U.S. presidential elections have increasingly become focal points of national and global attention, sparking debates and speculation about their potential impact on financial markets. However, a thorough examination reveals that the relationship between elections and market performance is nuanced, influenced by a myriad of factors beyond mere political outcomes. By analyzing historical trends, understanding the divergent priorities of Wall Street and Main Street, and recognizing the primacy of economic fundamentals and innovation, investors can gain a deeper understanding of how elections intersect with financial markets.

Historical Context: Market Performance and Political Control

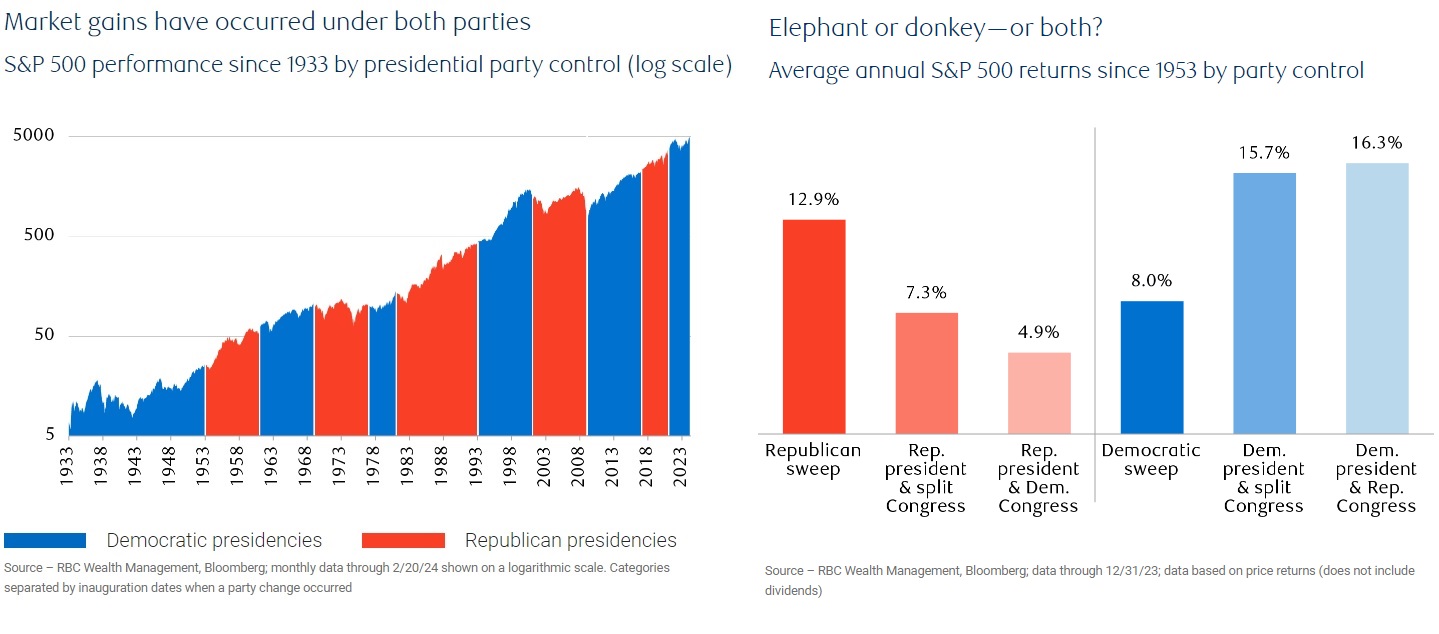

Historical data demonstrates that the market has exhibited resilience under both Republican and Democratic presidencies, experiencing periods of growth despite political volatility. While there have been instances of market fluctuations during specific administrations, such as the Nixon-Ford and Carter years, the overarching trend reveals consistent gains over time, irrespective of party affiliations in power. Notably, since 1953, the S&P 500 has shown robust returns under different scenarios of party control, highlighting the market's ability to thrive under diverse political landscapes.

Divergence of Priorities: Wall Street vs. Main Street

While social issues and campaign rhetoric may dominate public discourse, the focus of financial markets tends to center on economic policies with direct implications for corporate profitability. Issues such as taxation, trade policies, and geopolitical tensions take precedence on Wall Street, as they directly influence investor sentiment and market dynamics. Social issues, while significant in shaping political outcomes, have limited immediate impact on corporate profits, which remain the primary driver of stock market performance.

Economic Fundamentals and Innovation: Prime Drivers of Market Performance

Beyond the realm of politics, economic fundamentals and innovation likely more central to determining market performance. Federal Reserve policies, in particular, have a significant impact on economic conditions, inflation rates, and credit availability, thereby influencing corporate profitability and investor behavior. Moreover, technological innovation across various sectors has driven long-term growth and market expansion. From the advent of personal computers to the rise of artificial intelligence, innovation has consistently propelled profit growth and stock prices across industries. Thus, while political developments may garner attention in the short term, it is the underlying economic fundamentals and innovation trends that sustain long-term market growth.

Interpreting Historical Election Data: Nuances and Caveats

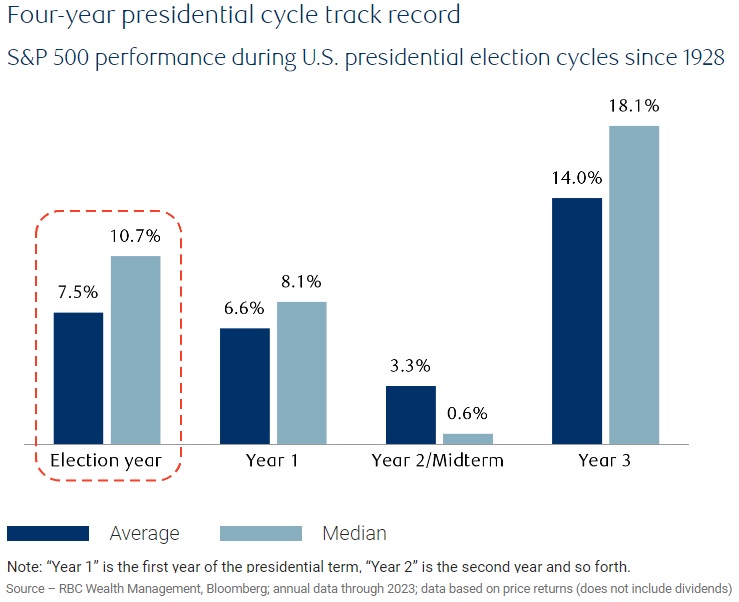

While historical election data offer valuable insights into market behavior, they come with caveats and limitations. Patterns observed over decades, such as the market's strength in certain years of the presidential cycle, provide useful context but should not be viewed as deterministic predictors of future outcomes. Outlier events, such as the contested 2000 election, underscore the complex interplay of factors influencing market performance. As such, investors should approach historical data with caution, recognizing that market dynamics are shaped by a multitude of variables beyond political cycles.

In conclusion, while U.S. elections undoubtedly capture public attention and evoke strong sentiments, their direct impact on financial markets is multifaceted. By understanding historical trends, recognizing the differing priorities of Wall Street and Main Street, and appreciating the primacy of economic fundamentals and innovation, investors can navigate election cycles with greater clarity and resilience. Rather than being swayed by short-term political rhetoric, informed investors should refocus on the enduring drivers of market performance, ensuring a more strategic approach to financial decision-making amidst political uncertainty.