It is hard to believe, but 2023 is coming to an end. We hope everyone had a wonderful holiday season with their loved ones and are looking forward to ringing in the New Year! Below we provide a review of 2023 from a market perspective and look ahead to what 2024 will bring.

2023 in Review

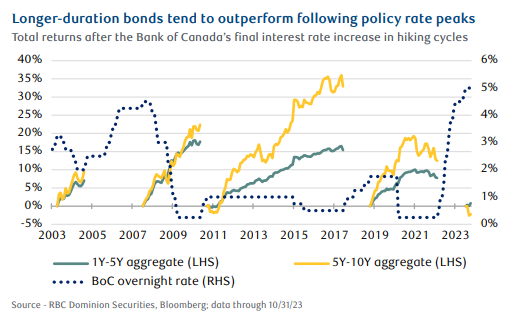

Both global equity and bond markets are signing off the year on a strong note. While 2023 has had it's ups and downs, it has proven to be a year of economic and market resilience. Growth has slowed but there have been positive surprises, especially in the U.S. where the consumer has been strong. The inflation backdrop has meaningfully improved, transitioning from an accelerating rate last year to a decelerating one currently. Lower inflation and volatility have been welcome developments in the bond market, where returns have been more normal and favourable compared to last year. In the portfolios we have opportunistically extended bond duration while overweighting the fixed income asset class relative to cash to take advantage of higher yields.

Equities have also seen reasonable returns, with some markets performing better than others. The gain in US equities was primarily driven by large cap technology stocks - particularly the "magnificent 7" - which pushed the tech heavy NASDAQ index to achieve incredible returns. It is worth noting that the breadth of stock market gains improved towards year’s end and many investors chasing returns in these tech heavy stocks missed out on undervalued stocks participating in the recent rally. This is why a consistent, diversified approach to managing the equity portfolio is prudent.

What's in store for the New Year?

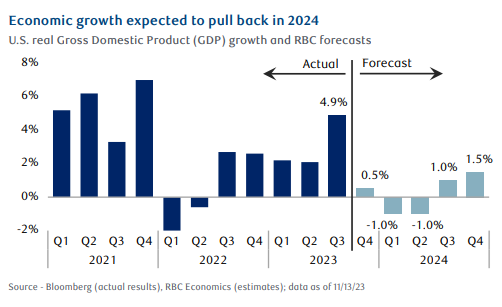

Our firm’s investment team believes the combination of high rates and restrictive lending standards is a recipe for declining growth, particularly in regions like Canada and Europe where growth figures have been underwhelming. There is the chance the U.S. and other regions avoid a recession, and instead experience a “soft landing”, where growth slows but does not outright decline. See below our expectations for US GDP in 2024.

In a soft landing scenario, earnings would not decline, but would keep growing, more modestly, and help the equity market generate further gains. The range of potential outcomes for equities over the next year remains wider than normal. The good news is that even if a recession materializes - the market typically bounces back and establishes a new uptrend partway through recession periods which gives us a buying opportunity to add market exposure. On the fixed income side, bond yields are significantly higher than they have been in some time which has re-established their role in portfolios. Bonds of high-quality issuers such as governments and highly rated companies now offer reasonably attractive levels of income combined with the potential to shield portfolios to some degree from any resurgence in volatility should a recessionary scenario develop.

For additional reading material - RBC Wealth Management has released the Global Insight - 2024 Outlook. This report highlights the firm's outlook for equities and fixed income as well as key themes for the year ahead.

Our approach to managing portfolios in 2024 will be consistent with this past year: treading more cautiously than normal given the range of potential outcomes discussed above. We expect to remain patient with the equity allocations in our portfolios, believing that the window of vulnerability that lies ahead will prove to be temporary. On the fixed income front, we continue to take advantage of the higher yields that are available.