Chapter 52: Debasing the US Dollar Debasement Thesis

Dear Clients,

In our final investment journal of the year, we would like to touch again on the performance characteristics of the fourth quarter. That we are in a secular, disinflationary market propelled by durable company advantages – pricing power, network effects, and scale advantages – was on full display for all investors to witness in the quarter. As a result, S&P500 earnings continues to be revised higher (consensus now at 15% earnings per share growth, up from 7% growth projected as of September 30th), approaching our 2025 year-end target of $300/share. While earnings continues its secular expansion driving our investment portfolio, the performance of the US dollar has given some investors pause, leading to some misguided fears about currency debasement. We would like to help dispel these fears in this installment.

First, we would like to acknowledge the market turbulence caused by tariff policy. This was evidenced during Liberation Day (April 2nd); however, the ensuing recovery was swift, in line with our investment thesis that the tariffs did not have time to erode the resilient, hard economic data on which earnings valuations are predicated. We believe the same thesis is true about the US dollar. Comporting with Bloomberg’s analysis, the performance of the trade-weighted US Dollar (the DXY) tracks trade policy in a similar manner as it did from 2017-2018, when tariffs were first contemplated and enacted. Then, the DXY swiftly recovered in the remainder of the President’s first presidential term. Combined with a gradually slowing labour market, resilient earnings data as described above, and trade wars turning into trade deals (see Chapter 48: Separating Signal from Noise in the Tariff Uncertainties), we project the path of the dollar will follow its historical patterning (Exhibit 1).

Exhibit 1: Tracking of the US dollar between two trade regimes

![]() Source: Bloomberg September 22nd, 2025 Macro View by Brendan Fagan: Resilient Growth Boosts the Case for Dollar Strength

Source: Bloomberg September 22nd, 2025 Macro View by Brendan Fagan: Resilient Growth Boosts the Case for Dollar Strength

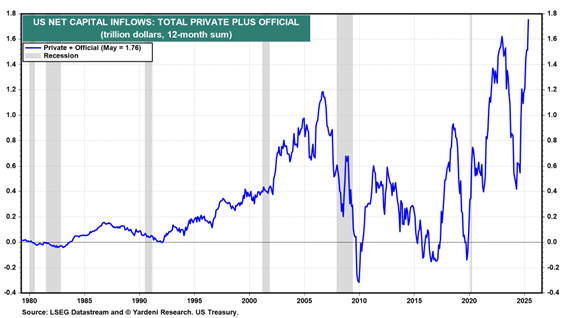

Furthermore, we would like to dissect the ownership profile of the US dollar, in terms of capital flows which are gathering steam. As Dr. Ed Yardeni shows in Exhibit 2, because the “US has the most diversified capital markets in the world,” over the past 12 months from May 2024 to May 2025, capital inflows by private and official foreign accounts totaled 1.76 trillion US dollars, a record high. This points to not just steady demand for US assets, but surging interest. As a result, our investment practice is disinclined to favour non-annuity producing hard assets such as gold, or digital assets such as cryptocurrencies, even as a hedge, as their intrinsic values are unknowable; the best hedge is to own the most productive companies in the world and allow their compounding growth characteristics to create real wealth.

Exhibit 2: US Net Capital Inflows

Source: Yardeni Research August 14 2025 “In Defense of the US Dollar”

Finally, investors in our practice will know that we have been making a case for the return of Bond Vigilante, leading to structurally higher long-term bond yields, as investors ask for a higher premium on deficit-financed fiscal expenditure. If this investment thesis comes to fruition, along with our base case of a non-recession, the US dollar stands to benefit from further foreign capital inflows, as the higher treasury rates at the long-end appeal to a broader investor base.

In conclusion, fears of currency debasement are likely to create more noise than signal. The resilient growth characteristics of US earnings growth, the limited impact of trade policy on hard economic data, and attractive long-end yields held up by the Bond Vigilante will likely drive the US dollar to a recovery, continuing to cement its status as the world’s reserve currency. Peering into 2026, we continue to favour long-lived, high quality annuity producers, with an eye on both attractive growth and value characteristics that can outperform through a full market cycle.

We are wishing clients a wonderful holiday season ahead.

Warmest regards,

Grace Wang | Senior Portfolio Manager

Samuel Jang, CFA | Investment Associate

Leslie Mah | Associate Advisor

Katherine Yang | Associate

Steven Bos | Administrative Assistant

Grace Wang Portfolio Management Practice of RBC Dominion Securities

Email: gracewangpractice@rbc.com

Phone: 604-257-2483

745 Thurlow Street, 20th Floor

Vancouver BC, V6E 0C5

gracewangpractice.com

This information is not investment advice and should be used only in conjunction with a discussion with your RBC Dominion Securities Inc. Investment Advisor. This will ensure that your own circumstances have been considered properly and that action is taken on the latest available information. The information contained herein has been obtained from sources believed to be reliable at the time obtained but neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers can guarantee its accuracy or completeness. This report is not and under no circumstances is to be construed as an offer to sell or the solicitation of an offer to buy any securities. This report is furnished on the basis and understanding that neither RBC Dominion Securities Inc. nor its employees, agents, or information suppliers is to be under any responsibility or liability whatsoever in respect thereof. The inventories of RBC Dominion Securities Inc. may from time to time include securities mentioned herein. RBC Dominion Securities Inc.* and Royal Bank of Canada are separate corporate entities which are affiliated. *Member-Canadian Investor Protection Fund. RBC Dominion Securities Inc. is a member company of RBC Wealth Management, a business segment of Royal Bank of Canada. ®/ TM Trademark(s) of Royal Bank of Canada. Used under license. © 2025 RBC Dominion Securities Inc. All rights reserved.