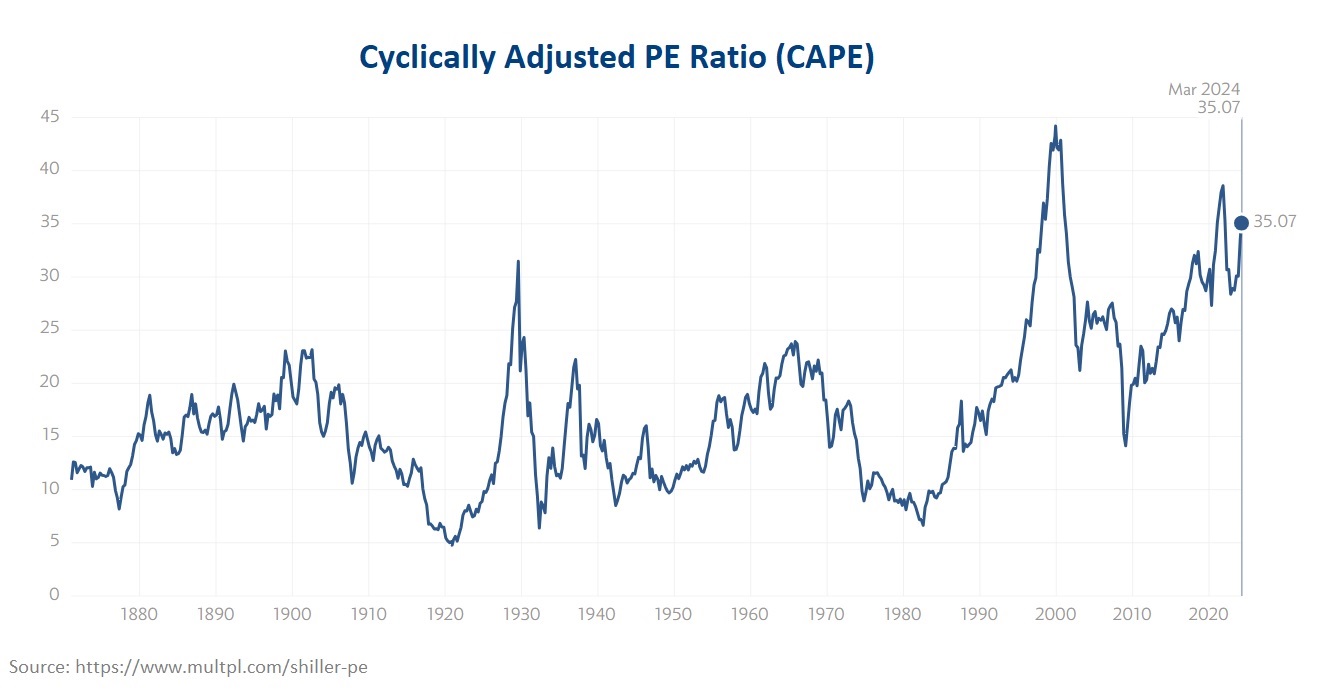

We talk to a lot of investors. In time, conversations eventually lead to the common gripe that US stocks appear expensive. Without fail, we hear this comment from investors of all stripes including, clients, professionals, and even within business school classrooms; And technically, they are right. A look at the CAPE Ratio (aka. Shiller PE), clearly shows that valuations are at lofty levels. The current reading of 35X is meaningfully higher than the long term average of 17.10X and the median of 15.97X. For those unfamiliar with this valuation metric, the CAPE ratio compares the price of S&P500 index to the average ten years of earnings, adjusted for inflation.

Prior to the dotcom bubble, there has only been one other period where stocks traded at this 25X. It occurred during the ‘roaring 20s’, which many recognize as a boom-bust cycle that culminated with a market crash and Great Depression. Unnervingly, over the last two decades, the CAPE ratio has traded at an average of 26X.

What could be driving this premium? Perhaps it is the result of an era of ultra-low interest rates that encouraged investors to pay higher for corporate earnings. Perhaps, the CAPE is reflecting the paradigm shift experienced by an economy that is increasingly dominated by technology. Afterall, a market weighted index should rightfully mirror the valuations of the most influential companies of a given investment age. Or perhaps there are other things going on.

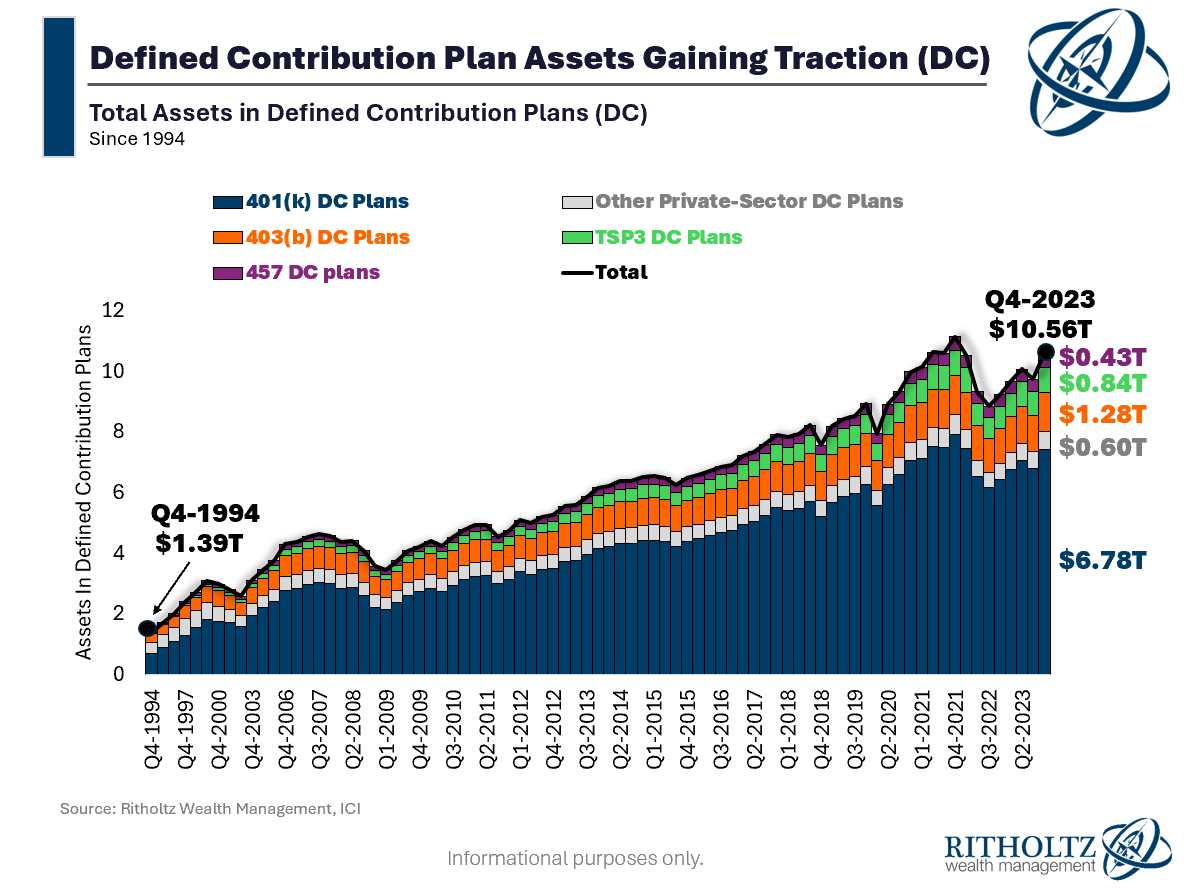

In our opinion, the premium attached to markets is related to the track record of resilience from the stock market. This is perhaps most apparent, but not always appreciated, at all-time highs. We believe this market resilience has influenced the wealth accumulation options provided by employers, and has changed our investing behavior. Over the last couple decades, employers (with society’s acceptance) have decided that they were going to hand the responsibility of funding one’s retirement to the employee. The common vehicle provided was the Defined Contribution Plan (DC) and as the chart below shows, the US has seen a proliferation in DC Plan assets from $1.39T (Q4-1994) to 10.56T (Q4-2023).

Why is this important? To put it bluntly, with every paycheck, a swell of money is being poured into the market. We would also argue that the nature of these contributions are mostly agnostic to the market noise of the day. Many readers who participate in DC plans through their employer can likely relate. Not only do participants automatically contribute to their DC plans, but asset mix changes occur seldomly. This behavior likely impacts the premium that is attributed to equities. As investment commentator ‘Zach Morris’, intelligently opined:

“When you contribute money to your [DC Plan] every month, what are you really doing? Are you saving? Or are you investing? I would contend most people are saving. They have no interest in risking what they’ve already earned, but if they don’t, they are certain to lose it to inflation and debasement. If people are saving their wealth in the S&P 500 instead of money, that means the equity market has attained a monetary premium."

The frequency and indiscriminate allocation to equites certainly impacts the price of stocks over time. It also contributes to the feedback loop in the ability of the market to recover and the investor perception of a reliable or eventual recovery. All together, this can contribute to the premium in valuations we have seen over the last 20 years.

Even with a constant inflow of cash to be invested, stocks are not immune to pullbacks, corrections, or bear markets. Investing is ultimately a compounding process that faces consolidation phases and uses time as its pixie dust. We cannot say with certainty that these high valuations will last forever, however, at the same time, we should be open to the idea that long term averages and median valuations may not be the most appropriate benchmark. The “reversion to normal” could be at a new elevated level that more accurately reflects the behavioral and wealth accumulation paradigm that we live in.