Good Morning Readers,

Stocks around the world have come full circle since we were presented with a tariff bristol board on Liberation Day in April. Down nearly -20% and back again after the US administration flip flopped on tariffs.

- tempting, but it’s not productive to reminisce on how flipping off your allies and trading partners is a bad idea, or how disrupting global trade and expecting others to buy your debt is nuts.

Productive is looking ahead for what’s in store for markets.

Does the V shape recovery rage higher into a new bull market?

- Unlikely - previous slowdowns in economic growth and earnings have been stoked by the federal reserve pumping liquidity and support into the market.

- Until we see a true economic contraction, and the inflation boogey man is put to sleep for good, stimulating the economy via the printing press is off the table.

- I also have a hard time seeing the market rally with tariffs in place. Even with trade deals, here’s where we currently sit

- Baseline tariffs are still in place, yet we’re just shy of an all time high in the market?

- Trumps position on tariffs has been around for decades, I don’t expect current tariffs to be reduced further.

- If anything, I could see another run at some more… The market shrugged off the first round, but what’s to stop the white house from thinking they can add more? Market is A-OK!

- Another kicker is the upcoming debt maturity wall

- As of now, the interest expense is 12% of the entire US budget. This will balloon higher if all that debt goes from 0% to 4%...

- I would expect the US admin’s top priority is to reduce rates… Maybe they replace a new fed chair with someone who comes with an immediate dovish tone…

Will the market rally fizzle out and reverse significantly?

- Unlikely for now. Leading indicators have trended down for months, but the true measure of damage being done is unemployment.

- We’ve yet to see jobless claims jump, and I have a hard time seeing a prolonged sell off in mega cap stocks until we get material news of unemployment rising.

The boring but likely outcome? We consolidate and hang out here for a while

- Markets will likely take a breather as everyone takes stock on what lies ahead.

- I imagine something like 2011 where the market chopped around for 6 months, digesting the news of the European debt crisis, but the economy avoided a recession and eventually looks to a brighter future.

For me, there’s three things to watch over the next few months.

- Oil prices

- Crude prices have dropped significantly. This helps to keep inflation in check and pressure on future interest rate expectations

- Interest rates

- Rates dropped materially in April, but have been rallying since. If the longer trend continues down, we should avoid a US recession.

- The US dollar

- The dollar weakening makes US goods cheaper, a tail wind for growth. Hopefully this helps offset the tariff tax.

The good news for us – we don’t need to perfectly predict the exact path of the S&P500 or TSX to profit from markets. We’ll continue to use volatility to our advantage, and get paid to wait with a focus dividends and income.

So far, our overweight to utilities has paid off nicely, it’s the one sector with both higher top line (revenue) and bottom line (earnings) estimates.

When volatility strikes – take a moment for self-reflection

When it comes to risk, there are two questions to ask yourself.

- What is your ability to take risk?

- What is your willingness to take risk?

As an Investment manager, I can only quantify and articulate your ability to take risk. This is quantifiable and objective.

When it comes to willingness, this is subjective. Money is very emotional, and willingness to take risk is a deep emotional bias that I can only adapt to.

The reality is, one does not truly know their appetite for risk until volatility strikes. How could you know your ok with high risk until you’ve gone through a 2008 like decline?

Any time we have a rapid decline like we did in April, it’s a good exercise to revisit the episode of volatility and be honest with yourself.

So…

When markets were down -20%, what was your gut feeling?

Not your feeling now with hindsight bias…Nobody is ever scared after the market recovers, just like nobody thought COVID was a big deal March 2020, and nobody thought roller blades were ever cool.

What was your gut feeling a six weeks ago when markets sold off -10% in three days?

- Did you lose any sleep? Did you wonder how will you ever recover?

- Good news – if you stuck it out, or even better added to your stock positions – you’re right back where you started plus some.

- Use this opportunity to allocate your portfolio to a more defensive position to avoid these feelings in the future. No harm, no foul.

- I say this sincerely - do not be embarrassed or resentful of these feelings. Nobody truly knows their risk tolerance until you see the volatility on a statement with your name on it. Loss Aversion is a behavioural bias that runs deep. A fraction of my clients and peers called me to say they wanted to buy into the weakness.

- Good news – if you stuck it out, or even better added to your stock positions – you’re right back where you started plus some.

Looking back, I hope this reinforces what the Top & Tail has said over and over again.

Stay diversified, stay balanced, and take what the market gives you.

The S&P 500 futures are hovering around -0% ytd return this morning. With the US dollar down -3.4% since Jan. 1, that’s an implied return of -3.4% for indexers. None of our portfolios have underperformed that mark.

Humility – I asked you for it, so I’ll shed some of my own. If you asked me to outperform the S&P 500 net of fees AND I was limited to the same 500 companies as the index, I’d say you’re better off elsewhere.

Yes, some mutual funds and portfolio managers can claim they beat the market, but very few. There’s a lot of survivorship bias there, as the funds that can’t, don’t tend to stick around for long.

If you were to ask me to outperform the S&P 500 net of fees, but I get the benefit of asset allocation, and can invest across any asset class, now that’s our bread and butter. The more time you give me, the more conviction I have.

Granted, if you’re planning to rely on investment income in retirement, I have a bristol board for why attempting to outperform the S&P 500 is obscene.

- Hint: Let’s not forget the story of the 6 foot man who drowned crossing a river that averaged a 5.5 foot depth – you have to survive the deepest depths of average.

- Aka - I never want to see the look of a retiree while the market is down -50% but I’m claiming outperformance because their nest egg is only down -40%...

The reason our portfolios have outperformed is because we harvested profits as markets were greedy, and we bought into weakness while markets were fearful.

Portfolio Update - Balanced Model (Paper Portfolio)

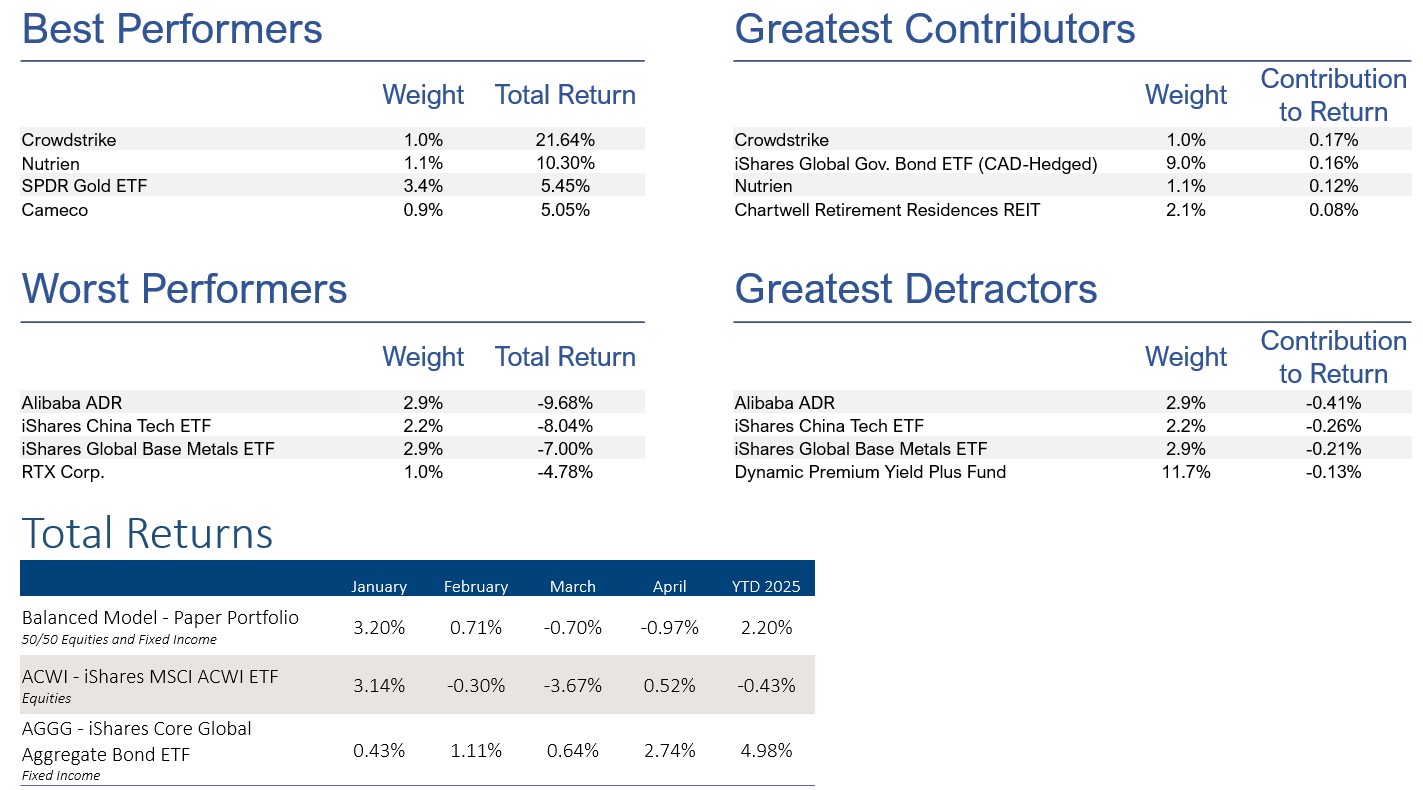

Balanced Model down -0.97% in April to $1,022,005, +2.2% YTD

Above are our numbers as of May 1st. We’re closer to month end, but having the numbers on record is important if we wanted to ever go back and revisit our decisions.

No changes were made to the portfolio other than our monthly rebalancing to target weights.

- Apologies for the delay on our monthly model update.

- The tax deadline is a perennially busy time.

- Sprinkle in market vol and unpredictable nature of life and here we are.

- The value of providing our balanced model update is updates to our positions.

- In this industry, pointing at a chart of what we did historically is nice, and can rhyme with the future, but not all that helpful.

- Don’t tell me what you did, if you want to provide value, tell me what you’re doing now”.

- This is what I think when watching Bloomberg or sitting through any investor presentation.

- I try to be true to myself, and want that reflected in our balanced model updates

- One hiccup we ran into in April, was almost the entire amount of volatility we experienced was within our monthly reporting.

- In real time, we were rebalancing client positions.

- Our Paper portfolio rule has been to only update on a monthly basis.

- This can be for better or for worse, however I am considering mid moth updates on volatility.

- The issue I need to resolve is how to provide those updates to readers and avoid any misconception I’m backdating picks.

- This one is in the parking lot for now.

As always, If you have any questions or comments – let me know!

Much love to you and yours,

Lucas

About the Paper Portfolio – Balanced Model

The Paper Portfolio is a model and NOT a real investment account. For any readers interested in a full list of positions and/or Monthly Performance, they are available upon request. No individual should act on this as investment advice, please consult a professional. The Paper Portfolio does not take into consideration taxes, or income requirements.