OPTIMISM IS WARREN-TED

The Canadian portion of our portfolios is composed of strong businesses – banks and utilities, for example – that meet our stringent investment criteria, because they are regulated, dividend-paying companies with strong balance sheets. However, the Canadian portion of our portfolios has been lagging the US portion in terms of recent performance – but we expect that performance gap to narrow, as interest rates move lower in Canada.

One important way to look at this situation is that there is more opportunity to find underpriced businesses in Canada. In other words, there are quality Canadian businesses trading at a discount relative to their US peers, which provides us with a margin of safety.

As long-time disciples of The Oracle of Omaha, Warren Buffett, we are pleased to be in alignment with his optimism about Canada: “We do not feel uncomfortable in any way, shape or form, putting our money into Canada,” said Mr. Buffett at the annual meeting of his holding company, Berkshire Hathaway, in early May.

He continued: “We don’t have any mental blocks about that country. And of course, there’s a lot of countries we don’t understand at all. So Canada, it’s terrific when you’ve got a major economy – not the size of the U.S., but a major economy that you absolutely, you feel confident about operating there.”

We note that Berkshire Hathaway’s cash reserves are at an all-time high – $189-billion, up dramatically from the $130-billion on hand at last year’s meeting – suggesting that Mr. Buffett sees US assets as being overpriced, which is consistent with our general view.

During the annual meeting, which has now been occurring for approximately 60 years, there is a five-hour question-and-answer session in which Mr. Buffett (and formerly his business partner Charlie Munger, whom we said goodbye to here) takes questions from the thousands of shareholders who have made the pilgrimage to Berkshire Hathaway headquarters in Omaha, Nebraska.

Asked about Berkshire’s cash reserves, Mr. Buffett said, "We'd love to spend it, but we won't spend it unless we think we're doing something that has very little risk and can make us a lot of money…We only swing at pitches we like.”

We could not agree more with this philosophy.

EXTRA-LARGE TYPE

A case in point is Artificial Intelligence (AI). When we first started discussing its importance over a year ago, people were talking about it, but the amount of chatter was nothing compared to what it is now, and I am regularly asked about it.

What would Warren do?

He would be cautious about the potential for unwarranted valuations, which is exactly what we are now in relation to Nvidia, Alphabet, Amazon, and other stocks we own with AI exposure. Now that the AI story has moved from the back page to the front page of the news and appears in extra-large type, literally and figuratively, we will be even more careful in how we navigate this space. That said, we are comfortable with our exposure and have already benefitted from it considerably.

AI AND CLIMATE CHANGE

When speaking with our clients, something we keep hearing is their concern about climate change. On this issue, we take note that AI requires enormous amounts of energy to do its work. When someone uses ChatGPT or another AI application, a supercomputer in a data centre somewhere in the world springs into action. According to the International Energy Agency, by 2026, AI could contribute to a doubling of global electricity use by data centres to 1,000 terawatt-hours, which is equivalent to the entire annual use of Japan.

The impact of AI on climate change is therefore an important emerging issue. As we reported in the May, 2021 edition of this blog, many global players believe that climate change is in fact the biggest long-term threat to the world’s economy. Thus, we have for years seen a win-win opportunity in investing in businesses that meet our evolving Environmental, Social & Governance (ESG) standards, and are increasingly making them a core component of our portfolios. Businesses with a robust ESG strategy have been proven to have a lower cost of capital, higher valuations, are less vulnerable to systemic risks, and are able to create more long-term value and sustainability.

And so it will be necessary for companies in the AI space, and all businesses in general, to become more energy efficient, in order to continue delivering value to themselves, investors and the planet.

Investing in ESG companies is important to us, not just because of our personal feelings about the need to preserve and protect our environment, but also because it will generate better returns not just for investors, but for all stakeholders.

WE ARE HERE

We are fortunate to work with multiple generations of our client families. We have heard concerns about climate change from all of them. If anyone in your family, of any generation, would like to talk about ESG investing or the impact of AI on our environment, please do not hesitate to reach out.

CAPITAL GAINS UPDATE

The federal government has indicated that the increase to the capital gains inclusion rate will indeed come into effect, as originally planned, on June 25th. We covered the story, and its potential impact on our clients, in the April edition of Marche Monthly.

We believe that the increase erodes the competitive position of the Canadian tax system vs. other countries, is a disincentive to capital investment in our country, will have a negative effect on productivity, and makes our tax system more complicated than it already is.

If there is a silver lining, it is that the impending increase has motivated many Canadians, our clients among them, to be more aware of what they keep after taxes. Many of our clients have since been working with us to strategize accordingly.

We continue to monitor the situation closely, and where appropriate are working side by side with our clients’ accountants or other advisors, to ensure that, as always, we deploy the best strategies possible to preserve and grow your wealth.

For example, we are positioned to trigger gains before June 25th if it is advantageous, although, as we pointed out in April, we don’t yet know the specific rules as to how the new capital gains regime will be enforced.

If you would like us to meet with you, your accountant, or other advisors, to see what strategies may be available to help maximize your wealth, just let us know.

SUMMERTIME MUSE

We have had the good fortune of a great late May. Summer is almost here, and as we tend to note every year at this time, many of our clients use this season to look at things more holistically – in terms of intergenerational matters including will and estate planning, for example.

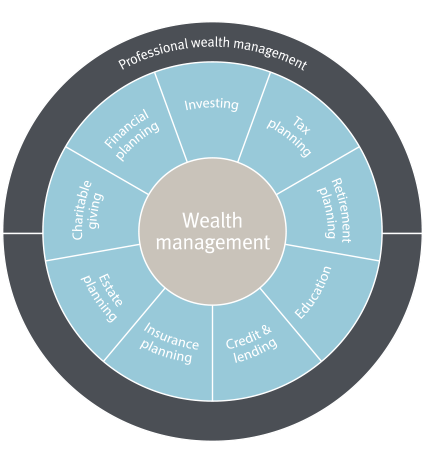

Whatever issue you find yourself considering, we have Canada’s deepest, broadest, most expert team at our disposal to advise you. Get in touch with us, and we will take it from there.

--

We don’t speak jargon. We’re all about uncomplicating your life, so we speak plain English. If there is someone you care about – someone who would appreciate this simple and straightforward approach – please feel free to share this message with them or put us in touch.

Want to discuss any aspect of this month’s blog, or any other issue on your mind? Have a story idea? I am always happy to receive your call or email.

WHO WE ARE

**To learn about our unrivalled team of experts, delivering Canada’s widest array of wealth management services to our clients, visit our website, here and here.

WHAT WE DO