This is How Our Mind Plays Tricks on Us

This is How Our Mind Plays Tricks on Us

The human mind is capable of doing amazing things. However, in some

ways, it is sadly lacking. Dr. Robert Koester has done research for search and

rescue personal as a leading expert on the behaviour of lost people. One of the things

Dr. Koester did as part of his research was to ask people to walk in a

straight line while blindfolded. While we think this should be fairly easy, the

actual path that we take is anything but straight. Please see this example from his

research showing the path that four different individuals took when asked to walk

in a straight line for 100 metres!

What does this show us? It tells us that our mind can sometimes lead us to

believe we are doing something totally opposite to what we should be doing or

what we believe we are doing. When blindfolded, we walk in circles instead of

straight lines. Yet, we are convinced we are walking in a straight line until we see

what we really did.

Our minds can cause us to come to false conclusions in other matters as well.

For example, when it relates to investing, we tend to think that the more prices

rise, the more they will rise in the future. We also tend to think that the more prices fall,

the more they will fall in the future. This is called recency bias. We all have to deal with

recency bias, which causes us to believe what has happened in the recent past will

continue into the future. This works against us as we try to determine a reversal in the

market trend.

In reality, when stock prices fall, they actually become more attractive, not less

attractive. Statistics compiled by Investors Intelligence over the last 50 years

shows a very consistent pattern. Experts and investors become more optimistic as

prices rise and more pessimistic as prices fall. At times of extreme pessimism, so

many experts are saying that prices are likely to fall further. When we listen to

these forecasts, it makes it feel like stock markets are going to fall much more.

The only problem is that history shows feeling like stock prices are going to fall

much more at extreme levels of pessimism is like believing we are walking in a

straight line when in fact we are walking in circles. What has happened in the past

shows high levels of pessimism actually occur at market bottoms, not before

much larger declines. This means that the risk actually declines as pessimism

grows, not the other way around. You can see this in the most recent chart from

Investors Intelligence on the next page.

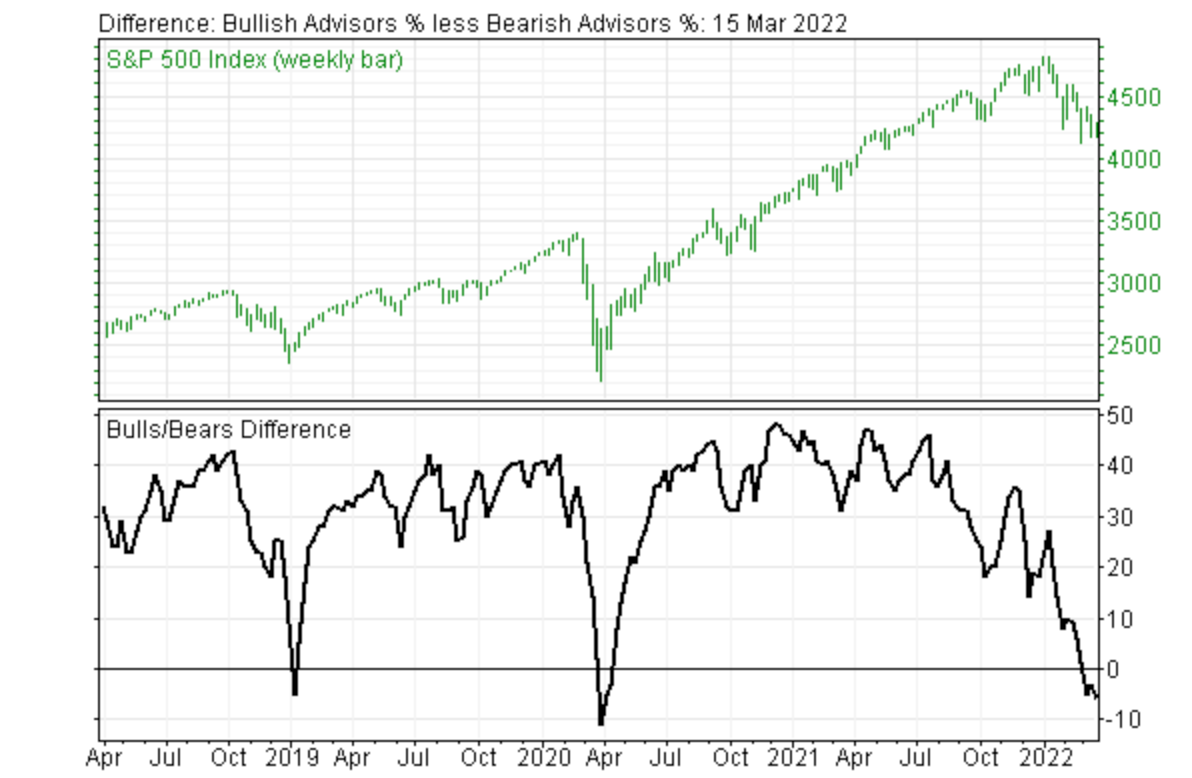

The green chart on the top shows the level of the S&P 500 Index of 500 large

US companies since April 2018. The black line below rises as optimism increases

and falls as it decreases. When the black line falls below 0%, it means we are

hearing more pessimistic stock market forecasts than positive ones. You can see

this happened when the S&P 500 19% decline ended in January 2018 and when

the Covid-19 sell-off ended in late March 2020. It is at -5.9% now.

It is easy for us to accept that markets figures of -5% or -10% in the black line

have lead to market bottoms in the past. It is much more challenging to accept

that current levels of pessimism will also occur near a market low now. You see,

we know how the corrections in 2018 and 2020 played out, so the emotions of

stress, anxiety and uncertainty are absent.

When we are in the present situation, the emotions of anxiety and uncertainty

are front and center in addition to the real stress of watching men, women and

children suffer in a military conflict. It takes real effort to look at the facts and

ignore our emotions, just like it takes effort to focus on a compass when walking

in the dark and ignore our own intuition no matter how powerful our inner voice

is. What has happened to stock markets in the past are statistics absent of

emotions. What happens in the present fills us all with various emotions that we

must deal with.

Warren Buffett summed it all up when he said, “Be fearful when others are

greedy and be greedy when others are fearful.” This is a very useful rule to

follow. But, how much fear is enough fear to be “greedy?” There are two tools I

have found to be most useful to determine when there is enough fear to warrant

buying more investments. It is important to note that both of these tools are based

on the behaviour of investors and experts, not on economic or financial

information. The first is the sentiment data shown on the previous page. When the

level of optimism falls close the 10% level in a mild 5% to 10% correction or to

the 0% or below during a serious correction or bear market, that is a positive sign.

The second indicator I use to determine if there is enough fear to become greedy

is when the long-term oscillators for major market averages decline close to fully

oversold level and then turn up.

For example, the white line in the chart below is the long-term oscillator for

the S&P 500 going back five years. You can see that it dropped down to low

levels in November 2016, April 2018, December 2018, March 2020 and in

February of this year. (The red and green line is the level of the S&P 500.) There

were no double bottoms in 2018 and 2020 because markets responded to

significant comments or actions by the Federal Reserve. The Fed is not

intervening this time so markets are handling this correction in the natural way.

Chart is from data provided by Refinitv

Chart is from data provided by Refinitv

In a natural correction, where there is no major intervention by the Fed, the

selling needs to be exhausted before another uptrend can start. When this

oscillator (the white line) bottoms near a low level and turns up, it indicates that

the worst-case scenario has been factored into current prices. When that happens,

stock prices cannot really go down much more. Sometimes this oscillator will

form a double bottom just like stock markets typically do during a severe sell-off.

Warren Buffett followed his own advice to be greedy when others are fearful

soon after the Financial Crisis began in September 2008. The only problem was

that stock prices continued to crater until late November. He would have been

much better off had he waited for this long-term oscillator to bottom and turn up

again. This oscillator started declining in September 2008 and then bottomed and

turned up in late November 2008. US stock prices fell another 20% or so from late

September 2008 to November 21, 2008. That is why this is such a good indicator.

US stock prices have followed a normal pattern of experiencing a double

bottom this year. The first low was on January 24th and the second was a month

later. Usually they are six to eight weeks apart instead of only four weeks.

However, as of this Monday, March 14th, it has been seven weeks since the initial

low, so we are right within the typical time frame that is required for the selling of

stocks to reach the point where the selling is exhausted and the excess optimism

has been eliminated. If this long-term oscillator for the S&P 500 continues to rise

early next week, it could be a confirmation that this correction is over.

It was reported that US corporations have recently announced that they want to

buy back a record $238 billion of their shares this year to take advantage of this

market weakness. They are following Mr. Buffett’s advice. This will produce a lot

of buying power to drive prices higher once there is confidence that this

correction is over. Huge corporate share buyback programs are one of the reasons

why the S&P 500 has often rallied back to record highs four months or so after a

correction. I will keep you informed about how investors are behaving in the

markets.

This is what Warren Buffett said about buying his first stocks a few months

after Pearl Harbour when the US was losing ground in World War II. “I didn’t

buy it because I thought losing the war was a good idea. I bought it because I

thought stocks were cheap and that eventually we’d win the war, and the same

way in Europe.”

In summary, we may think that our thought processes are rational. However,

our mind can play tricks on us when we are blindfolded and asked to walk in a

straight line. It can also play tricks on us when our emotions are affected by

increasing pessimism about current events and stock market declines. When there

is more pessimism than optimism, we feel the risk of further declines is increasing

when it is actually decreasing. Investor behaviour and expert sentiment during this

correction has followed patterns similar to other corrections. Sentiment levels are

at levels where previous severe corrections have ended. The long-term oscillator

for the S&P 500 has bottomed and turned up for the second time, just like it has

when the worst-case scenario has already been factored into current prices before.

In my experience, these are the two most reliable indicators to determine when a

market decline ends and a new advance has started. According to Ned Davis

Research, when sentiment has been like this (from 1994 to the present), the

average gain after 12 months has been 28.2%. I will continue to keep you

informed.

SAR Update

It has been very quiet as far as SAR calls go until last weekend. We were asked

to go the Chehalis area to look for a 12-year-old boy who was missing all night. It

turns out that this boy and his mother went for a walk on a river delta and got lost.

They were not able to find their way out by nightfall so they spent Friday night

outside. The boy left to try to find a way out to get his mother’s medication but he

could not figure out how to find a way out. In the meantime, his mother was able

to find her way to where people were. At 11 am we were paged to help the local

band members look for the boy.

We call this area the Chehalis triangle named after the Bermuda triangle. There

are hundred of acres of flat gravel bars with smaller trees on them. While walking

on dirt produces trails that you can see, walking on gravel provides no markings

of where you have been. We usually have to find a few lost fishermen there every

year. One time we even had to rescue the same person twice!

Fortunately, the young boy was found on a gravel bar around 1 pm and carried

across the channel to civilization by a local man. That was a very happy ending

because surviving another night may have proved to be disastrous. Please see a

photo from Facebook on the next page.

Our team responded to another incident on Wednesday but I am not able to share

Our team responded to another incident on Wednesday but I am not able to share

details at this time. Perhaps I can by next week. Be safe and have a good

weekend!