In the world of investing, one of the most important truths is the recognition of uncertainty. Markets are inherently unpredictable, and this uncertainty often fuels both fear and opportunity. Understanding and embracing this concept can be a cornerstone of a successful investment strategy.

The Nature of Market Uncertainty

The market operates in cycles, influenced by many factors from economic indicators to geopolitical events. While it is tempting to seek patterns or predict outcomes, the reality is that certainty in market movements is an illusion. Historical data shows that markets do not move linearly but rather oscillate through periods of growth and contraction.

The Myth of Predictability

A common mistake investors make is assuming that past performance can reliably predict future results. This belief can lead to overconfidence and, consequently, poor decision-making. The key is not to eliminate uncertainty—an impossible task—but to develop strategies that can thrive despite it.

The Role of Valuations

Market valuations often reflect investor sentiment, fluctuating based on perceived certainty or uncertainty. During times of optimism, valuations can soar, sometimes beyond what is fundamentally justified. Conversely, during periods of pessimism, valuations can plummet, presenting opportunities for the discerning investor.

The Uncertainty of Macroeconomics

Macroeconomic factors, such as interest rates, inflation, and GDP growth, add another layer of complexity to market uncertainty. Various elements, including government policies, global trade dynamics, and unforeseen events like natural disasters or pandemics, influence these variables. Despite the best efforts of economists to predict and control these factors, their inherently unpredictable nature means that macroeconomic conditions can shift rapidly and unexpectedly. This unpredictability can lead to sudden market swings, affecting everything from stock prices to consumer confidence. For investors, understanding that macroeconomic forecasts are, at best, educated guesses can reinforce the importance of flexibility and adaptability in their investment strategies. By preparing for a range of economic scenarios rather than betting on a single outcome, investors can better navigate the turbulent waters of the global economy.

Psychological Resilience

Investing under uncertainty requires a strong psychological framework. Emotional decision-making can lead to panic selling or impulsive buying, both of which can be detrimental. Instead, maintaining discipline and sticking to a well-thought-out plan is crucial.

The Benefits of Uncertainty

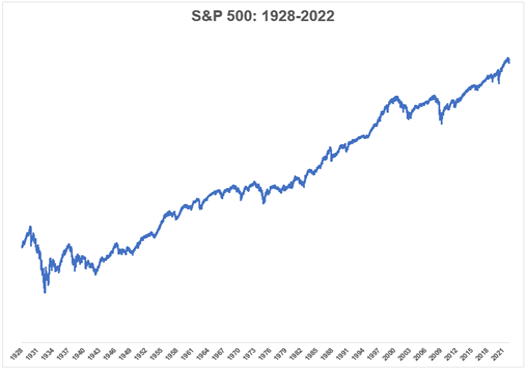

Interestingly, uncertainty can also present significant opportunities. When markets are volatile and prices are depressed, astute investors can acquire good businesses at discounted prices. This contrarian approach can lead to substantial gains once the inevitable long-term trajectory of the stock market takes hold. This is evidenced by the long term stock market chart below.

Uncertainty is an intrinsic part of investing. By acknowledging this and adopting strategies that embrace it, investors can not only protect their portfolios but also capitalize on the opportunities it presents.

Quite often when speaking with clients we reiterate what Benjamin Graham (Warren Buffet’s mentor) said about markets – “In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

The focus should always be on sound, long-term investment principles rather than attempting to outguess the market. In doing so, investors can build resilient portfolios capable of withstanding the inevitable ebbs and flows of the market.