Mortgage Rates May Have Peaked

Mortgage Rates May Have Peaked

Central banks like the Bank of Canada, the Federal Reserve in the U.S. and

the European Central Bank only control very short-term interest rates. The

interest rate for mortgages and GICs for longer than 90 days are determined by

the bond markets. Of course, these rates are therefore determined by bond

investors.

Fed Chairperson Jerome Powell has said that they plan to keep raising interest

rates into 2023. However, as last week’s Investment Update pointed out, what Fed

officials have forecast and what they have actually done have been completely

different. For example, in May of 2022, Fed Chairperson Powell said that they

would not raise interest rates by as much as 0.75% at a time. Since May, the Fed

has not just raised interest rates by 0.75% once, or twice or even three times. They

have increased very short-term interest rates by ¾ of a percent four times in the

last six months! It is hard to believe.

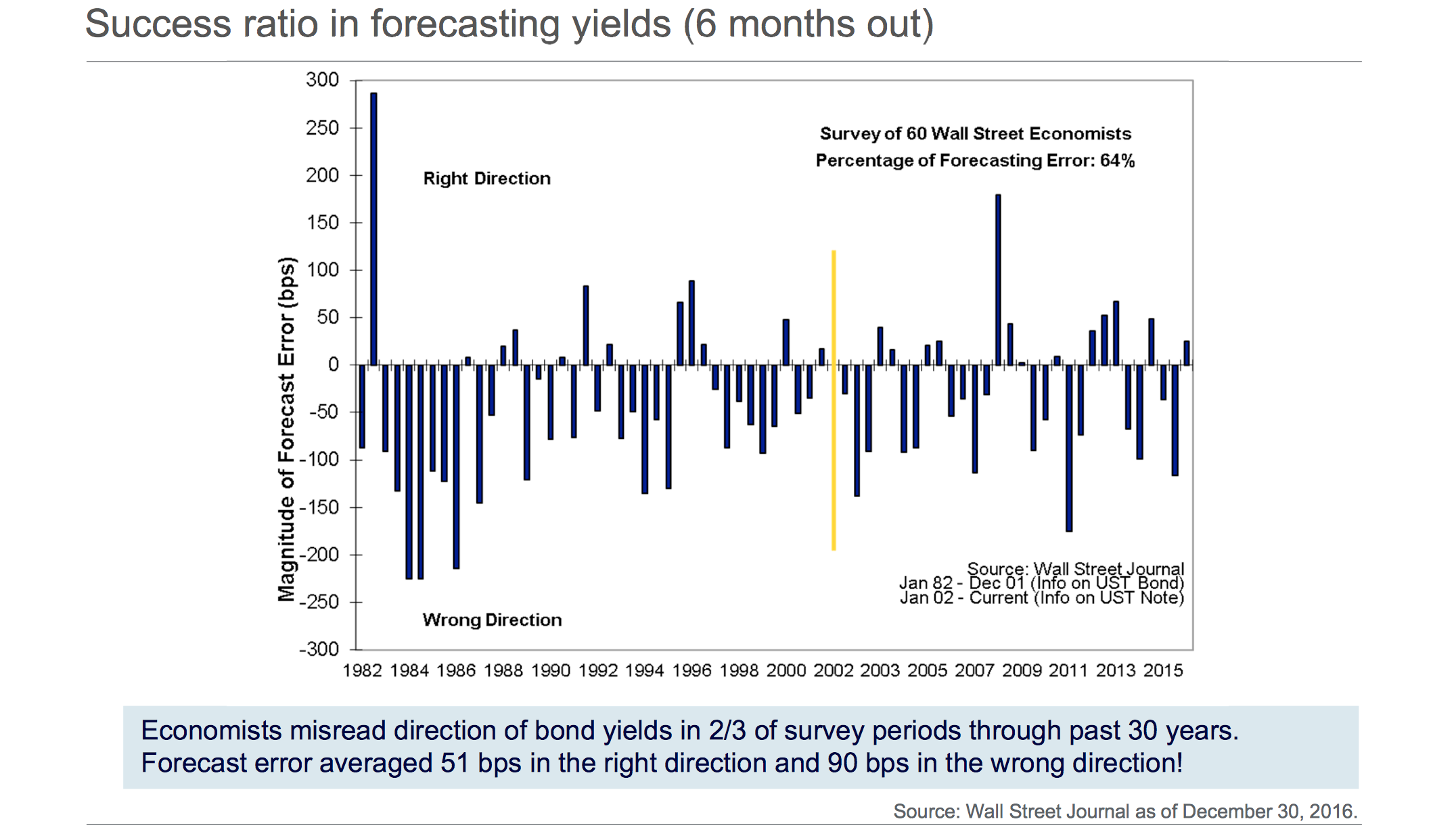

The 35-year study shown below, conducted by The Wall Street Journal in 2016,

showed that interest rate forecasts for six months into the future by economists

were wrong 2/3rds of the time, which means they were only accurate 1/3rd of the

time. Therefore, if we cannot rely on the guidance provided by Fed officials or

economic experts, what can we rely on?

As mentioned last week, central bank officials do not have a monopoly on

As mentioned last week, central bank officials do not have a monopoly on

wisdom. They are not superhuman. There are many bond investors and

professional money managers who have just as much wisdom and insight as

central bankers do. Some of them might even have better wisdom and insight.

Therefore, how bond investors are interpreting current data and reacting in the

bond markets can be a very useful guide at a time like this. What has happened in

2022 also shows us that what happens to interest rates has a huge impact on what

happens to stock prices. If this is the case, let us take a look at what has been

happening in the bond market this month.

The chart of the 2-year US bond yield over the last 3 months shows that yields

peaked at 4.69% on November 2nd and now trade at a yield of 4.456%. That is a

decline very close to 0.25%. This means that the interest rate on 2-year mortgages

and GIC’s should be 0.25% lower now than they were earlier this month. (Chart

by CNBC.)

The yield on the U.S. 5-year bond has declined from 4.45% on October 19th to

3.94% today, a decline of 0.50%. This means that the interest rate on a 5-year GIC

and mortgage should also have declined by 0.50% in the last 3 weeks. Please see

the chart of the 5-year US bond yield below.

Stock markets popped higher by 5.5% on Thursday November 10th when data

Stock markets popped higher by 5.5% on Thursday November 10th when data

showed U.S. inflation fell more than expected. However, stock prices bottomed

on October 13th. As stated above, the 2-year bond price bottomed

on November 2nd and the 5-year bond price bottomed on October 19th. This was

well before the positive inflation news was released last week. This shows how

markets do not just react to the news. This is evidence that prices bottom when

the worst-case scenario is factored into current prices. They bottom when the

selling is exhausted. The news does not show us when this happens, but

oscillators do. More about that below.

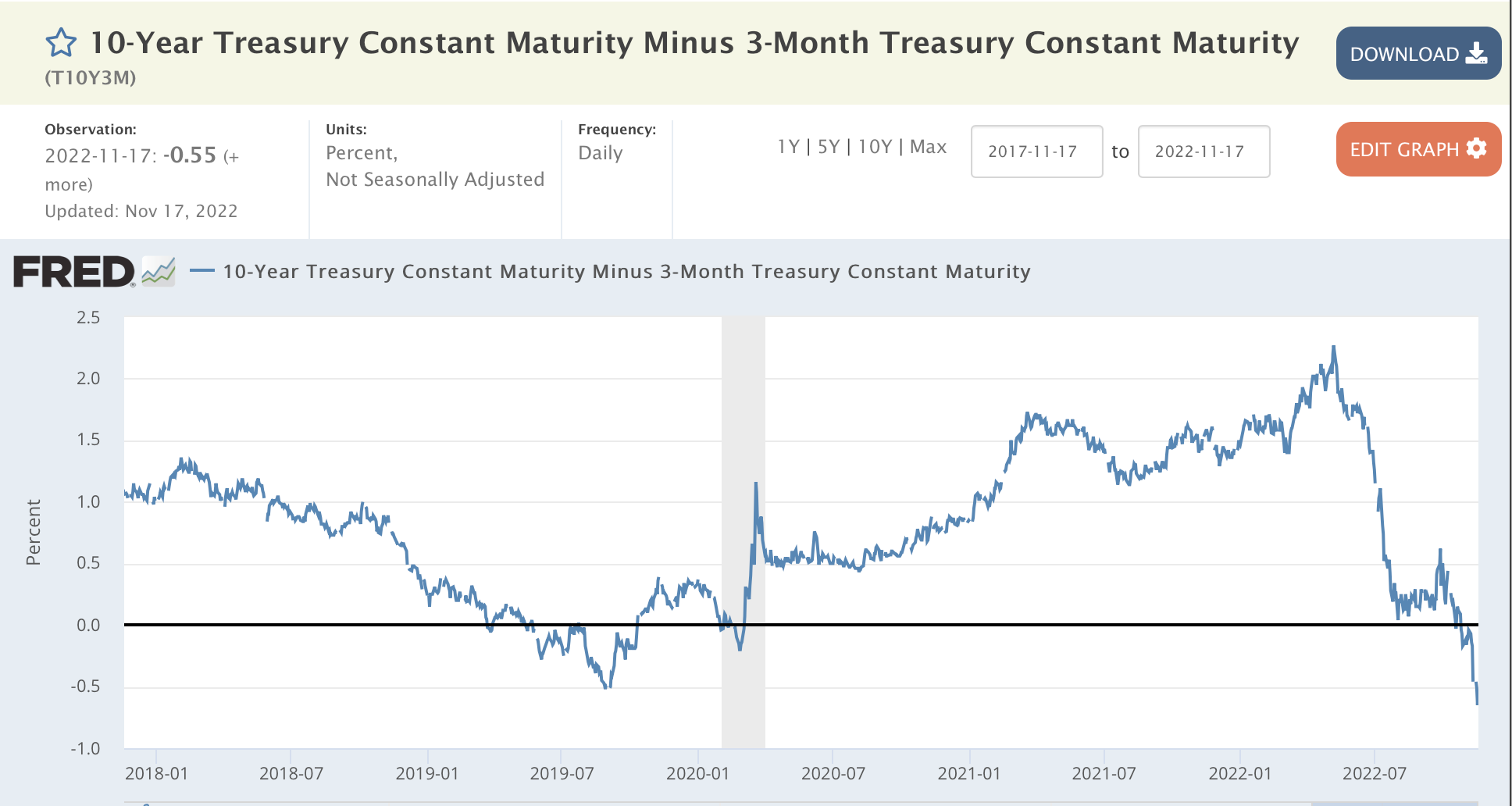

One of the most reliable indicators of an economic recession in the U.S.

occurs when the Fed raises interest rates to the point that short-term interest rates

are higher than longer-term rates. Usually, short-term interest rates are lower than

long-term rates so when short-term rates are higher, it is called an inverted yield

curve because the normal interest rate curve is upside down.

As of today, the yield on a U.S. 3-month Treasury Bill is 4.28%. The yield on

a 10-year U.S. bond is 3.78%. The yield on the three-month U.S. T Bill is now

0.50% higher than the yield on the U.S. 10-year U.S. bond, so the yield curve has

definitely been inverted since late October. This indicates that a U.S. recession is

very likely in the future. No one knows whether it will be a mild recession or a

serious one. At this point, it appears as though the slowdown is mild since

employment is still strong. Please see a chart showing the 3-month vs. 10-year

yield curve from FRED below.

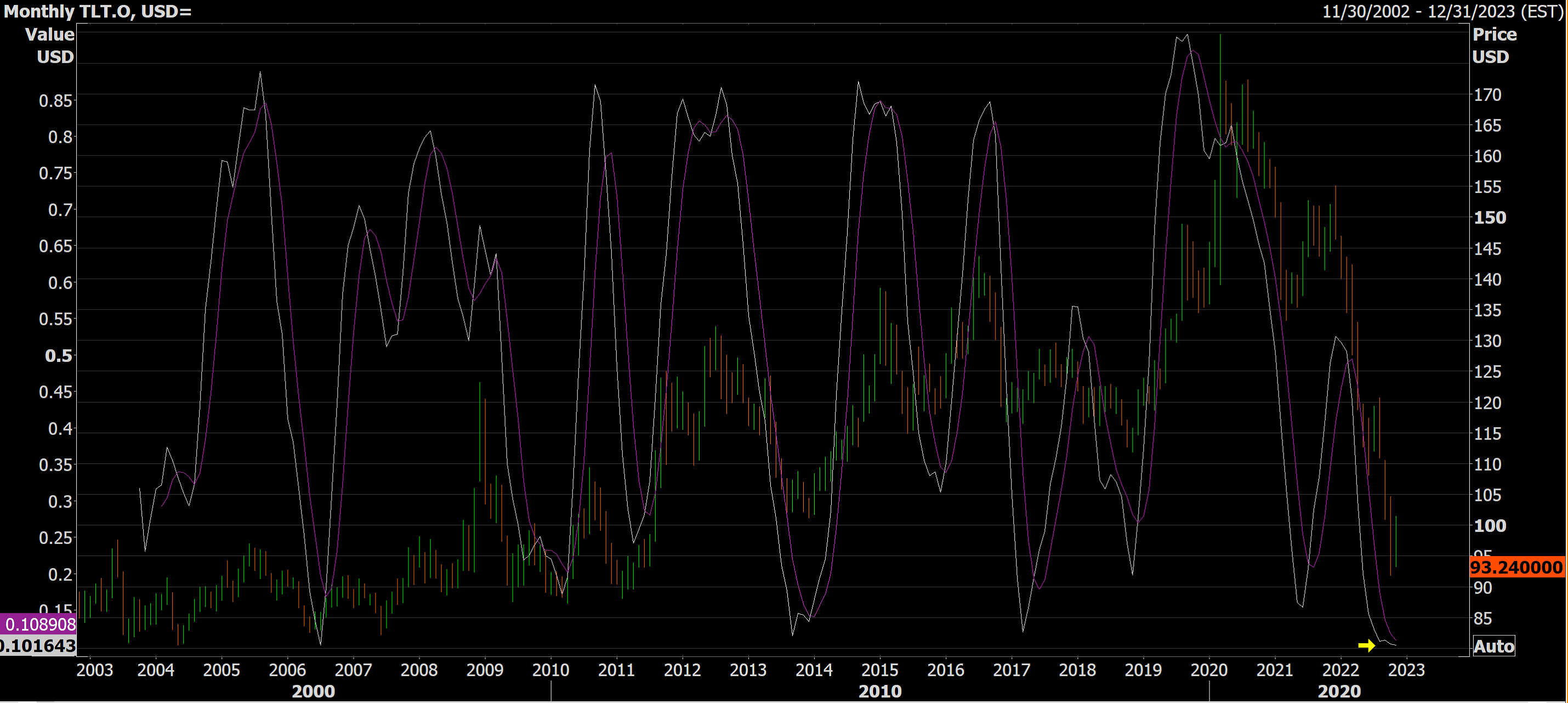

These charts show us what bond investors are thinking today. They do not

suggest what might happen in the future. I have found that oscillators can be very

helpful for providing forward guidance at certain turning points, so please see the

monthly oscillator for the U.S. long-term bond ETF (symbol TLT) below.

The white line on this 20-year chart is the very long-term or monthly oscillator

for TLT. When the white line falls down near the bottom of the chart, it indicates

that the worst-case scenario has been factored into current prices. When that

happens, it is a sign that prices cannot go down any more. Bond prices fall as

interest rates rise.

The small yellow arrow at the bottom right of the chart shows that the

oscillator has only been this low one other time in the last 20 years. In the past 20

years, the price of TLT has risen for at least six months every time the oscillator

has turned up from very low levels. This implies that interest rates should be in a

downward trend for at least six months once this oscillator turns up. The yellow

arrow points to the area showing that the oscillator appears to be on the verge of

turning up. It will be updated again on December 1st. The long-term or weekly

oscillator (as opposed to the very long-term or monthly oscillator shown above)

turned up three weeks ago and is already rising. Please see a chart of TLT from

WSJ below.

This bond ETF fell from a high of 155 in December 2021 to a low of $92 on

October 24th, a fall of 40.1%. Bonds have provided almost no return over the past

6 years, even after including interest payments. They did not help to reduce

volatility very much during this bear market either. You will notice that only a

miniscule amount of your portfolio, if any, has been invested in bonds for years

now. I have stayed away from bonds because we are six years into a 35-year

cycle of rising interest rates and inflation, which started in 2016.

This ETF has jumped from $92 to $100.33 in the last three weeks, a gain of $8

or 8.7%. The oversold condition of bonds and lower U.S. inflation data for four

months in a row is having a positive impact on the minds of bond investors.

Stock market investors have also indicated that the worst-case scenario has

already been factored into stock prices as of a month ago October 13, 2022. Since

then, the DJIA has produced the biggest monthly gain in October since January

1976. Last Thursday, U.S. stock markets had the biggest one-day gain since

prices started to recover from the Covid sell-off in April 2020. A rise of more

than 5% in one day, as was the case last Thursday, is very rare.

The bond market is ten times the size in dollar volume compared to the stock

markets. The behaviour of bond investors is confirming what stock investors have

been seeing over the last month. It is becoming clearer that a trend of lower U.S.

inflation is developing. This suggests that the need for higher interest rates is

diminishing. Almost every indicator, including the bond markets, are suggesting

that the worst of this bear market is behind us and that a new uptrend has started,

not only for stock prices, but bond prices as well. This suggests that we have

likely seen a peak in interest and mortgage rates even though the Fed may raise

interest rates once more in December.

I have been recommending that investors have exposure to the relatively

unknown S&P 400 Index of U.S. mid-sized companies because they have

outperformed the S&P 500 by close to 3% per year since the inception of the S&P

400 in 1981. Mid-sized companies generally have more room to grow than large

companies. The S&P 400 has not been any more volatile than the S&P 500 on

average so there is no additional risk for higher returns.

The S&P 500 has been outperforming the S&P 400 in the last 2 years because

large technology companies have been doing very well since Covid. That has

changed this year as technology companies have sold off more than others.

The ETF that tracks the S&P 400 IJH is almost back to the price it traded at in

late January 2022. It is now down 13.8% from the peak in November 2021.

However, the US dollar has increased in value by 7.4% as well. Canadian

investors who own IJH are now down only 6.4% from the all-time highs.

The S&P 500 is down 17.8% from the peak in January 2022, down 4% more

than the S&P 400. The US dollar has risen 5.3% since the S&P 500 peaked which

means that the S&P 500 is down 12.5% from the high for a Canadian investor.

The S&P 500 is now down 4% more from the highs than the S&P 400. The S&P

400 is showing its value once again. The Dow Jones Industrial Average (DJIA) is

down 8.7% from the peak in early January and down a paltry 3.4% in Canadian

dollars. A lot of progress has been made in the last month. Thank you for your

patience, trust and confidence during this volatile year!

Aloha! I am writing this from Kauai, which is known as the garden island of

Hawaii. It is our favourite place to go to relax and decompress in the winter. I

don’t like to leave home much from April to October since I feel what I have near

me at home is hard to beat during those months.

The natural beauty is stunning along with a quieter lifestyle. No building is

allowed to be higher than a palm tree. There are good medical facilities and we

can trust the authorities. There are numerous empty beaches were we can swim,

paddleboard and snorkel with fish and sea turtles.

It is so nice to be able to travel like we used to before Covid. My wife and I

had this trip planned with our entire family in 2021 and in early 2022. It is finally

happening now with the rest of our immediate family and foster daughter hoping

to arrive tonight. Have a great weekend my friend!