What Does the Collapse of Cryptocurrencies Mean for Investors?

What Does the Collapse of Cryptocurrencies Mean for Investors?

When you strip everything away, there is really only one factor involved in

many of the important decisions we make. This factor is not something

tangible, as we might think it is. This factor is an emotion, which most

economists and experts seem not to pay much attention to. Without confidence

that learning might enable us to get a good career, people may not bother to

pursue an education. Many may not pursue a friendship or marriage relationship

without the confidence that this would be rewarding. Who would take out a

mortgage to buy a home if they did not have confidence that it would work out

well in the end? Who would start a business or invest in a business if they did not

think it would be successful? Confidence is a critical component of many of our

actions.

Booms, busts, economic growth and recessions are caused by major swings in

confidence. When confidence wanes, the basic or lowest value of an asset is

revealed. During the Financial Crisis, Royal Bank shares fell from more than $50

down to $25 because of all of the problems U.S. banks were going through. RBC

kept earning $1 billion a quarter throughout this difficult time and continued

paying the dividends. Nonetheless, some investors lost confidence that RBC

would be spared from massive loan losses that U.S. counterparts were

experiencing. In the end, RBC did not have any significant losses during that time.

However, that did not stop the share price from falling. The earning power and

dividend payments by RBC ended up providing confidence for investors to

support the share valuation when it fell to $25.00 in early 2009 when fear was at

its highest level. By early this year, RBC shares had almost tripled to $147 and the

dividend has almost tripled as well. All of the volatility in RBC shares during the

Financial Crisis was based on levels of confidence, not on any developments

within the company.

Various global currencies are stable in their home country. However, the value

of these currencies can fluctuate wildly compared to value of other global

currencies. Decades ago, the value of some currencies were also tied to the value

of gold held by the governments of that country. In recent decades, the strength of

an economy and the power of taxation provide the support for each global

currency.

Frustrations about higher levels of government debt, massive printing of

money and oppressive financial regulations were some of the factors that led to

the development of the Bitcoin network in January 2009. Some also wanted to

make financial transactions that could not be tracked by the authorities around the

world.

Bitcoin is a digital currency instead of a paper currency. A digital currency, or

cryptocurrency, is a digital asset created by using encryption algorithms that

enable people to buy, sell and trade them securely. This enables digital currencies

to circulate without a monetary authority such as a central bank like the Bank of

Canada or the U.S. Federal Reserve Board. Instead of sending money to others

around the world, payments in a cryptocurrency exists purely as a digital entry on

an online database.

There has been one basic very important question since the inception of Bitcoin

and the other digital currencies and tokens that followed. What provides the

basis of support for these currencies when confidence is shaken? There is no

tangible support. The only support is what investors believe the value to be in

their minds. It is like the value of a priceless painting. The frame, and the canvas

are of minimal value. The value of the painting is in the eye of the beholder.

Gold is valued as much more than silver. Gold is just an industrial metal, but it

has a value based on how rare it is and how hard it is to find. Decades ago, gold

used to trade close to 10 times the value of silver. Today, silver trades at U$23

and ounce while gold trades at US$1,784 an ounce, or 77 times the value of silver.

Does this mean that gold is expensive or is silver cheap? Who knows? Gold and

silver pay no dividends but have been the oldest currencies known to man. For

your information, gold traded at US$850 an ounce 42 years ago. It has only

doubled in value over that period while the S&P 500 has risen by more than 100

times. This shows us how useful precious metals are as an investment.

Whenever I hear of Bitcoin, it always reminds me of the fairy tale called, The

Emperor’s New Clothes, that I read to my children and grandchildren. The story is

about a new tailor who walked into a town and told people that only the wise

could see the clothes that he made. No one wanted to think they were not wise so

no one was willing to admit that they could not see the clothes people were

wearing. One day, the king was walking naked in a parade, thinking he was

wearing wonderful, expensive clothing when a young child asked why he was

walking down the road with no clothes on. At that time, everyone realized they

had been totally deceived into believing what the tailor had told them. The clothes

did not seem real to them but no one wanted to trust what their common sense was

telling them. Peer pressure and the crowd mentality got the better of them.

Up to this point, in spite of what many have said, I just have not been able to

find anything that supports the value for cryptocurrencies and tokens. This is why

there has never been a single investment in anything connected to a

cryptocurrency in any of my client’s accounts.

Falling stock, bond and commodity prices this year have been a sign of much

lower confidence. Consequently, there has been a move from riskier assets to

safer assets. This prompted investors in digital currencies to want to sell in order

to move some of their cryptocurrencies into cash. This is when the true support

for digital currencies was revealed. “Accidents” happen during bear markets since

bear markets expose assets that are vulnerable.

FTX seemed to be the largest and most legitimate cryptocurrency exchange in

the world. Many investors stored their digital currencies there so that they could

trade them easily. In early November, there were concerns about inappropriate

handling of currencies at FTX. This resulted in a massive withdrawal of assets at

FTX, causing it to declare bankruptcy. The value of FTX fell to nothing, wiping

out $32 billion of value. Cryptocurrencies lost a staggering $200 billion in value

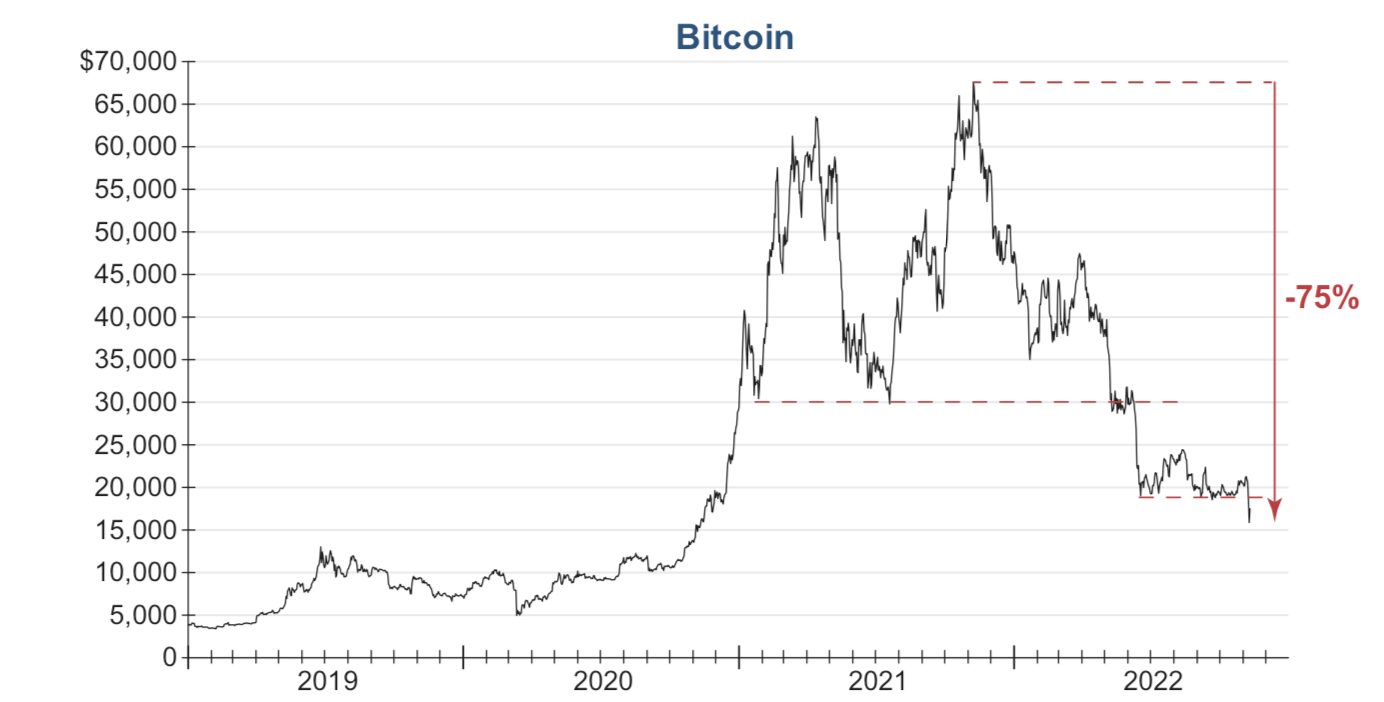

in the days after FTX went bankrupt. Bitcoin, the gorilla of all digital currencies,

fell from almost $70,000 early this year to $19,000. (See the chart below from

InvesTech)

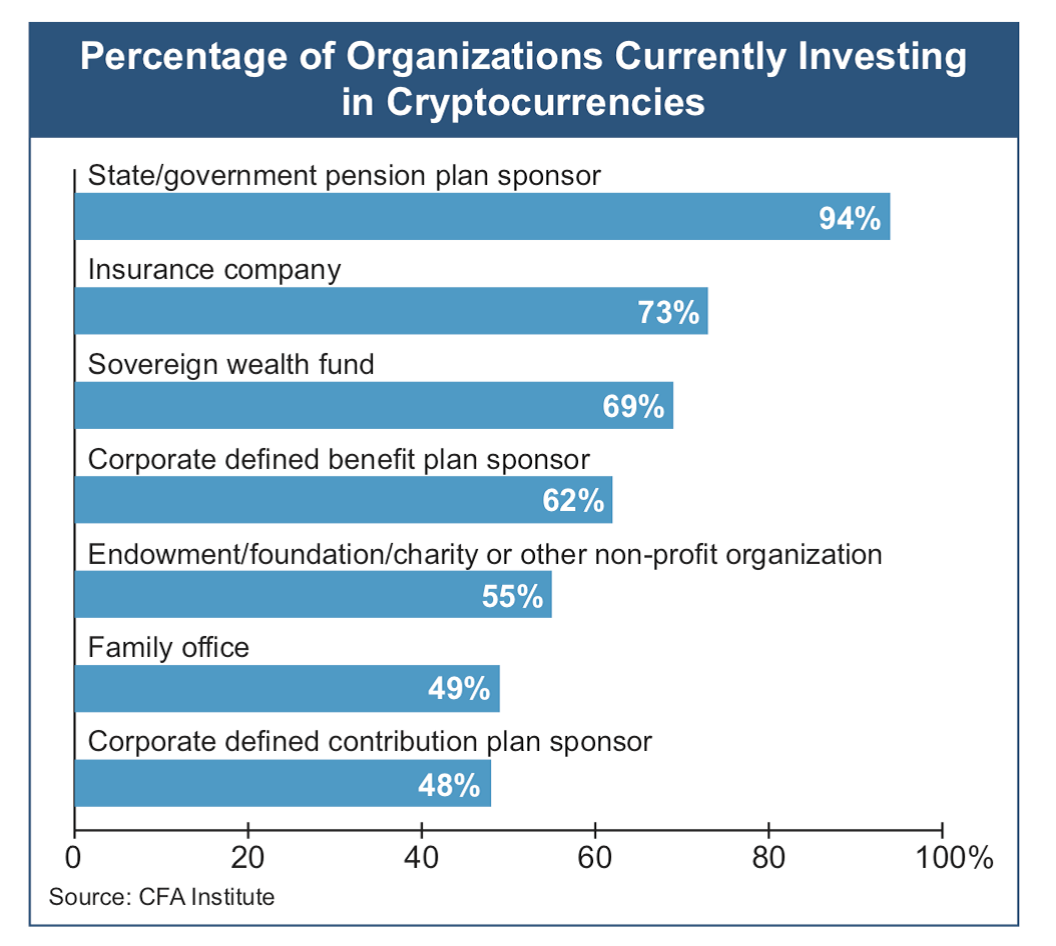

In spite of the concerns, cryptocurrencies had been gaining the acceptance of

both individual and institutional investors over the years. Studies show that 33%

of individual investor and 44% of professional or institutional investors recently

owned some investments in digital currencies. For example, on November 2,

2022, Fortune magazine reported that a Canadian Teachers Pension Plan had lost

$92 million in the collapse of FTX. Please see a list of all of the U.S.

organizations that have been investing in cryptocurrencies. (List provided by

InvesTech)

This shows that many professional money managers will have some difficult

shareholder questions to answer as the losses that have recently been sustained

appear on the books. Last month we saw that “the emperor had no clothes.”

Crypto currencies are likely here to stay. However, digital currencies are likely

going to continue to be volatile and risky until there are some sort of regulations

and significant financial support system in place. It is hard to imagine that any

company or digital currency can have the resources to provide support similar to

what a government can provide as a backstop for it’s currency.

Major stock market declines and/or recessions expose companies or sectors that

have used too much leverage and taken too much risk. Bear markets have often

come to an end when there is a major bankruptcy or collapse that creates fear

which exhausts the selling. A major purpose of a bear market is to eliminate

excesses that were created during the good times when optimism was high. What

has happened to cryptocurrencies and FTX in the last month is another classic

example of this.

It is another sign that the bear market is over because it has accomplished its

purpose. Hopefully the money that has been diverted into digital currencies in

recent years will now go into investments that are more productive and that this

spurs the innovation that is such a major factor during growth cycles like this.

Speaking about growth, please see below I took of a huge tree in Kauai on the

next page.

I am not sure why this truck was parked in front of this tree like this. I cannot

imagine them trying to move it. However, it is in a perfect place to see the actual

size of this tree. It certainly is not suitable for a Christmas tree!

I don't think anyone ever expected what started as a small tree to eventually

become as large as this over the years! It is an example of how innovation and

change can create much more growth in the economy and stock prices than we

can imagine, over time. This growth did not happen in an instant, a week or a

year. Have a good weekend!