At the conference, we had a number of fantastic speakers including Bobby Le Blanc, the CEO of Onex Corp, our chief investment strategist, Jim Allworth, our head of US equity strategy, Lori Calvasina, as well as dozens of our top analysts. It is always a great time to hear different perspectives on the year ahead.

Market Forecast for 2024

In my 30 year career in this industry I have learned a few things, one of the most notable being it is impossible to predict what will happen in the year ahead. A recent article in the New York Times highlights this fact in that from 2000 to 2020, the median Wall Street forecast had missed its target by an average of 12.9% per year. That error rate is astounding and makes weather forecasters seem like geniuses.

Instead of trying to tell you where the market will end in 2024, we’ll focus on the broader market trends like changes with interest rates, economic growth, and corporate earnings to determine whether the wind will be in our face or at our backs, so to speak. We then drill down to identify companies with a strong management team, competitive advantage, and growing earnings and cashflow. Outside factors such as moves by the Bank of Canada and Federal Reserve, election results or changes to tax legislation are often unpredictable and will impact the broader markets.

The Big Story of 2023…

A large part of the growth came from the U.S. market where the Magnificent Seven stocks (Apple, Microsoft, Google, Amazon, NVIDIA, Tesla and Meta) really drove the US market contributing over 2/3 of the total return in the S&P500. When you step back and consider the fact that 7 companies accounting for over 2/3 of the return of a 500 stock index it was truly a unique year. On average, these companies were up 105% in 2023. Over a two year period these high performing stocks have achieved a more modest 6% return. Although we like the prospects for a lot of these companies, valuations are definitely a consideration.

Looking ahead into 2024….

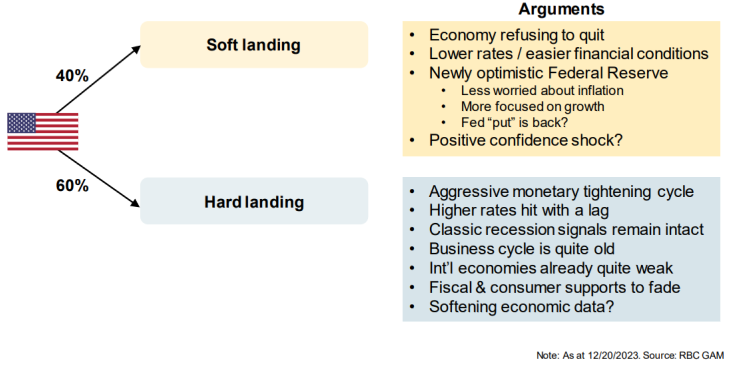

The two big questions this year will center on whether or not we go into a recession in 2024 and the extent and timing of rate cuts in North America. Our view is that we have seen an economic slowdown in many sectors already over the past few years and whether we call it a recession or not doesn’t matter as much. The reality is that rising rates have had an impact on the North American consumer and will continue to have an impact throughout the coming year and into 2025. We are preparing for this in our portfolios and although we anticipate solid returns in 2024, there are a number of factors that could add volatility.

Recent data from the past week show that GDP growth in Q4 came in at 3.3%, a very positive sign supporting the soft landing scenario.

Our approach to managing portfolios in 2024 will be consistent with past years with a focus on companies that can grow their earnings and cashflow over time. From an asset allocation perspective, 2024 offers new opportunities as rates on the fixed income side are attractive for the first time in years.

If you are interested in a more comprehensive outlook on 2024, our firm’s flagship investment publication can be found here