Own Your Future – Calm, Clear, and Composed amid Chaos

Jonathan Greenwald

It’s easy to forget that volatility is normal when markets are declining and headlines are loud. In times like these, investors often ask if what we’re experiencing is unusual. The answer based on decades of market history is no. What feels like chaos in the moment is often part of the market’s regular rhythm.

Short-term drawdowns are not rare events; they are a consistent part of long-term investing. Rather than trying to avoid them, successful investors recognize them as opportunities to stay disciplined and focused.

Drawdowns Happen All the Time

Let’s look at the numbers.

Since 1980, the S&P 500 has experienced an intra-year decline of 5% or more in nearly every calendar year, averaging about 4.6 instances annually. These temporary pullbacks are routine and should be expected as part of market participation.

Corrections of 10% or more occur, on average, once every 1.2 years. While these larger drops can feel unsettling, they are also typical. They provide moments for portfolios to reset, valuations to normalize, and long-term opportunities to emerge.

Even the more serious declines—bear markets, defined as drops of 20% or more—are not as uncommon as one would think. Since 1950, they’ve happened 13 times, or about once every 5.8 years. Despite their frequency, markets have recovered from every single one. Long-term investors who held through those periods ultimately benefited from the rebound and subsequent growth.

https://awealthofcommonsense.com

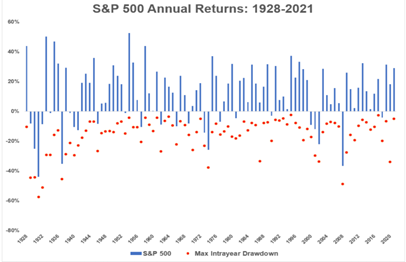

The average intra-year drawdown for the S&P 500 going back to 1928 is -16.3%

The chart above compares the maximum intra-year drawdowns (red dots) of the S&P 500 to its full-year returns (blue bars), illustrating how markets often recover from mid-year declines. Despite frequent pullbacks, the index ends most years in positive territory—highlighting the importance of staying invested through volatility.

Short-term drawdowns test our patience. But they also reaffirm the value of long-term discipline. Reacting emotionally to market swings often results in locking in losses and missing out on the recovery that tends to follow.

Rather than attempting to avoid volatility, which is impossible, we focus on planning around it. That means building portfolios that are prepared for ups and downs, maintaining appropriate cash reserves for near-term needs, and ensuring that the mix of investments reflects each client’s long-term goals.

During pullbacks, we also look for ways to strengthen your portfolio by upgrading quality or adding to positions at lower prices. These actions aren’t reactive—they’re strategic, and they align with our belief that volatility can create opportunity.

Focus on What You Can Control

Markets will always move in cycles. Drawdowns of 5%, 10%, and even 20% will continue to happen, sometimes more frequently than we’d like. But they don’t derail the long-term trajectory of a well-constructed plan.

Instead of focusing on the short-term noise, we encourage you to stay grounded in your goals, revisit your time horizon, and rely on the structure we’ve built together. If you’re feeling uncertain, now is a good time to review your plan, not abandon it.