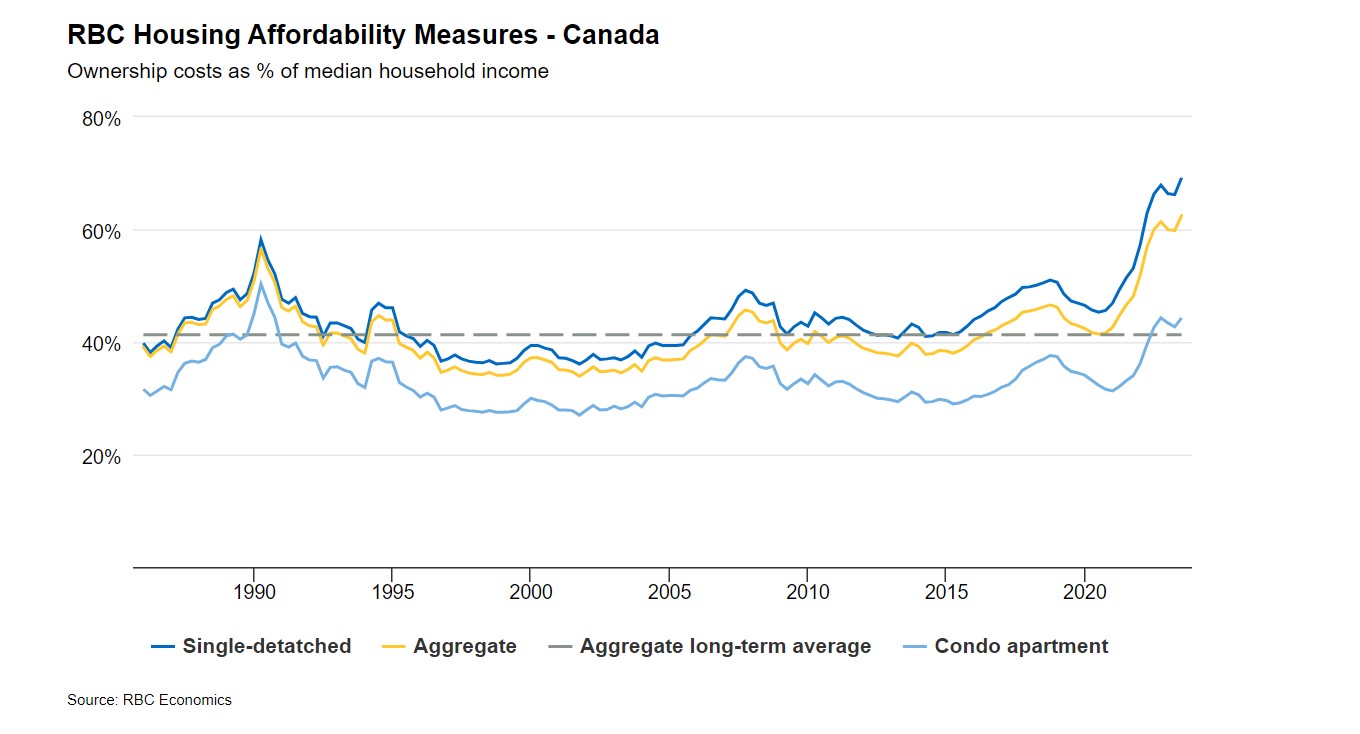

Despite the recent pullback in the real estate market, a lot of first-time home buyers still feel that housing ownership is still out of reach.

The recent RBC Housing Affordability Report dated Dec 20, 2023 confirms that high interest rates and prices continue to make it less affordable to own a home in Canada. Fortunately, the Affordability report has noted a silver lining in the horizon. The weaker housing market, since the summer of 2023, has led to price declines in parts of Canada. With the increased expectations that the next move from the Bank of Canada will be a rate cut, the cost of home ownership could be reduced. Although the RBC report cautions that any improvement in affordability likely to be modest, lower mortgage rates will help home buyers should price appreciation remain muted.

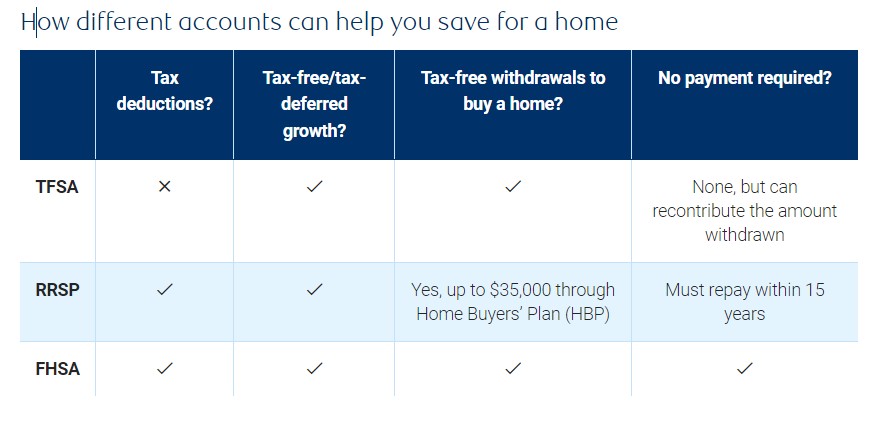

Beyond the expected lower interest rates, further assistance has come from the Federal government. In 2022, the Federal budget proposed to create a new registered account that would help first-time homebuyers save for a down payment. This account is called The First Home Savings Account (FHSA). Contributions will be tax deductible (similar to RSP contribution) and these savings can be invested and withdrawn tax free (similar to withdrawals in TFSA). Withdrawals are tax free when made to purchase a home. This blog will further cover the benefits and other considerations of the FHSA.

Who may open the FHSA?

- First time home buyers (meaning, you and/or your spouse or common-law partner have not owned a home that you lived in the calendar year in which you open the account or at any time in the preceding four calendar years)

- at least 18 in age (and no less than the age of majority in your province)

- have a Social Insurance Number (SIN)

What is the lifetime contribution limit?

The lifetime contribution limit is $40,000. The annual limit is $8,000. Unused contribution room can be carried over to the next year, up to a maximum of $8,000.

What is the account time limit?

You must use the funds in your FHSA by December 31 of the 15th year after opening your first FHSA account or the year you turn 71, whichever comes first. If the funds are not used to buy your first home, you may choose to rollover to your Registered Retirement Savings Plan (RRSP) without impacting your RRSP contribution room, or to your Registered Retirement Income Fund (RRIF); otherwise, your withdrawal will be taxed.

May I use Home Buyers’ Plan (HBP) and take advantage of the FHSA?

Both plans complement each other and may use concurrently.

Summary

Below are 3 common ways and their characteristics to save for your first home. You may opt to use any combination in purchasing your dream home. As everyone’s financial situation is different, consult with us to assess what strategies would be suitable based on your unique circumstances.