moved higher since Trump’s announcement, making it worthwhile for us to recall that, despite the imposition of steel and aluminum tariffs, Canadian equities demonstrated resilience during President Trump’s first term. For example, between 2018 and 2019, Canadian stocks outperformed other non-US developed markets, as our industries exposed to tariffs represented only a fraction of our domestic equities market.

In fact, the Canadian equities market may be more insulated from the impact of tariffs than the Canadian economy overall. For example, sectors such as financial services, software, and food retail are not directly exposed to tariffs, as they do not rely on physical exports. As well, an increasing number of Canadian companies that make up our domestic stock market have diversified their businesses internationally, reducing their sensitivity to economic developments here at home.

TAKING ADVANTAGE

All of these reasons lead me to encourage you not to worry about the US election result as it pertains to your portfolio and financial plan. The bottom line is that we believe any impact from US tariffs may be less punitive than some expect. In fact, the greater unpredictability one would expect from a Trump administration may add to market volatility from time to time – which, as regular readers of this blog will know, creates opportunities for us to buy underpriced assets, which gives us a margin of safety – something we have always been ready for, and will remain so in 2025 and beyond.

FEAR IS GOOD

This year has been a particularly strong one. Our portfolios outperformed all of our benchmarks, especially on a risk-adjusted basis. As disciples of value investor Warren Buffett (net worth: $150-billion USD), last month we quoted one of his many famous maxims. Here it is again:

"A simple rule dictates my buying: Be fearful when others are greedy, and be greedy when others are fearful."

Right now, many others are being greedy. The S&P 500, which we consider to be the authoritative index of how the markets are doing overall, is up more than 27% year to date. Given the tendency of humans to make emotional investment mistakes (a primary task of ours is to ensure our clients do not), while it may feel like this is the perfect time to buy aggressively, the exact opposite may be true.

And so we remain confident in our long-time investing strategy, and careful and fearful, all at the same time.

SOMEONE YOU KNOW

We are deeply honoured to receive so many referrals from our clients. There are a number of times throughout the year when people are looking at their financial situation and asking themselves: “Could I do better? Could I pay less tax?” It happens in the New Year, it happens during tax season, it happens in the summer, and it is happening right now, as the year draws to a close.

This past year contained a new milestone for many Canadians. It was the increase to the capital gains tax inclusion rate from one-half to two-thirds – for corporations and for over $250,000 personally – that took effect on June 25th. My observation is that it pushed many Canadians to the point of looking extremely seriously at the ever-shrinking number of strategies remaining to save tax in this country.

For people with corporations, one of those strategies is to use insurance to generate above-average tax-free returns and get money out of their corporations on a tax-free basis. We have been doing a great deal of this work, because, more than ever before, clients are truly gravitating toward these strategies.

Is there a family member, friend or colleague you know of, who is questioning their investment returns and tax situation? You could mention to them that we are always happy to have a zero-obligation, 100% confidential consultation about where they are now, where they would like to be, and how can help get them there.

PODCAST: THE TRUTH ABOUT BEING AN EXECUTOR

Being chosen as an executor should not primarily be thought of as an honour.

To accept it as such would be a completely understandable emotional response.

Emotion – or pressure to accept the job – can get in the way of realizing just how demanding the job can be.

Perhaps you have been named executor and want to make an informed decision as to whether you should delegate some or all of your responsibilities. Maybe you are in the process of carrying out your executor duties right now, but have realized that you are overwhelmed. Or, it could be that you are thinking about your estate plan, and the possibility of using a professional executor, which is a solution to all of these issues.

Reach out to us. We can help. We have also found this new podcast to be very helpful and enjoyable. In it, Leanne Kaufman, President and CEO, Royal Trust, speaks with Clare Burns, a partner at the law firm WeirFoulds in Toronto, a very well-respected specialist in the area of trust, estates and capacity litigation.

Listen to the 28-minute episode (or you can read the transcript) to discover the duties and potential liabilities of being an executor, as well as the ideal characteristics required for the role.

Because many people think about bigger picture issues as the year ends, this is indeed a season in which we do a lot of estate planning work, bringing in Alleen Sakarian, LL.B., TEP, our Will and Estate Specialist. Alleen has worked with many of our clients and is always available to review estate plans with you, as well as the pros and cons of being an executor and whether to hire a professional.

YEAR-END

We have essentially completed year-end planning for our clients. However, if there is anything at all that you would like to discuss, please do not hesitate to contact us.

A BIG DAY

The last few months have really flown by, and now Joy Loewen’s last day, December 20th, is almost upon us. As we announced in September, Joy is retiring after 37 years of providing exceptional client service in our industry, the last nine at Marche Wealth Management. Congratulations and thank you, Joy!

The unparalleled depth and breadth of RBC resources will ensure that this transition will be seamless and that everything will be business as usual.

In other news, Tanvir Howlader, our new Associate Wealth Advisor, has been working alongside both Joy and I over the past few months, to gain a holistic understanding of our business – and will soon transition to work alongside me on investment management and financial planning. Tanvir’s impressive credentials, designations, knowledge and experience will help take our clients’ experience to the next level.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

Tyler Marche, MBA, CFP, FCSI

Your life, uncomplicated

tyler.marche@rbc.com

1-416-974-4810

www.tylermarche.com

WHO WE ARE

Tyler Marche, MBA, CFP, FCSI – Senior Portfolio Manager and Wealth Advisor

Tanvir Howlader, B.Comm, MBA, CIM®, FCSI – Associate Wealth Advisor

Tracy McClure, CPA, CA, CFP – Financial Planner

Joy Loewen – Senior Associate

Karen Snowdon-Steacy, TEP – Senior Trust Advisor

Steve Mogdan, CPA, CA – Financial Planning Specialist

Andrew Sipes, CLU, CFP – Insurance and Estate Planning Specialist

Alleen Sakarian, LL.B., TEP – Will and Estate Specialist

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

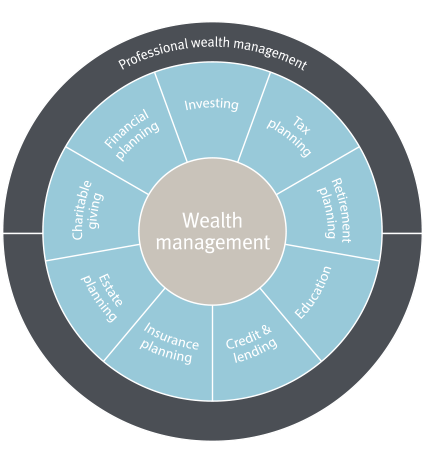

WHAT WE DO