A Surprise can Happen at any Moment

A Surprise can Happen at any Moment

The circumstances during bear markets are always different, but our

reactions to them are very similar. We are human beings with powerful

emotions. We go through various phases when we lose a loved one or a

relationship ends.

Having more access to psychological help than ever still doesn’t seem to do

much to ease the pain of a loss. It still seems to take the same amount of time to

go through the stages of recovery as it did for people over the ages.

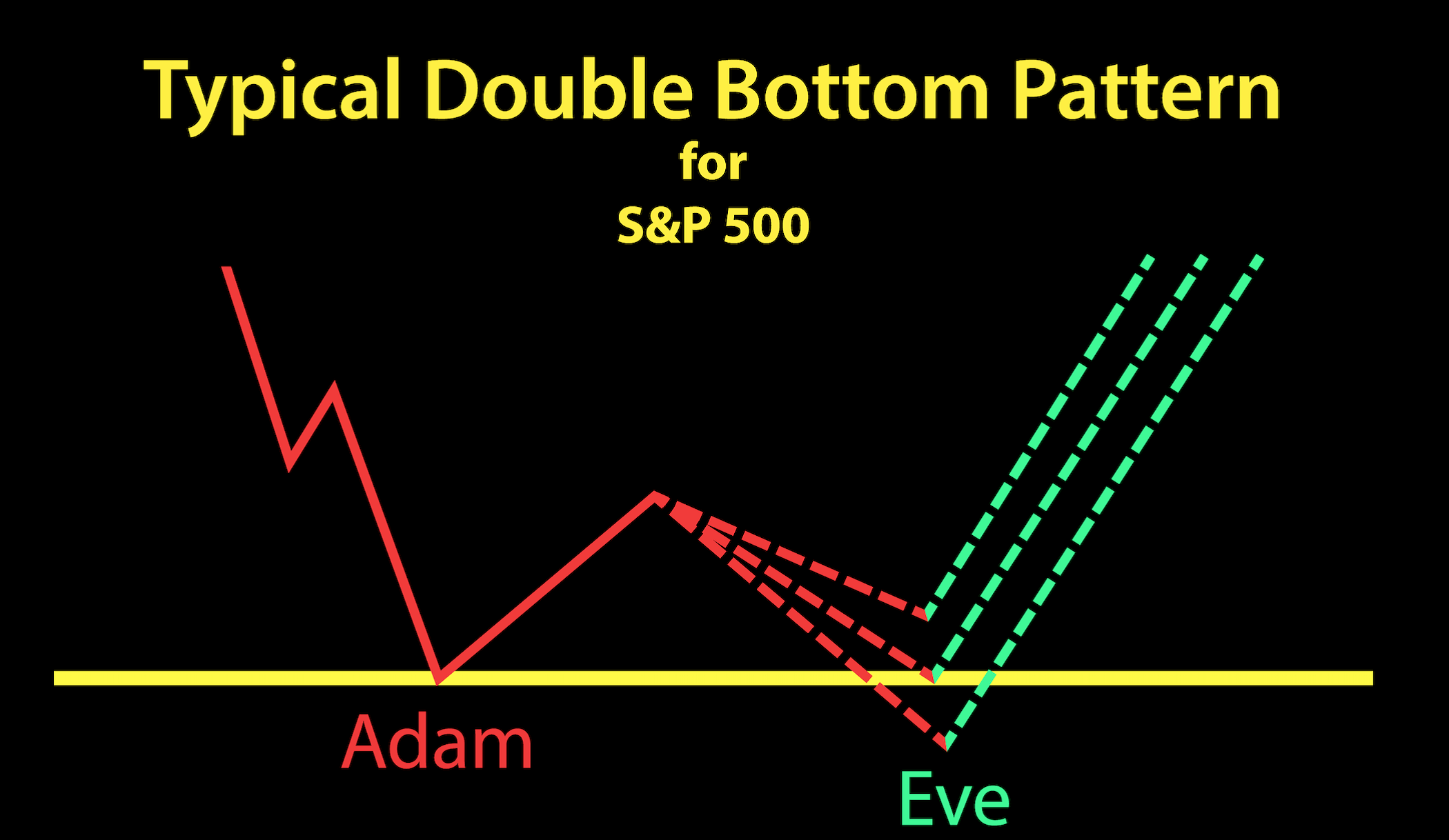

In the same way, investors typically go through defined stages during a bear

market, which manifests itself by producing a pattern of a double bottom. First,

prices drop to a low and then they stage a recovery. After that, prices fall again to

another low anywhere from 4 weeks to 4 months later. If the second low holds

within 4% or so of the first low and then starts a steady uptrend, it is a sign that

the bear market could well be over. Please see my illustration below.

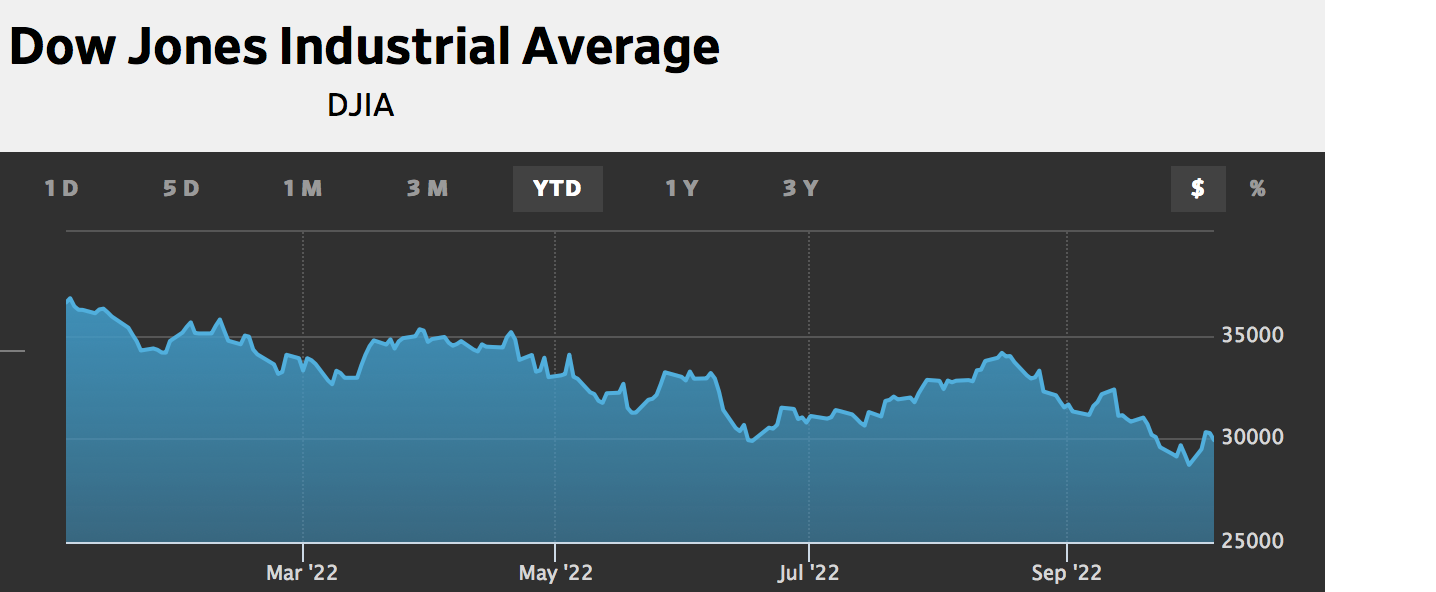

The first low in this bear market occurred for U.S. market averages on June

17th.The second low may have occurred last Friday, September 30th. Let us take a

look at how investors have reacted during this bear market by looking at year-to-date

charts for various stock markets averages from WSJ below.

The second low last Friday was 3.9% lower than the June 17th low for the DJIA. The

second low for the S&P 500 was 2.2% below the June low.

The second bottom for the NASDAQ was only 0.07% below the first low or

almost at exactly the same level.

The second low for the S&P 400 Index of U.S. mid-sized companies was also

less than 1% below the June low.

The second low for the Canadian TSX Index occurred on July 14 because the TSX

is more influenced by the price of oil. The second low here was only 0.09% below

the first low.

The second low for this ETF of 100 of the largest global companies was 4.7%

below the first low. Huge gains by the U.S. dollar have only increased the decline

of international stocks for U.S. investors.

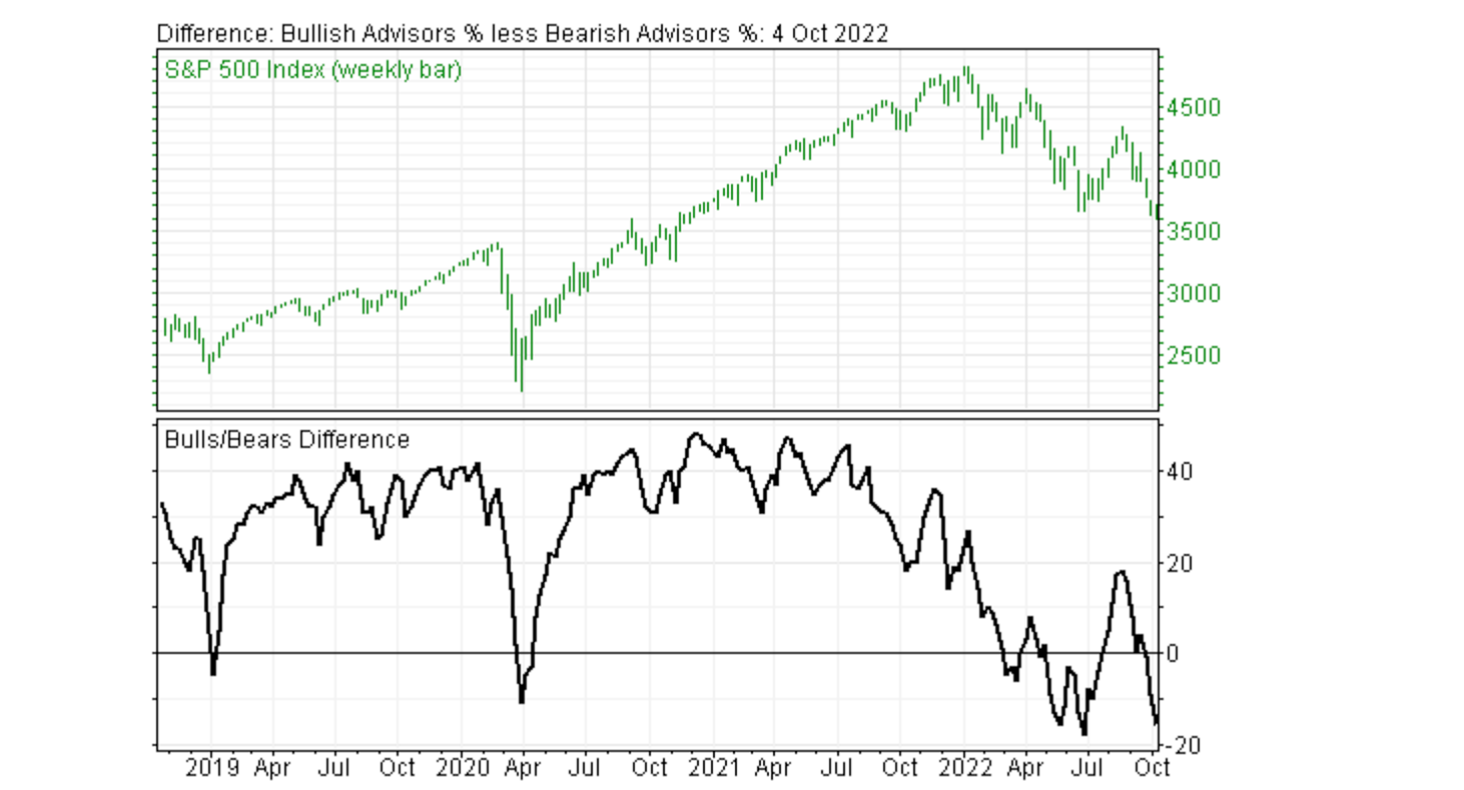

The chart on top of the next page from Investors Intelligence shows that

optimism is at very low levels again - even lower than during the 34% fall in 2020.

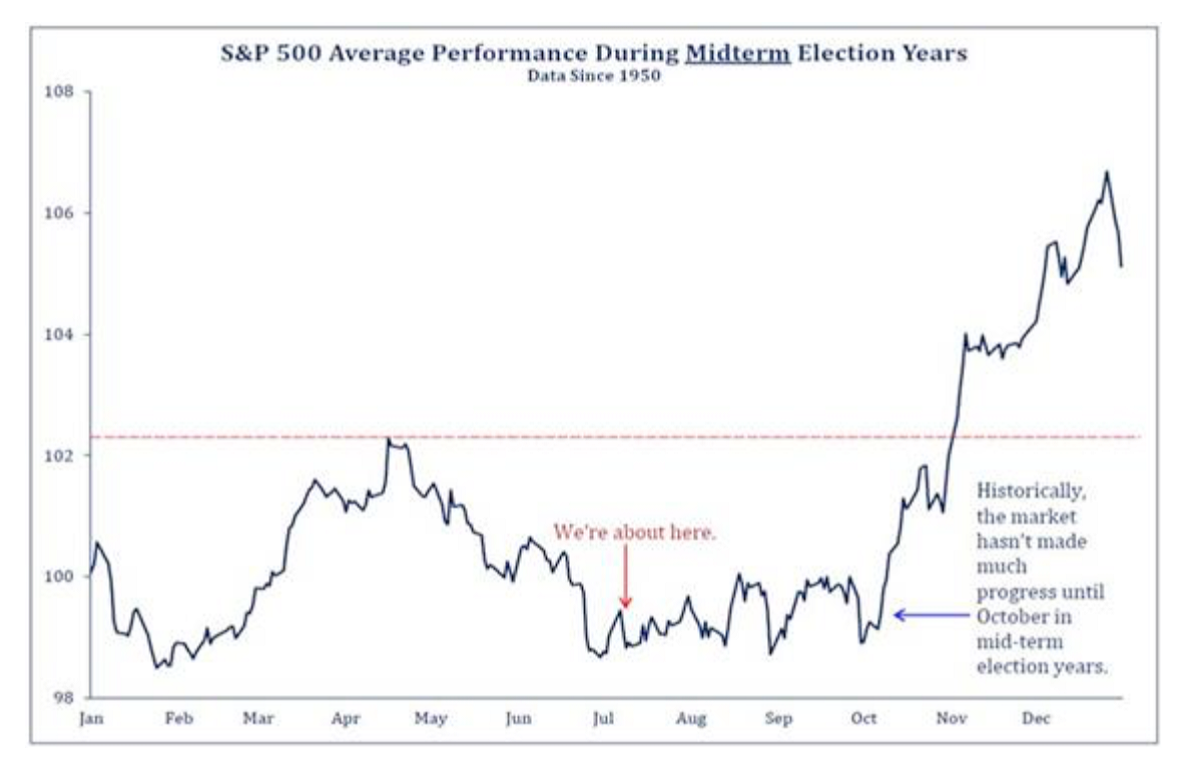

The chart on top of the previous page, produced by Barometer in July, shows

how U.S. stock prices usually react during mid-term election years. In the past,

stock prices have risen sharply in early October to more than make up for

weakness earlier in the year. While rising inflation and the war in the Ukraine

have definitely been major negative factors this year, the influence of a mid-term

election on the minds of U.S. investors could also be a factor.

Over the last 60 years, close to 90% of the gains in stock prices have occurred

from November 1st to May 1st. We are now entering the time of year when stocks

have been strong on a seasonal basis.

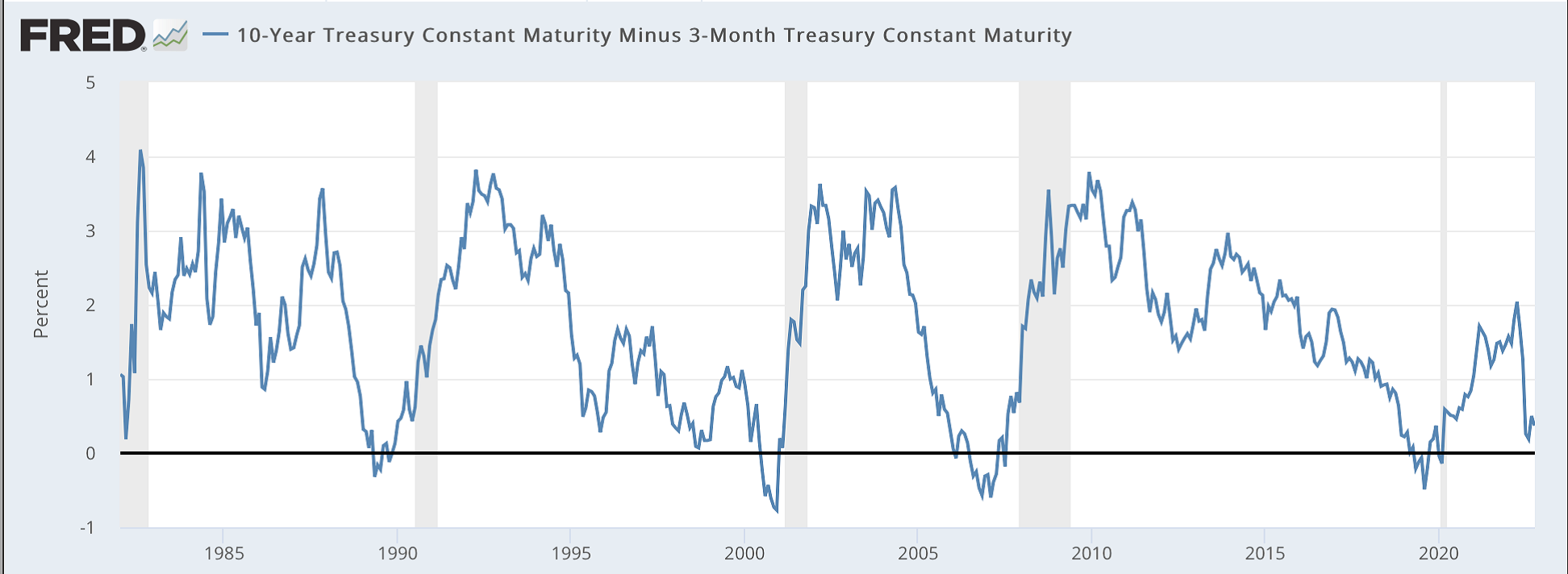

The chart below shows that the interest rate on a U.S. 10-year bond is still

0.37% higher than the rate on a 3-month Treasury Bill. The gray shaded areas

show when there was a recession.

In a study completed in 1996, two Federal Reserve economists concluded that

this yield curve is the simplest and most reliable tool to forecast an economic

recession in the months ahead. Since it has not inverted this year (the 3-month T

Bill rate has been lower than the rate on the 10-year bond), this could be a sign

that there will be not be a recession, as many are forecasting. Remember, there is

a saying that economists have forecast 9 out of the last 5 recessions.

The Federal Reserve and other central banks have been raising interest rates

sharply this year. The Fed has hiked interest rates by 3% in a very short period of

time. This is like going into a shower and turning the tap to maximum heat to get

hot water as fast as possible. However, once you step under the water, you will

burn yourself if you don’t turn the hot water down after it reaches full heat.

The Fed has been reactive instead of proactive. Last year, Fed officials said

that they expected to raise interest rates by only 0.25% this year. Their forecast

has been way off base once again. By raising interest rates so much so quickly,

they now risk harming global investments and markets. They have turned the tap

in the shower to maximum hot water.

Much higher interest rates in the U.S. have also sent the U.S. dollar soaring.

This reduces prices for goods coming into the U.S., which reduces inflation.

However, it makes it harder for foreign countries that have large amounts of U.S.

dollar debt when they have to pay interest in U.S. dollars. The U.S. dollar has now

become a wrecking ball, causing problems around the world. No one is really

aware of the extent of the problems. However, it is at times like this that the

collapse of something like a major investment firm, hedge fund, pension fund or

investment can come out of no where. Warren Buffett said you don’t know who is

swimming naked until the tide goes out. The tide is now out and there are likely

some who have extended themselves to far. For example, the large global bank,

Credit Suisse is one financial institution that is under stress. Those who have been

swimming naked could be exposed at anytime. When there is a major collapse or

failure, this is when the Fed usually steps in to announce that they will make a

change to their interest rate policy. An announcement like this is what has often

caused stocks to start a year-long rally in an instant. This could force the Fed to

turn down the temperature of the water in the shower or say that they will.

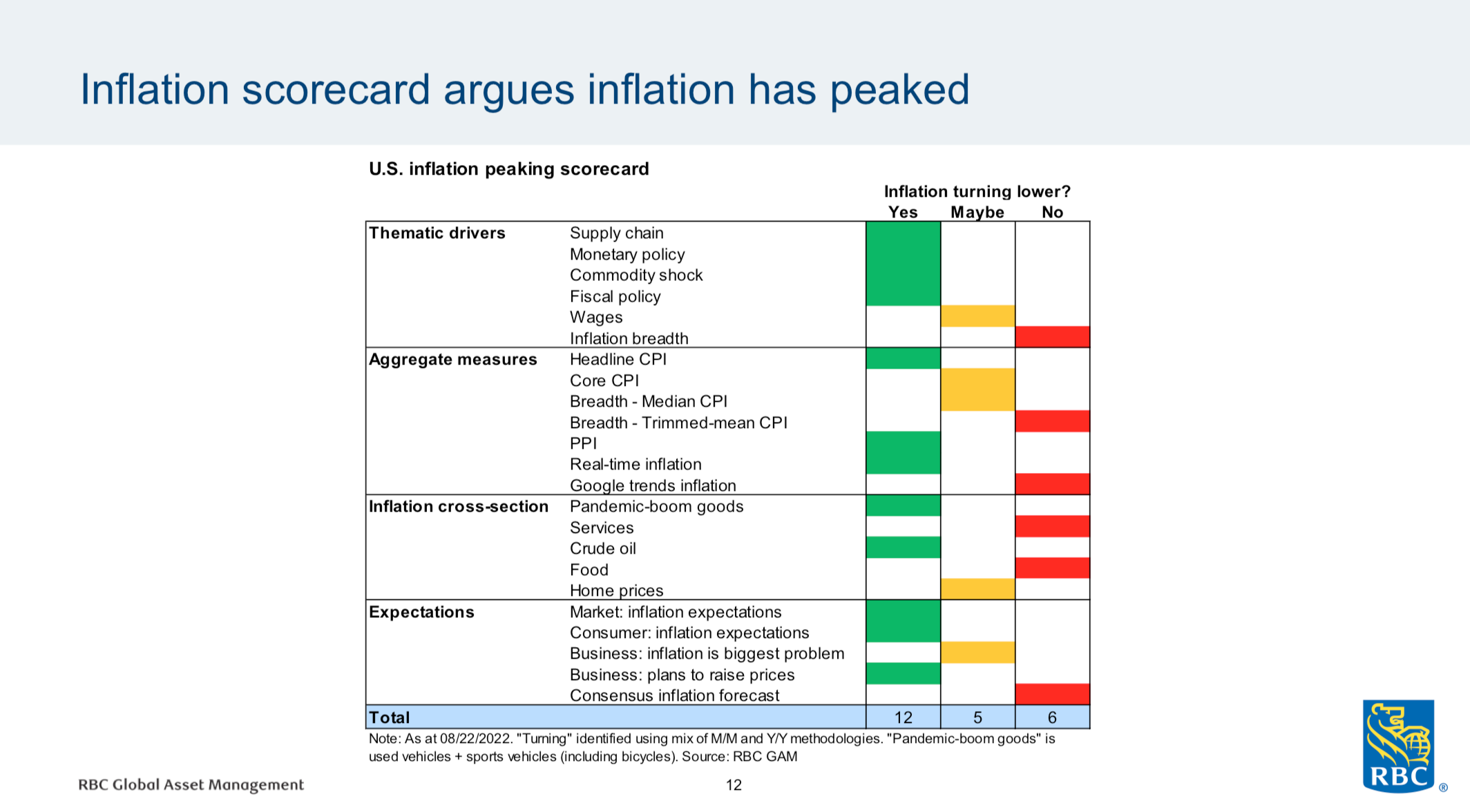

Statistics are already showing that inflation has peaked and is slowing. Any

signs of lower inflation should also encourage investors and give the Fed reasons

to raise rates less than they have forecast.

In summary, stock markets have reached almost every extreme of selling in

recent months. They could well be completing the classic double bottom pattern

that has ended bear markets in the past. Pessimism is at levels typically seen when

the selling is exhausted. Therefore, it is important not to let the prevailing mood

affect our own outlook.

Inflation has already peaked. Sharply higher interest rates, combined by a much

higher U.S. dollar is creating stress in debt markets. There are often unintended

consequences to actions that the Fed have taken.

It takes 6 to 12 months for the full impact of a change in interest rates to be

known. The Fed has moved too much, too fast and seems like they are on

autopilot by planning to keep raising interest rates into 2023. They changed

course completely in January 2019 when they made the same mistake as they are

making now. They well be forced to pivot again.

It is exactly at times like this that accidents happen. Accidents and a positive

response from the Fed to deal with them have often happened in October too. The

Fed does not have to lower interest rates. All they have to do is dial down the

prospects of future rate increases to encourage investors and business owners.

Investors around the world were encouraged early this week when the Reserve

Bank of Australia (which is what the Bank of Canada is for Canada) was more

pragmatic by only raising interest rates by 0.25%.

We are at a point where a surprise can now come from anywhere at anytime

that changes the mood of investors. Sentiment and oversold conditions are ripe for

investors to change their opinion from the glass being half empty to the glass

being half full. The next two or three weeks could be very interesting as we wait

and watch for a surprise that could confirm that a new long-term uptrend has

started.

With the unusually warm weather at this time of year, I had the privilege of

taking my grandchildren who live close by for rides on my personal watercraft at

Cultus Lake the other day. (I have two more grandsons and my oldest grand

daughter in Saskatoon.)

I lost a very close friend who passed away while on a strenuous hike on

September 25th but I am still very thankful for all that I have been blessed with,

including you. I always appreciate your trust and confidence. Happy

Thanksgiving!