Good Afternoon Readers,

From sweater weather and rain, to hot and scorching this weekend.

We’re Canadian. We know better than most – it’s not bad weather, just bad clothing.

Noting against the weatherman….But we all know they’re far from perfect.

Markets have endured the same weatherman dilemma. Coming into 2025, the forecasters called for an SP500 target of 6600 by year end, only to cut that target to 5500 in April. After a V shaped recovery, we’re back to a 6500 target.

2025 - Are we halfway there yet?

Markets have rebounded nicely since the April lows. Recently, we’ve been promptly taking profits and trimming equity exposures near these highs. Here’s why.

The Price of Oil

- We’ve previously highlighted the importance of oil prices, and identified rising oil as a risk to markets.

- So far this month, WTI Crude has jumped from $61.11à$75.80 (+24%)

- Looking back through history, we can see how many recessions are led by a spike in oil prices.

- For now, we wait and see. When it comes to markets, geopolitical events are often short term and forgettable.

- If tensions continue to escalate, and in particular, the Strait of Hormuz is disrupted, we expect oil prices to continue rising and market volatility to pick up.

Pivoting from the “TACO” trade to the “Ego” trade

- History doesn’t repeat, but it often rhymes

- Markets balked at tariffs in March, and sold off

- Trump provided a 30 day reprieve

- Markets recovered, and balked at the April deadline…only to sell off

- …and trump provided a 3 month reprieve

- Markets balked at tariffs in March, and sold off

- Were just over two weeks away from the July deadline for tariffs to come back into effect

- Markets have shrugged off the risk of tariffs

- My fear this time is ego - Trump Always Chickens Out (TACO) is one way to get his attention

- I can’t see him rolling over and embracing this monicker

It’s possible that this time, geopolitics are the asteroid that actually strikes, and there are bigger fish to fry than tariffs. Between the two, I’m much more concerned with the president being called a chicken.

Either way, bring layers - nothing beats being prepared and ready to pivot. We’re Canadian, it’s what we do best.

Portfolio Update - Balanced Model (Paper Portfolio)

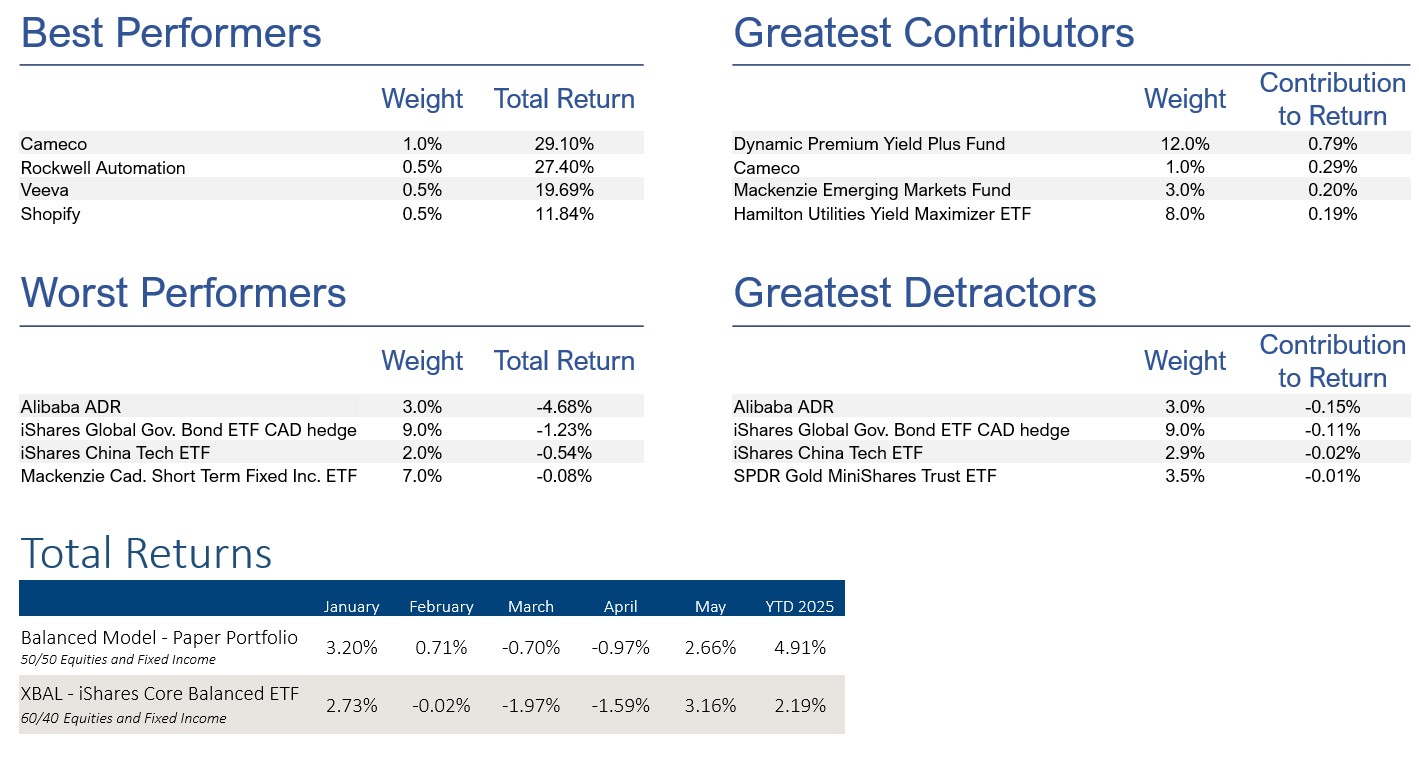

Balanced Model up +2.65% in May to $1,049,109, +4.9% YTD

- are our numbers as of June 1st.

Two new additions to the portfolio for this month.

- AtkinsRéalis (ATRL)

- Formerly SNC-Lavalin, ATRL is a Canadian engineering and construction firm.

- They also construct and service nuclear reactors, and have continued to win contracts to construct SMR’s.

- Revenue and profits from their Nuclear division will continue to surge.

- We’ve initiated a 1.5% position

- Dollar Tree (DLTR)

- Similar to Dollarama, US consumers have continued to search for value and discounted everyday goods.

- Unlike Dollarama, DLTR is still down -68% from the all-time hit in 2022.

- With a slowdown a growth considered the best outcome, we expect foot traffic to keep rising. After all, DLTR was one of a few stocks to have a positive return in 2008.

- We’ve initiated a 1.5% position

To raise cash for the above buys, we liquidated our position in Telus (maintain exposure through UMAX) and trimmed profits from our remaining equities, bringing our positions back to target weights.

As always, If you have any questions or comments – let me know!

Much love to you and yours,

Lucas

| About the Paper Portfolio – Balanced Model The Paper Portfolio is a model and NOT a real investment account. For any readers interested in a full list of positions and/or Monthly Performance, they are available upon request. No individual should act on this as investment advice, please consult a professional. The Paper Portfolio does not take into consideration taxes, or income requirements. |