Good Evening Readers,

Meme stock mania is back for now.

Opendoor Technologies Inc. has rallied over +300% to $2.42 a share this month. At this rate, it won’t be long before it gets back to its all time high of $34/share set back in 2021.

So what’s up with that?

Markets are up, people feel good, FOMO is human nature.

Naturally this creates a dilemma. If you buy now, the market will sell off. If you sell, stocks will keep ripping. Mr. Market loves to wait till you show your hand and work against you.

The best way to avoid this is to stay consistent. When it feels hard to resist the enthusiasm of a rising market, it’s time to take profits.

On the flip side, when the fear of losing more strikes, and you are apprehensive to buy into a wave of worry and uncertainty, you know you’re doing it right.

On a personal note – when I start to get messages from old friends and colleagues asking about meme stocks and new crypto coins, I know it’s the smart money selling out of their positions. For every buy, there’s a sell.

Instead, I’d be looking at yesterday’s heroes.

For quite some time we’ve discussed the difficulties facing the housing market, in particular the condo market.

The mainstream market has finally started to pickup on it too.

As more and more units are coming online, developers have been cancelling projects left, right, and center.

For many Canadians looking to downsize in retirement, I think this could be an interesting opportunity.

If there’s too much supply today, developers aren’t starting new projects, and it takes 5-6 years to complete a new building…. Could that mean we will have a supply shortage in the future?

This will be a continued area of interest for us. Thinking out loud, I would guess it’s too soon now, but waiting for developers to start playing catch up is late

Portfolio Update - Balanced Model (Paper Portfolio)

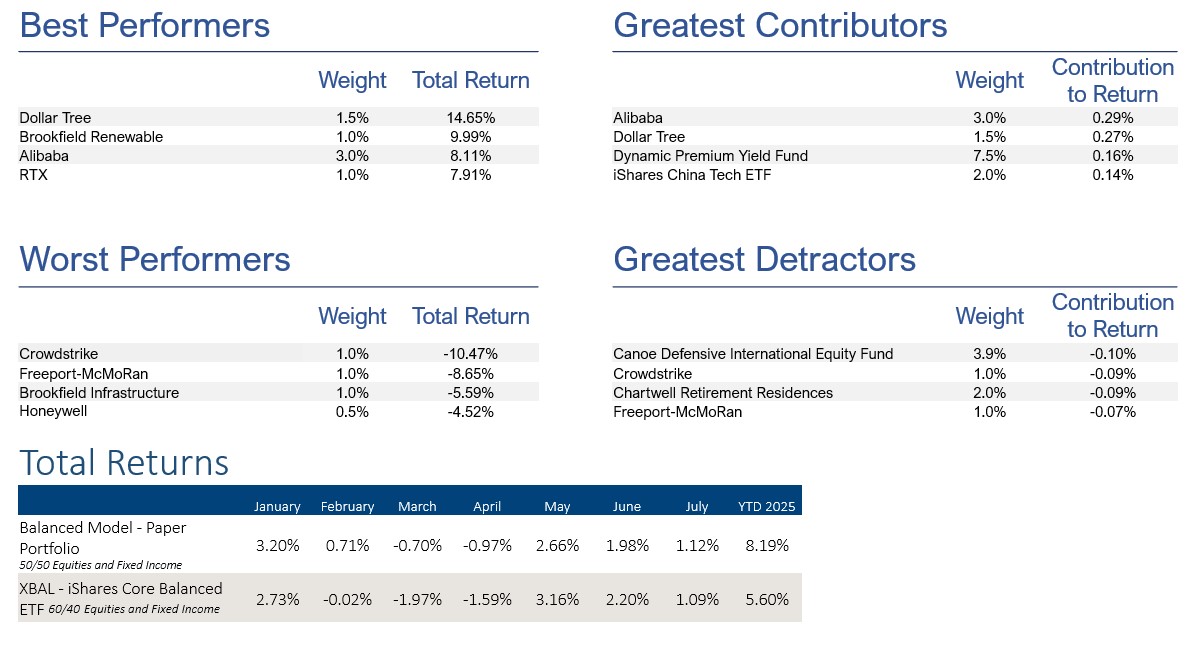

Balanced Model up +1.12% in July to $1,081,868, +8.19% YTD

Above are our numbers as of August 1st.

We made minor changes to our model portfolio this month.

The rationale behind each is the recent strength in the US dollar. Conversely, we believe the USD will continue to weaken (think Loonie headed back to its long term average of 0.78).

This should be a tailwind for gold and foreign equities.

- Swapping our Gold bullion etf GLDM for CI’s Gold Bullion ETF CAD Hedged (VALT)

- VALT offers us the same gold exposure, however the MER is 30bps cheaper (0.18%)

- VALT is also listed on the TSX and provides a hedge back to the Loonie. This won’t impact performance, but avoids fluctuations due to FX.

- We’ve also increased our weighting from 2.5% to 4%

- Increasing our weighting in Mackenzie Emerging Markets Fund to 5%

- A declining dollar is beneficial for Emerging markets, as foreign input costs become cheaper, and foreign denominated debt becomes less burdensome.

- YTD the fund is up +15.14%

A word about our benchmark – iShares Core Balanced ETF (ticker XBAL)

- Why XBAL as our benchmark?

- This is a low cost, balanced etf accessible to all.

- MER is 0.2%

- Traditional asset allocation

- 60% of the etf is invested in global equities, and 40% in global fixed income

- This is similar to traditional balanced portfolios, and to our very own.

- CAD denominated, just like our accounts.

- Performance is relative to the Canadian dollar, and we want currency exchange rates reflected in our benchmark just like our accounts.

- This is a low cost, balanced etf accessible to all.

Year to date, our model has returned +8.19%

- We outperformed the benchmark by +2.59% .

- Our objective is simple

- Outperform the market on the downside, and keep up with it on the upside

- Rebalance regularly – we take profits and buy dips

- Looking at monthly returns, we did just that

- From Feb. 1st to May 1st, the benchmark declined -3.58%

- Our model declined -0.98%

- Our objective is simple

As always, If you have any questions or comments – let me know!

Much love to you and yours,

Lucas

About the Paper Portfolio – Balanced Model

The Paper Portfolio is a model and NOT a real investment account. For any readers interested in a full list of positions and/or Monthly Performance, they are available upon request. No individual should act on this as investment advice, please consult a professional. The Paper Portfolio does not take into consideration taxes, or income requirements.