Indicators Give Buy Signals, Suggesting Risk is as Low as it Gets, and Potential Gain is as High as it Gets.

Indicators Give Buy Signals, Suggesting Risk is as Low as it Gets, and Potential Gain is as High as it Gets.

When talking about how to be a successful investor, Warren Buffett said,

“We don't have to be smarter than the rest. We have to be more disciplined than

the rest.” He also said, “The most important quality for an investor is

temperament, not intellect.” He is saying that it is critical not to have

unreasonable changes in mood and not to follow the mood of the crowd.

Have you noticed that the education of investment experts is rarely mentioned?

That is because it is not an important factor for investing. The years of experience

and assets under management are the factors that the investment industry respects.

It is similar for pilots. All that matters for pilots is hours of flying time or

experience. Pilots have to ignore their senses and rely on instruments to fly safely

when there is poor visibility.

There is always poor visibility for investors so we also have to rely on

“instruments” to make wise decisions for investments. Studies show that market

experts are only right close to 48% of the time, on average. This shows that

relying on our senses to produce an accurate forecast is just not enough.

This is why I have spent decades studying markets to develop a way to take the

emotions out of the decision-making process in order to make prudent, disciplined

decisions. I have found three tools to determine when a bear market has ended and

a new, longer-term advance has started. To be useful, there must not be any

opinions involved. Decisions like this must be based entirely on how investors are

behaving in the markets. The signals must be simple, clear and decisive.

The first buy signal I use is a system based in Calgary, Alberta that compares

the strength of the major asset classes of stocks, bonds, currencies and cash. This

is called relative strength analysis.

SIA Charts has developed the system below for selling and buying stocks.

There are 3 zones. The green zone is the positive or favoured zone. The yellow

zone is the neutral zone and the red zone is the negative zone. It is a sell signal

when the blue line falls from the green zone into the red zone. It is a buy signal

when the blue line rises back into the green zone after being in the red zone.

There have been 4 buy signals since the inception of this tool in 2005 up to

last month. These dates were May 4, 2009, January 10, 2012, March 29, 2016 and

April 29, 2020. The S&P 500 was up 4 out of 4 times one year later. The lowest

gain was 10.1% and the average increase was 16.8% after 12 months.

If you look at the chart on the bottom you will see that the blue line just rose

from the red zone into the green zone. This happened last Friday on November

25th. In response to this, SIA stated, “Increase equity exposure to the highest

limits of your portfolios, as high as 100% if possible.”

If you look at the bottom of the attachment on the previous page you will see

that US Equity is #1. This means it has exhibited the greatest relative strength

compared to Canadian stocks, international stocks, bonds, currencies and cash.

There can be no debate about the verdict of this indicator. The only decision is if

one is going to accept the verdict.

Please see a chart of the S&P 500 showing what has happened after these buy

signals below. (From TradingView) You can see that multi-year advances often

started just before these buy signals.

It is much, much more difficult to know when to sell than to know when to

buy. That is true with this indicator as well. After a sell signal, an investor would

be buying back at a higher price instead of a lower price 3 out of 5 times. The

S&P 500 was higher by 14.1% on average during these 3 times. In May 2009, the

S&P 500 was 25.2% lower than the sell signal, which was a fabulous call to miss

much of the losses during the Financial Crisis. In 2012, the S&P 500 was only 2%

lower at the buy signal than at the sell signal that preceded it. In essence, an

investor really only profited by using these sell signals one out of 5 times.

This is one of the three indicators I have found to be most reliable for buying.

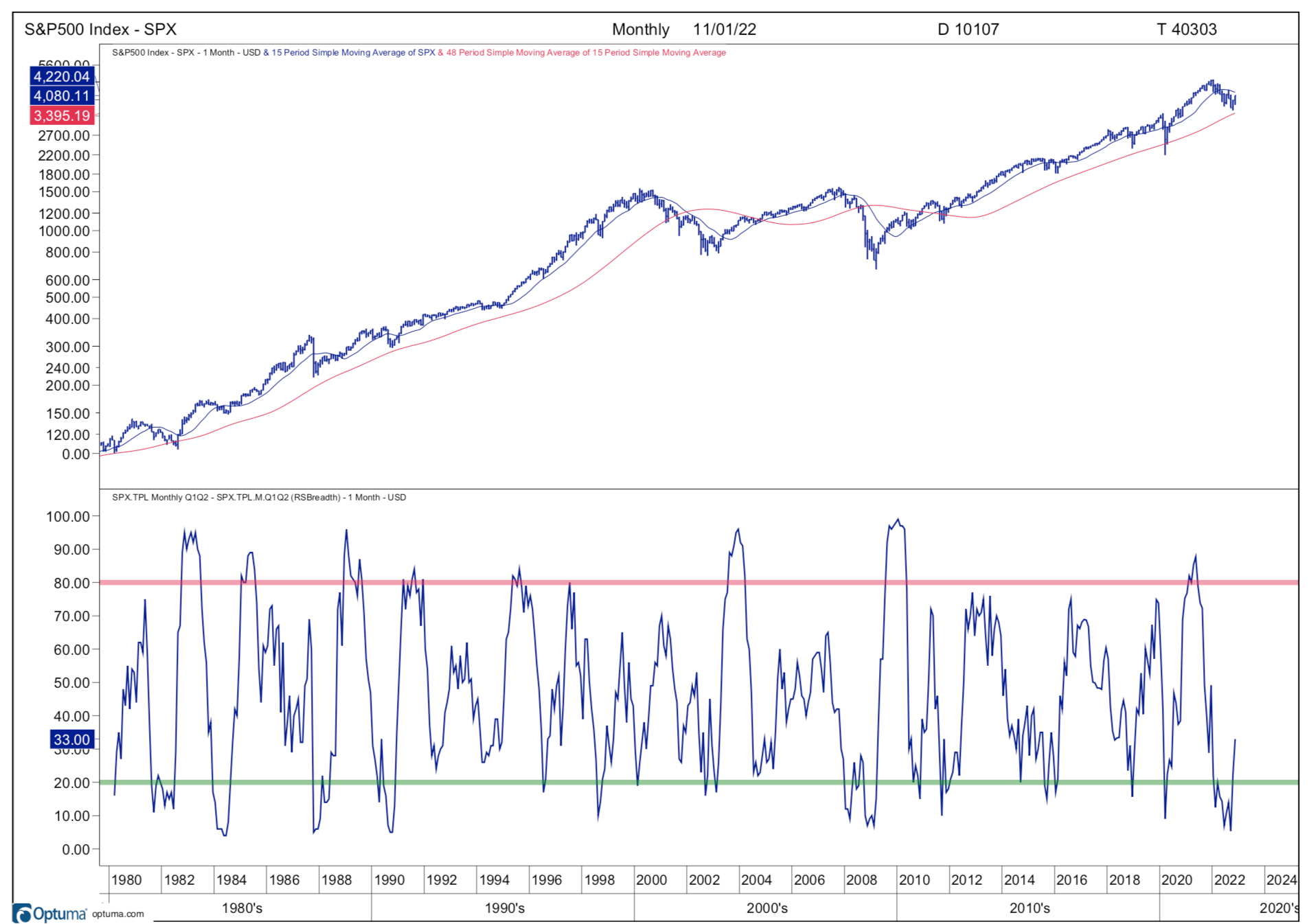

The second indicator I have found to be most reliable has recorded the percentage

of stocks in major market averages that are in an uptrend since early 1982. A buy

signal is triggered by investor behaviour when the percentage of stocks in an

uptrend falls below 20% and then rises above 20% again. I have found that US

stocks have produced attractive returns in the 12 months after 20% or more of the

stocks in the S&P 500 and the TSX have dropped below 20% and then rose above

20% again. The chart below, from Optuma, shows the S&P 500 since 1982 on the

top and the indicator on the bottom. If you look at the bottom right of the chart

you will see that the indicator fell below 20% and is at 33% as of today. The

indicator gave a buy signal for the S&P 500 on November 1st when it was just

above 20%. However, the indicator for the TSX had only risen to 17% as of

November 1st.

This is a monthly indicator that is calculated at the start of every month. The

next page displays the same indicator for the TSX showing that 30% percent of

the stocks in the TSX are in an uptrend as of today, December 1st. (See the left

hand scale of the charts for the exact level.)

This indicator has now issued a buy signal for investors. The S&P 500 and TSX

have issued 10 buy signals since 1982. This is a period of 40 years! The S&P 500

has been up 100% of the time one year after these signals. The lowest gain after 12

months was 13.35% with an average gain of 29.2%. Again, there can be no debate

about what this indicator is telling us. The only issue open for discussion is

whether you are going to accept the verdict or not.

These indicators show us when the minds of investors switch from looking at

the glass being half empty to being half full. They show us when confidence has

returned, not when all the problems in the world have been solved. If you strip

everything away, confidence is the most critical factor for consumers, business

owners and investors. Very little would happen without confidence. What has

happened in the past shows us that U.S. stock prices have produced very attractive

returns one-year later every time when this much confidence has returned after a

period of great fear and uncertainty. While past performance does not guarantee

future results, this is good as it gets. While it seems that there is still a lot of

uncertainty right now, these indicators are telling us something much

different. They are telling us that the risk is now as low as it gets and that the

opportunity for gains is now as great as it gets. This is why SIA Charts is

recommending that investors move to 100% invested. There are only certain times

(one out of every four years on average) that the outlook can be this clear 12

months into the future, so this is the time to take advantage of it.

The third indicator I use only happens when the rise off of a market low is

extremely strong. The 2-1 Advance/Decline Buy Signal occurs less frequently

than the buy signals mentioned in this Update. It has not issued a buy signal so

far. However, that does not mean that a new bull market has not started. It just

means that the move from the lows has not been extremely strong as it sometimes

can be.

The rebound off the Key Reversal Day on October 13th lows has been very

strong. This has confirmed that stocks have produced the classic double bottoming

pattern which signals that the selling has been exhausted. The DJIA has risen a

total of 19.7% for October and November. In second place is the S&P 400 with a

17.3% gain for the last two months. The S&P 500 is in third place with a gain of

13.5% with the NASDAQ bringing up the rear moving higher by 8.4% in the last

2 months. Now the relative strength tools from SIA Charts and the indicators

showing the percentage of stocks in an uptrend have risen above 20% for the S&P

500 and the TSX. This is the classic progression or sequence of events to show

investors that a bear market has ended and that a new bull market has started.

These are the instruments investors and professional money managers can rely on

at times when uncertainty is at its highest. These are the instruments that create

visibility for the year ahead when many have absolutely no idea what the future

holds. I look forward to giving you the returns generated by these signals a year

from now.

Fed Chairperson Jerome Powell made an important announcement on

November 30th, stating that the pace of raising interest rates could slow down as

early as the meeting on December 13th and 14th. U.S. stock prices jumped 2.5% on

the news. I believe there could be more announcements indicating that the Fed

will not raise rates as much as they expected to just a month or two ago. In the

meantime, thank you for your trust and confidence during this volatile year. The

buy signals that have just been issued in the last week imply that the next year

should be much better and could more than make up for the draw down that may

occur in 2022. A lot can happen in one month in the beginning of a bull market!

If you missed last week’s Update, my wife and I were finally able to take our

entire immediate family (including our 23-year old foster daughter) to the

Hawaiian island of Kauai after two cancelations due to Covid. There were 18 of

us in total. We returned on November 28th.

I am still amazed by air travel. Early in the day, my family and I was seeing

turtles, monk seals and playing in the Hawaiian surf. After watching a movie and

eating lunch while sitting in a comfortable plane for six hours, we have been

transported to a totally different climate, culture and animal life.

The first flights to Hawaii from North America only started 86 years ago in

1936. It carried seven people, took 21 hours and cost a fortune. We are so

fortunate to be alive today. This is an example of innovation that takes place over

time.

Please see the photo below of our two horses in our field of snow.

Clean snow, bright skies and brisk air are wonderful too. Have a great weekend

my friend!